Mortgage After Trust Deed – Complete Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you curious about what happens to your mortgage after a trust deed? Or perhaps you’re worried about how a trust deed might affect your credit score? This article is here to answer your questions.

First of all, know that you’re not alone. Each month, our website is visited by over 170,000 people who are seeking advice about debt solutions. We understand worrying about debt can be hard, and we’re here to help you make sense of it all.

In this article, we’ll explain:

- What a trust deed is and how it works

- How a trust deed might affect your ability to get a mortgage

- Steps you can take to improve your credit score after a trust deed

- How long a trust deed stays on your credit file

- Different options available to you after a trust deed

Our team has lots of experience dealing with trust deeds and debt. We understand the stress it can cause, and we’re here to give you the facts you need in a simple way you can understand.

Let’s get started on your journey to understanding your mortgage after a trust deed.

What does getting a mortgage after a trust deed involve?

- Saving for a deposit.

A higher deposit is perhaps one of the greatest factors in helping you get a mortgage since it decreases the lender’s risk. With a good-sized deposit, they may offer you lower interest rates and diminished organisation expenses, as well as give access to a more extensive scope of alternatives.

Perhaps a portion of the money that was used to reimburse banks every month (for your debt) could be put aside for a house deposit after the trust deed is complete.

- Rebuild your credit rating.

Factors such as your credit profile, credit rating, credit score, credit file, credit limit, credit reports, and credit balance matter hugely when trying to get a mortgage.

It might be worth taking a look at ‘credit builder’ credit cards, which are intended to help people with a poor credit history. Although elevated interest charges are applied, these credit cards help to demonstrate that you are able to make repayments reliably.

To restore your credit rating, you’ll have to make monthly payments. S,o it’s a better idea to use a credit card for a regular payment that you know is reasonable and pragmatic, instead of more modest sums that can rapidly add up. Failure to reimburse this kind of credit card will bring about weighty penalties, and further long-term harm to your low credit score.

- Check your credit file.

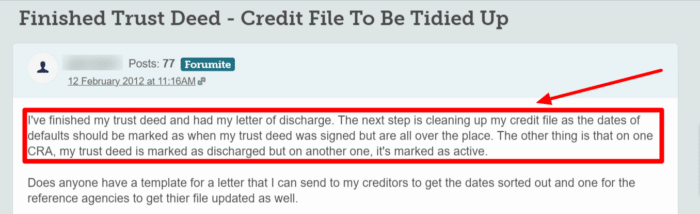

After your Trust Deed has been discharged, you should obtain a credit report from some reputable credit reference agencies, as this forum user has done:

The four primary credit reference agencies with offices in the UK are:

- Experian

- Equifax

- Crediva

- TransUnion.

You can acquire a credit report from any or all four organizations to check that the data they hold is up-to-date. However, you may find out that every one of them has somewhat different data regarding your credit about you.

You should approach your creditors if your credit record hasn’t already been revised – doing this expands your odds of obtaining money, as it’s one of the main reference points lenders use to evaluate your capacity to reimburse.

Furthermore, lenders should update your default notices, as these notices stay on your credit file for six years.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

The risks of advancing towards lenders yourself

At the point when you apply for borrowing, the lender will look through your credit report to establish your creditworthiness. By doing this, a ‘mark’ is left on your credit file, and the possibility that you are declined by the money lender can negatively impact the odds of being accepted by other organizations.

So, it can sometimes be a good idea to move towards ‘whole-of-market’ independent local mortgage lenders – ideally one who you trust and has good reviews (it may be worth consulting a financial advisor about this).

You’ll have the option to discuss your situation and mortgage conditions face to face, and pick up from the dealer’s extensive information on the items on offer.

They will narrow down your most suitable alternatives, lowering the odds of your credit record being influenced by lender searches and possible dismissals.

Get a mortgage broker/trader

Mortgage brokers are an authority with inside and outside information available. They’re ready to take a look at a scope of mortgage items that suit your requirements.

It’s a smart idea to speak to a few different brokers to fully understand what’s on offer, and who will be most suitable for you.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Making every payment on time

The primary factors deciding your monthly payments are the size and term of the credit.

Size is the total amount of money you obtain, and the term is the period of time you need to take care of it.

Generally, the more drawn out your term, the lower your regularly scheduled installments are.

A Trust Deed stays on your credit document for a very long time (six years), a timescale that exceeds the term of most debt management plans (which are normally finished in three or four years).

» TAKE ACTION NOW: Fill out the short debt form