Nationwide Debt Recovery Debt Collection – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about a letter from Nationwide Debt Recovery? You may not have to pay, but it’s not wise to ignore them. This guide will help you understand your choices.

Many people have questions when they get a letter like this. They wonder where the debt comes from or whether they should pay it. Some worry if it’s real or if they can afford to pay. You’re not alone with these worries. In fact, over 170,000 people each month come to our website for information about their debt questions.

In this guide, we will talk about:

- Who Nationwide Debt Recovery are and why they might contact you.

- How to check if the money they say you owe is really your debt.

- What to do if you don’t want to pay or can’t afford to pay.

- What the law says about debt collectors and how they operate.

- How to keep on top of your debts and get help if you’re struggling.

Our team has lots of experience with debt collectors. We know it can be scary, but we’re here to help you make sense of it all. We’ll give you clear, simple advice to help you figure out ways to deal with Nationwide Debt Recovery.

Let’s dive into what your next steps should be.

Why are Nationwide Debt Recovery Debt Collectors contacting you?

There is no denying that the debt collection industry is big business. There are a wide range of types of debt collectors like Nationwide Debt Recovery Debt Collectors, including those which are independent businesses, those who work as a business arm of the original credit company, and sometimes even sole traders operate within the debt recovery industry. If you are being contacted by a debt collection company, you would be forgiven for not quite understanding how they operate.

The fact is that debt collectors such as Nationwide Debt Recovery Debt Collectors will purchase the debt from the original credit company (who you took out the loan/credit card etc with in the first place.) They buy the debt for a fee, which is sometimes as low as 20% of face value. The way they make a profit is by collecting payments on the debt. In fact, if they don’t get any payments, they have lost the money they spent purchasing it. Unfortunately, this means that they will often resort to underhand tactics to try and get you to pay the debt. The Office for Fair Trading (OFT, 2010) said that poor practices among debt collection agencies “appear to be widespread”.

How to find out if you owe the money?

If you are questioning the validity of the debt, either because you don’t think you owe it, or you have paid it off. You should request proof that it is your debt, and what the total cost is comprised of.

You may not recognise Nationwide Debt Recovery Debt Collectors, and this is because they are trying to chase the debt on behalf of another company. The cost may be higher than you remember too, as there will be charges and interest added. It could end up being much more than you previously thought.

In order to establish the debt and where it originated, as well as how the costs were incurred, you can write to Nationwide Debt Recovery Debt Collectors, and ask them to send you a copy of the original credit agreement. Until this time, you have no obligation to pay them.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What if I don’t want to pay?

Unfortunately, it is not as simple as you just don’t want to pay your debt. If you owe it, then you must make arrangements to pay it back. Obviously, the best course of action would be to pay it all of in the one go, as this would save you from having the stress of the debt and dealing with debt collectors like Nationwide Debt Recovery Debt Collectors. If you are unable to though, you can set up a repayment plan with the debt collectors, or perhaps, make a partial payment to clear off your debt.

Visiting your premises

There may be occasions when debt collectors say that they plan to take matters into their own hands by visiting you at home to either take your possessions or simply ‘discuss’ the debt. They are not permitted to do this, so this is nothing but an empty threat. Under no circumstances can they access your property, without your permission.

Do not give them permission to come to your home, and if they threaten you in any way, you can seek help from the police, who will deal with the situation for you.

» TAKE ACTION NOW: Fill out the short debt form

You can write off your debt

It can be possible to enter into an Individual Voluntary Arrangement (IVA). With this formal agreement you pay the debt collectors an affordable amount, either as a one-off sum or as monthly payments and the rest will be written off after a period of time, usually five years. The process must be carried out by an insolvency practitioner.

Find a local licenced IVA insolvency practitioner here.

Another option is a Debt Relief Order (DRO). You can only get this if you have £75 or less each month after paying your household expenses and you are not a homeowner or have assets over £2,000.

To apply for a DRO you will need to go through an authorised debt advisor. You can find a list of authorised debt advisors here.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Staying On Top Of Your Debts

One of the hardest parts about being in debt is that the industry isn’t at all transparent.

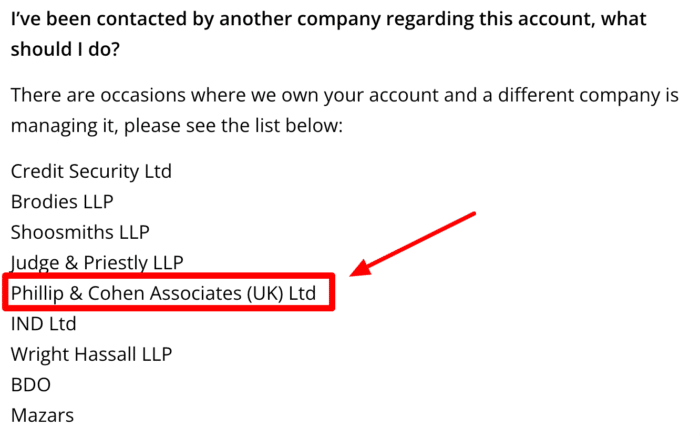

One common tactic used by Debt Collectors is contacting you under multiple names and addresses.

Sometimes, it’s for practical reasons, but even then it can be confusing and intimidating. So it’s important to try to keep a level head and research what’s going on.

Some of the biggest debt collectors in the UK operate under multiple names.

- Robinson Way will sometimes contact you under the name Hoist Finance.

- Cabot Financial Group recently bought Wescot Credit Services

- Credit Style communicate as both Credit Style and CST Law.

- Lowell Financial also owns Overdales and collects debts under both names.

In fact, in the case of PRA Group, they’ve been known to use multiple company names. As you can see in the image below.

If you’ve been contacted by a debt collector recently, it’s worth going through your post and emails to check that you haven’t missed anything, just in case they’ve started writing to you under a different name.

Nationwide Debt Recovery Contact Details

| Company Name: | Nationwide Debt Recovery Ltd |

| Other Names: | Nationwide Debt Collectors, NDR Debt |

| Address: | PO Box 55, Liverpool L2 2S |

| Contact Number: | 0844 811 0112 |

| Website: | www.shopdirect.com |

| Numbers they call from: | 01612238605 |