Joint Loans for Debt Consolidation – What You Should Know

Are you looking to manage your debt and make it easier to handle? You’re in the right place. We’ll be talking about joint loans for debt consolidation, which is a way to put all your debts into one bigger loan. Often, you can do this with the help of a family member or spouse.

Every month, more than 170,000 people come to our website for advice on dealing with debt. We’re here to help you, too. In this piece, you’ll learn about:

- What a joint loan for debt consolidation is.

- How it can help you manage your debt.

- The good and not-so-good points of this type of loan.

- How to know if this choice is right for you.

- Some extra tips to help you on your journey.

Debt can make you worry a lot., but remember, you’re not alone. There are many different ways to handle debt, and we’re here to help you understand them all.

Let’s start and learn more about joint loans for debt consolidation.

What is a Joint Loan for Debt Consolidation?

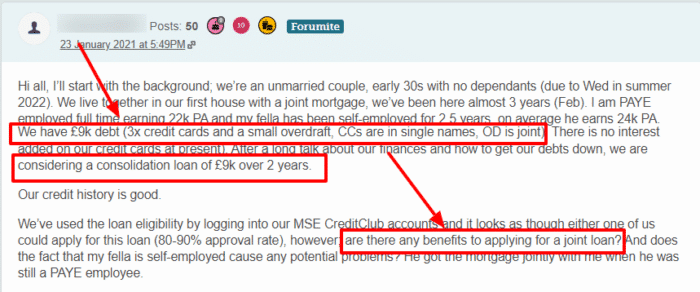

To put it simply, a joint loan for debt consolidation is where you work together with a spouse or another close family member to apply for a debt consolidation loan.

Since creditors consider your financial circumstances, credit score, income, and other factors when deciding whether to give you personal loans, you may be refused if you don’t match their criteria for the agreement on your own.

A joint consolidation loan is one where you apply with a partner, a close friend, or some other family member to apply for a loan. Both of you combine your incomes, credit scores, and financial circumstances to improve your chances of getting a loan.

If you have a bad credit score and don’t think you’ll be able to get a consolidation loan with monthly repayments on your own, you can team up with a spouse or a relative who has a better credit history and borrowing record and apply for the loan together.

Whether it’s a loan to pay your credit card debt or something else, both of you will sign the loan agreement together.

What Should You Know Before Taking a Joint Debt Consolidation Loan?

First, you should know that not all debt consolidation companies are equally good. Some are far better than others in terms of the strings they attach to their personal loans.

Make sure you’re going to a reputed company that won’t disadvantage you.

Secondly, you should be able to make the repayments you owe every month. If your loan is so large that you can’t afford it, don’t go for it.

Third, be aware that a consolidation loan may severely impact your credit rating. If you or your partner fail to make repayments, don’t manage it well, and act carelessly, it will come back to haunt you.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 6.34% |

£219.34 |

£26,320.83 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 7.99% |

£222.20 |

£26,664.58 |

| Selina | 8.45% |

£223.00 |

£26,760.42 |

| Equifinance | 9.95% |

£225.61 |

£27,072.92 |

| Evolution | 10.2% |

£226.04 |

£27,125.00 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

Benefits of a Joint Debt Consolidation Loan – Credit Score and Consolidation Loans

Let’s do a quick run-through of how a joint consolidation loan can help you.

1. Joint consolidation loans are easy to manage

Under normal circumstances, if you’re registered in England, you’ll have to keep up with all your loans, where your money goes each month, and keep track of all the debts you owe.

In these conditions, it can be very easy to mismanage your debt. You may miss a couple of payments, forget to keep track of your payments, or even find that you have less money than you expected to contribute towards a particular loan.

Joint consolidation allows you and your partner to make a single payment each month without having to worry about where your money’s going.

And when you have a joint account, it can be easier for both of you to deposit your funds into the account to make loan payments.

2. Closer family ties and shared responsibility

A joint consolidation loan and the corresponding application process is one of the finest examples of shared responsibility, where both partners assume liability for the loan and work together with a common goal.

3. Stable repayment plan

When you get a loan from a company authorised and regulated by the Financial Conduct Authority, you’ll be assigned a fixed payment schedule.

The best part about it IS that your charges will be fixed, you’ll be making a single payment each month, and you won’t have to worry about hidden costs or surprise charges hitting you every few months.

4. Helps you work on your credit score

If you’re looking to get a mortgage loan with monthly repayment, you and your partner can work on rebuilding your credit rating and getting the mortgage loan you want for yourself and your partner.

A joint loan for debt consolidation allows you to share the burden of repayment and responsibility with your partner. However, only say yes to a joint debt consolidation loan when doing so helps reduce your interest or saves you money. And both of you should be on the same page about repaying the loan.

Debt consolidations loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking for a better interest rate?

- Stuck with the confusion of multiple repayment plans?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

Should I Take a Joint Debt Consolidation Loan

Taking out a joint debt consolidation loan is a big advantage, especially if you and your partner can combine your credit scores and income to secure a large enough loan.

That said, keep in mind that a joint loan means both co-borrowers are legally liable for paying back the entire amount.

So, if your partner doesn’t live up to their end of the bargain or if you split up and your partner refuses to pay, you could be on the hook for the whole loan amount. This could significantly damage your credit score.

Verify that you are really ready to commit to a joint loan with your partner before you sign up for a joint loan for debt consolidation.

Lastly, seek advice from an independent debt charity like Citizens Advice or National Debtline for guidance on how best to clear your debts.