Max Recovery Limited Debt – You May Not Need to Pay

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you got a letter from Max Recovery Limited about a debt? Don’t worry, we’re here to guide you. Every month, more than 170,000 people visit our website for help with debt problems, just like yours.

In this article, we’ll help you understand:

- Who Max Recovery Limited is and why they might contact you.

- How to check if the debt they say you owe is really yours.

- What you can do if you can’t afford to pay or think the claim might be wrong.

- How to stop them bothering you too much.

- Ways to manage or even erase your debt.

We know it can be scary and confusing when a debt collector contacts you. Some of us have been in your shoes. We’re here to help you figure out your next steps.

Why is Max Recovery Limited contacting me?

If you receive a Max Recovery debt notice, it’s likely that you are in debt. Max Recovery are a debt collection agency that chases payments for other companies. If you’ve ignored calls or letters from companies you owe money to, they may hand over the process of recovering this money to a company like Max Recovery.

Max Recovery Ltd also specialise in bulk-buying debt from larger companies. This means that these companies don’t have to waste time and energy pursuing these debts, and often sell them off at a low price to companies like Max Recovery. Instead of owing the original lender, you now owe Max Recovery Limited.

How should you deal with Max Recovery Limited?

So that’s an overview of who Max Recovery Ltd is. But how should you go about dealing with them? Here are some frequently asked questions so you know exactly where you stand and what action you can take, which will hopefully save you loads of stress and help you sort out this outstanding debt.

Should you ignore their phone calls or letters?

Debt collection and persistence, unfortunately, go hand-in-hand. What’s more, getting loads of letters and calls each week might discourage you from dealing with them properly, especially if you don’t recognise who’s asking you for money. Unfortunately, debt collectors like Max Recovery Limited are allowed to be persistent in their dealings with you. However, they legally cannot harass you, and it’s often a fine line between persistence and harassment.

At the end of the day, you should never ignore a debt collection agency contacting you – they usually don’t contact you by mistake. So, when you get a letter or a call from Max Recovery Ltd, check all the relevant information you might have about the issue, and get in touch with them as soon as you can. Ignoring them won’t stop them, and could lead them to escalate the matter.

You can make specific contact requests, which they should abide by. For example, you can ask them to deal with your case primarily in writing.

You’ve just got a letter from Max Recovery Limited – what should you do?

It can be stressful getting a letter from a debt collection agency, especially from a company you didn’t even know you owed money to. However, it’s nothing to panic about. Knowing your rights, as well as theirs, can help you reach a quick and painless resolution.

First of all, check through the letter and see if the original debt they are recovering if mentioned. As mentioned earlier, Max Recovery Limited both collects debts on behalf of companies and buys ‘bad’ debts. As such, you will either owe Max Recovery Ltd or another company they’re representing.

It’s likely you will have correspondence from the original company chasing up on the money you owe, so it’s really important to cross–reference these with the letter from Max Recovery.

You can also get them to prove your debt, with a ‘prove the debt’ letter. If they can’t prove that the debt is yours, they have no choice but to mark it as settled. You can find a good template for a similar styled letter here.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Why is Max Recovery on my credit report?

If Max Recovery is on your credit report, it is likely they bought a debt that you owe. They can purchase a debt even if you have agreed on a repayment plan with the original creditor.

Once a debt is sold to a collection agency, it can be reported as a separate account on your credit report. The name of the original creditor won’t be associated with the debt. If you don’t believe the debt is yours, contact Max Recovery as soon as possible.

So what does this mean?

Their letters may be confusing as you may not recognise the debt amount. It may also seem strange to have to owe a company you may not have dealt with in the past this amount of money.

However, this doesn’t mean that they’re not legitimate or out to scam you. They now legally own the debt, so instead of owing the original company, you now officially owe Max Recovery Limited.

Max Recovery has been known to contact via the phone and with letters.

» TAKE ACTION NOW: Fill out the short debt form

Should you pay the debt?

In short – yes. If they have proof of your debt, laid out in a ‘prove the debt’ letter or your paperwork and correspondence lines up with your understanding of the debt, and you are financially capable of paying it, then you will need to pay. The quicker you contact them with a payment agreement, the sooner the letters and phone calls will stop.

Staying On Top Of Your Debts

One of the hardest parts about being in debt is that the industry isn’t at all transparent.

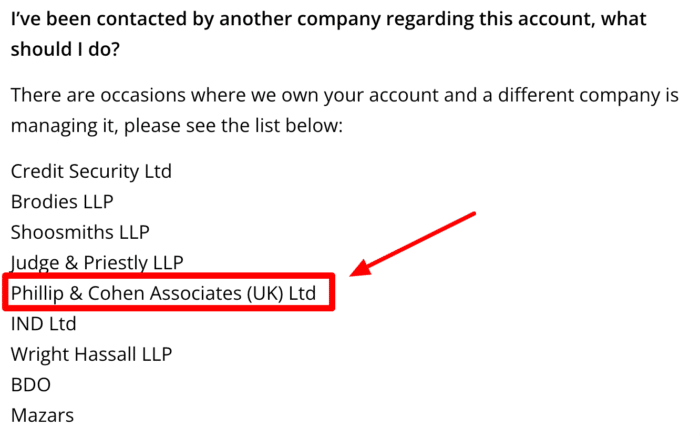

One common tactic used by Debt Collectors is contacting you under multiple names and addresses.

Sometimes, it’s for practical reasons, but even then it can be confusing and intimidating. So it’s important to try to keep a level head and research what’s going on.

Some of the biggest debt collectors in the UK operate under multiple names.

- Robinson Way will sometimes contact you under the name Hoist Finance.

- Cabot Financial Group recently bought Wescot Credit Services

- Credit Style communicate as both Credit Style and CST Law.

- Lowell Financial also owns Overdales and collects debts under both names.

In fact, in the case of PRA Group, they’ve been known to use multiple company names. As you can see in the image below.

If you’ve been contacted by a debt collector recently, it’s worth going through your post and emails to check that you haven’t missed anything, just in case they’ve started writing to you under a different name.

What rights do you have?

Max Recovery Limited are a member of the Credit Services Association (CSA), which means there are some strict rules and regulations about how they go about their dealings day-to-day. Not only do they agree to the terms laid out in the CSA conditions, buy they are also expected to work within these rules. Some of these rules cover the following things:

Knowing your rights is really important, as there is evidence of debt collection agencies disobeying these rulings without the receiving party realising that the agency was doing wrong. It’s good practice to carefully keep track of all correspondence with debt collection agencies such as Max Recovery Ltd.

What rights do they have?

Max Recovery Limited also has rights, and as a debt collection agency, their legal powers are no different from the original creditor who they either represent or have bought the debt from. They have every right to chase you (within reason) for payment of the debt, but they are not allowed to harass you.

Max Recovery Limited could also send debt collection field agents to your home if you fail to pay or ignore their correspondence. It is worth knowing that if this happens, these agents are not bailiffs, and it is against the law for them to claim to be. They are not allowed to enter your home without your specific permission, and they are obliged to leave if you ask them to.

What if you can’t pay the debt?

Admitting that you may not be able to pay off your debt can be really hard to deal with, but there are certain measures in place that could really help you out with paying.

First and foremost, ensure that you have kept in touch with Max Recovery Ltd and you keep records of when and how you have contacted each other. If you’re open and honest with them from the off, they will be more understanding of your situation and will hopefully help you to come to some sort of resolution.

Reviews on several forums say that Max Recovery Limited reps are quite compassionate and personable in contrast to other companies, so as long as you’re open and forthright with them, they’ll try and help you too.

If you are facing problems with repayment, you should contact the debt collection agency as soon as you can to explain your current financial situation. This sort of honesty will work in your favour, and between you and Max Recovery Ltd, you could come up with a suitable payment plan and a timescale. Taking this initiative should also avoid you needing to pay unreasonable charges or interest rates as well.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What are some initiatives you can use to help repay your debt?

Another option in place that would help to pay your debt is either a debt consolidation loan or management plan. These will not only contribute affordable monthly payments, but also they also help to pay off all outstanding debts you have at the same time. To find out more information, it’s worth having a look at our debt options page.

There is also the option to write off your debts with Max Recovery Limited using an individual voluntary arrangement (IVA). This consolidates all your debts into one and means you make monthly payments for a set time period, after which, any remaining debt is legally written off. You can find more information about IVA’s here.

There are some really good websites that offer free and to-the-minute advice about what you can do if you are having difficulties with your debts. These include:

Max Recovery Ltd Contact Details

Final Thoughts

If Max Recovery Limited have sent you a letter or have called you up, then the advice we’ve outlined will help you formulate a game plan. Hopefully, you can then take steps to sort it out quickly and easily.

It’s never nice to get letters that can come across as vaguely threatening that demand money from you, but if you ensure you’ve got all the right information and paperwork to hand, you will be able to resolve the matter.

If Max Recovery Limited haven’t behaved respectfully or seemed to have followed the code as laid out in their governing body, the Credit Services Association, then you have a right to make a formal complaint about them.

If you feel they have mistreated you or gone against their code of conduct, start off by sending them a letter directly and explain your complaint. Failure to acknowledge this correspondence means that you can step it up a gear, and refer the case to the Financial Ombudsman Service.