Late in Paying a Debt? Here are Your Options

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Facing a late payment? Don’t Panic. It may not be as bad as it seems.

Once you learn about all available options, you’ll see that all is not lost yet.

I break down some best practices and available options regarding being late in paying a debt, and also answer some FAQs to help you out.

Let’s begin.

Late Payments Options

By now, you must be thinking:

“Okay, what options do I have to manage interest and recovery payments? How do I make sure that an unpaid debt doesn’t end with me having to face possible court action or some other unpleasant outcome?”

Well, here’s a list of options you can consider in such a situation.

1. Pay in Instalments (Debt Management Plan & Other Options)

You should consider informal arrangements with your creditor, such as paying the amount over a specified period with interest or forgiving debt recovery costs.

You can also discuss and agree to a debt management plan with your creditor, which makes sure that you can keep paying the sum over time without having to face legal consequences or payments like added interest or debt recovery costs.

There are a few options you can enlist when you’re late in paying a debt, but most of them involve long-term agreements with creditors that can go very wrong if you keep failing to make your payments.

The consequences could include taking a hit to your credit rating, added interest, or other legal action.

2. Request Creditor for Payment Extension or Lower Interest

As you’ve probably noticed, a lot of your options involve individual agreements with your creditor. This, of course, means that the entire process is not linear, efficient, or always likely to turn out in your favour.

With that in mind, one thing you can do is request your creditor to extend the deadline of your payment or reduce your interest.

You can make unofficial requests to a creditor via a hardship letter, which the creditor has the full right to refuse.

Bear in mind that refusing to pay or being uncooperative (e.g., ignoring letters or calls) can have serious consequences (such as default notices or CCJ), just like outstanding debt on a credit card can.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

3. Bankruptcy

One more option you can look to avail yourself of under extreme duress is to declare bankruptcy.

When you declare bankruptcy, you’re legally investigated, and it is determined if you possess the assets required to pay off any money you owe.

If you don’t possess the required assets, your interest and the outstanding amount may be forgiven. Any possessions you have may be used to pay off what you owe.

The bad news is that being bankrupt comes with certain financial restrictions, such as an upper limit on the amount you can borrow without having to tell the lender that you’re bankrupt or added interest on future loans.

Bankruptcy will also hurt your credit score for six years.

If contacting your creditor and requesting them for an extension or an instalment plan doesn’t work, you may have to consider declaring yourself bankrupt.

4. Try to Cut Costs & Increase Income

Keeping track of your living costs and your income and trying to establish a healthy fiscal balance in your life should be one of your top priorities. We often underestimate the importance of cutting costs, saving, and generating income from multiple sources.

Take a close look at your spending and target areas where you can easily cut some costs without having to remove any essential item or service from your lifestyle. Take a look at utility bills, groceries, and other expenditures, and try to opt for cheaper options.

One more thing you can do if you’re looking to avoid being late in paying a debt is to sign up for national insurance. You’ll get access to certain benefits for a longer time than most.

When you’re late in paying a debt, every penny counts. You need to have a good idea about credit management. Try some of these ideas, and you’ll be surprised how fast you make progress.

What Qualifies as Late in Paying a Debt?

First of all, how do you know that you’re late in paying a debt?

Well, to put it simply, a late payment is the amount of money a borrower repays to a lender either after the due date has passed or after the specified grace period for the amount is over.

In commercial terms, you’re late in paying a debt when it’s 30 days past the specified date to pay public authorities and 60 days past the specified date when it comes to a business payment.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How Bad Can It Get? – Interest & Additional Costs

Truth be told, there are a number of things that can go very wrong when it comes to being late in paying a debt.

You need to be aware of the potential consequences you may face if you consistently mishandle your late payment situation.

For one, individuals and businesses are allowed to charge you recovery costs on late payments. This is troublesome because not only do you have to pay a fixed amount of money to the involved party as recovery, you can also be charged interest on a late payment.

The interest you may incur is referred to as “statutory interest”, and if you’re concerned about the specifics, you’ll incur 8% interest and the base rate for business transactions as specified by the Bank of England.

What’s worse is that your creditors aren’t legally required to inform you if they’ll be claiming interest on late payments or other compensation costs.

Legally, you’re vulnerable and may incur a lot of financial damage via interest and other problematic add-ons.

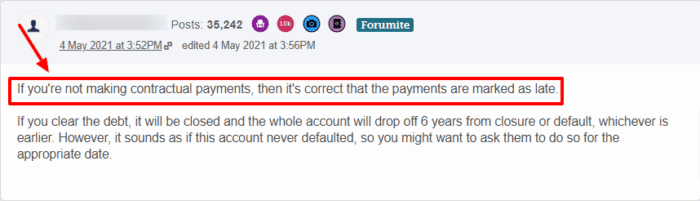

It’s worth noting that consistently being late on payments can negatively impact your credit report.

Multiple missed payments can stay on your credit file for six years, making it harder to obtain future credit.

This is a guidance tool only and not an assessment. For accurate interest calculations, contact the company issuing the credit. Do not rely solely on this calculator’s results.

FAQs – All You Should Know if You’re Late in Paying a Debt

Yes, you can be taken to court in such a situation. If you agree to pay at least some part of the whole, your creditor may choose to not go to court.

Creditors are likely to take you to court if you fail to pay the amount, even if it’s for a small debt recovery.

If you want to convince creditors to accept a lower payment than you originally owe, make a phone call or two, and try to offer a lump sum amount, if possible. For long-term plans, you often end up paying more than you originally owed, usually as interest, especially if you owe money to business owners.

You can convince creditors by knowing your facts, writing hardship letters, being genuine, and assuring them that you intend to pay at some point.

No, you can’t usually do this without paying anything at all, especially when you’re late in paying a debt.

There are ways you can get close to doing so, one of which is declaring bankruptcy. But bankruptcy, along with most other options to get away without any payments almost always involve significant harm in the long run.

If you have a non-recourse debt, whatever asset you put up as collateral will be seized but your creditor cannot ask you for further payment afterwards even if the asset does not pay back your debt completely.

If you’re having trouble with debt collectors, you may want to seek advice from an independent debt charity such as National Debtline or StepChange.