One Source Debt Resolution – Should you Pay them?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

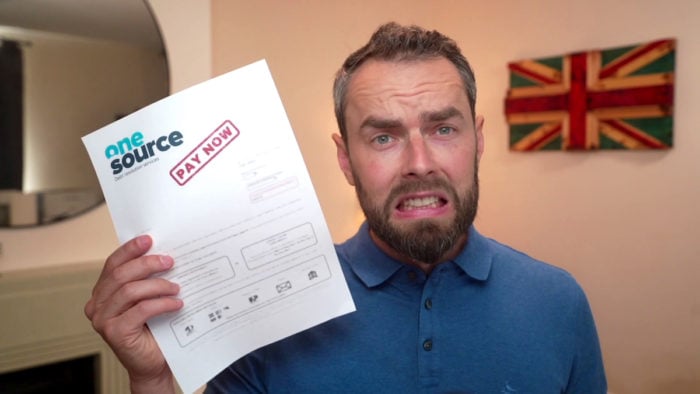

Are you puzzled by a letter from One Source Debt Resolution? Not sure what it means or if you have to pay?

Don’t worry; you’re in the right place. Each month, over 170,000 people visit our website for help with debt matters.

We’re here to help you understand:

- Who One Source Debt Resolution is and who they collect debts for.

- What a One Source Debt Notice of Enforcement letter means for you.

- How to steer clear of One Source scam messages.

- How you might write off some One Source debt.

- What happens if you don’t pay One Source Debt Resolution.

We know it can be scary and confusing when you get a surprise letter about a debt. Some of us have been in your position before. With our expertise, we’re here to guide you through your options.

What is a OneSource Debt Notice of Enforcement letter?

A Notice of Enforcement letter is sent by bailiffs like OneSource Enforcement to request payment from the debtor or expect bailiffs to come to their property. It is a prior warning and an opportunity to pay and avoid having bailiffs knocking at your door. Sending this letter incurs a charge of £75, which will be added to the total owed.

Watch out for OneSource scam messages!

On the official OneSource Debt Resolution website, which can be visited here, they state that some members of the public have received fraudulent messages. These messages claim to be from OneSource asking for payment. To be sure the letter you have received from OneSource is legitimate, you might want to get in touch and ask.

Should you pay OneSource Debt Resolution?

You should make arrangements to pay OneSource If you have received a OneSource Debt Resolution letter asking you to pay a debt in your name that is subject to a court order. Once a court order has been issued on a council debt, you are legally responsible to pay and delaying will only make matters worse.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

I can’t afford to pay OneSource Enforcement – help!

OneSource will recognise that not everybody can pay the money owed, which is why they are willing to listen to a proposal to pay the debt off in monthly payments.

You should contact them to discuss a monthly repayment plan as soon as you receive the Notice of Enforcement. If you wait until they visit your property to discuss a payment plan, you will incur further expensive fees. OneSource is not obligated to accept a payment plan.

When you agree on a payment plan with OneSource, you’ll usually have to sign a Controlled Goods Agreement. This is a contract that states if you stop making payment on your plan, bailiffs can return to your property and take possession of specific assets to sell at auction.

If you know you’ll miss a payment to OneSource Enforcement, it’s essential that you get in touch to try and re-arrange your payment plan.

What happens if you don’t pay OneSource Debt Resolution?

Ignoring a OneSource Debt Notice of Enforcement will result in their bailiffs coming to your home. They will ask you to pay the full amount or try to take possession of the valuable assets and goods in your name. Some assets cannot be seized, such as a vehicle on an HP agreement.

These assets are put into storage – which you’ll have to pay for – for a set period. You have this period to repay the debt or the assets will be sold at an auction. The money raised from the sale of goods is used to clear the debt and all fees owed to OneSource Debt Resolution.

But what if you can’t afford to pay the debt?

» TAKE ACTION NOW: Fill out the short debt form

Do I have to let OneSource bailiffs into my home?

You don’t have to let OneSource Debt Resolution bailiffs into your home. They cannot force their way into locked doors, but be aware that they can enter your property when the doors are unlocked or left open. For this reason, it is best to engage with the bailiffs from an upstairs bedroom window or through a letterbox.

Sometimes OneSource Enforcement bailiffs will not need to gain access to your property to take possessions. If there is a car on the driveway in your name – and not on an HP agreement – they could seize this asset by having it towed away.

Some people are not allowed to be visited by bailiffs under any circumstances. You can use the law to fight back against OneSource bailiffs if it applies to you. People with disabilities, pregnant mothers and vulnerable people can stop bailiffs from coming to their homes.

Get help from Citizens Advice or a UK debt charity to see if you can push back against OneSource using your legal rights.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Will They Give Up Chasing?

After all that you might be wondering whether you can just wait it out and hope they stop chasing you.

Sadly, that’s probably not going to happen. Most debt collectors are persistent.

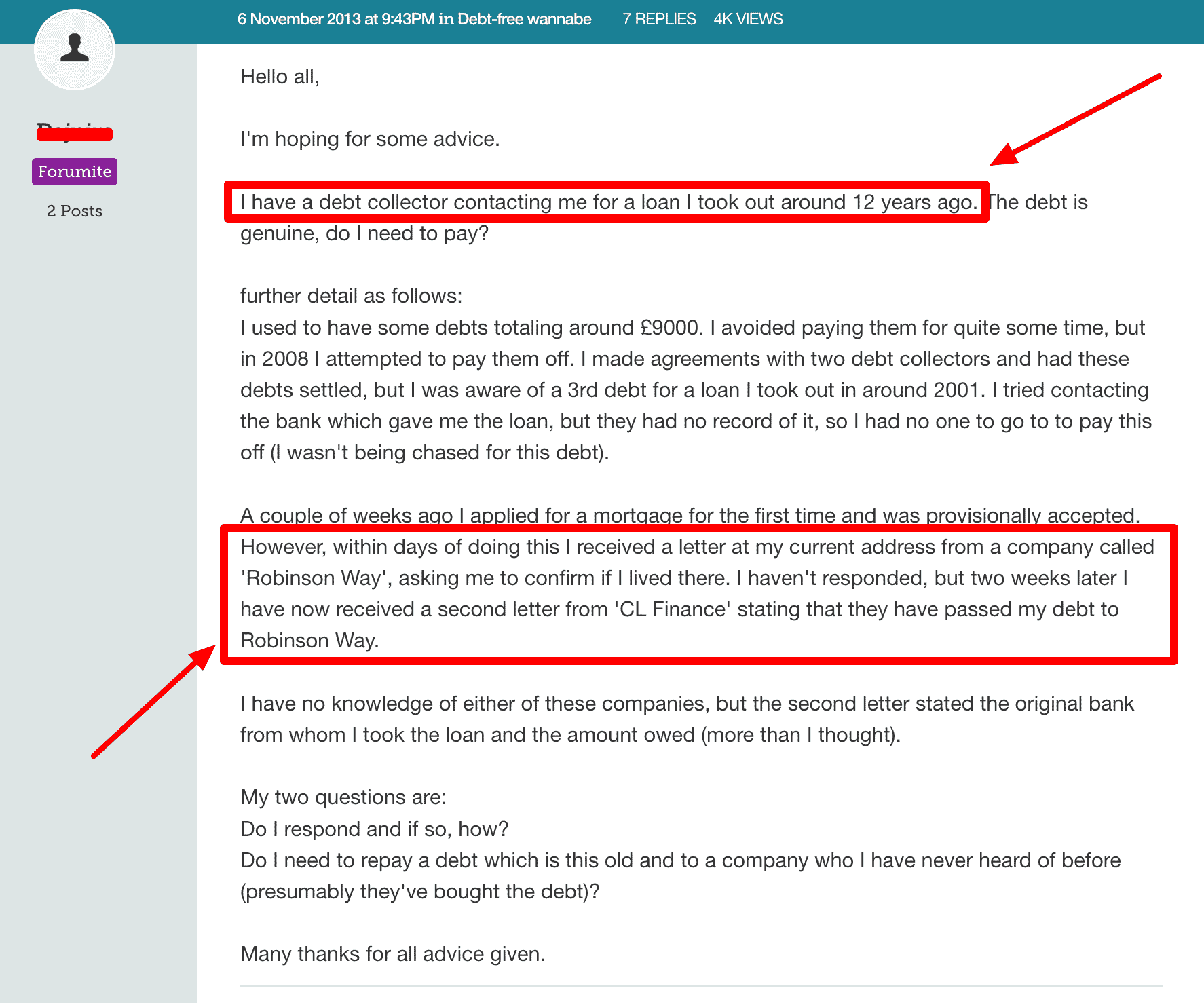

Source: Moneysavingexpert

As you can see Robinson Way starting to chase a debtor mere days after their mortgage application and a full 12 years after the debt was originally chased.

Other agencies like Lowell Group, Portfolio Recovery and Cabot Financial are constantly being accused of buying Statute Barred debts and then chasing people for payment.

One Source Contact Information

| Website: | https://enforcement.onesource.co.uk/ |

| Phone: | 0203 373 3588 |

| Email: | [email protected] |