Loan Temporary Repayment Plan – What You Need to Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re worried about how to handle loan debt, you’re in the right place. This guide aims to explain the ins and outs of a Loan Temporary Repayment Plan.

It’s not easy facing loan debt, but it’s important to remember that you’re not alone. Every month, over 170,000 people visit our website for advice on debt solutions. We understand what you’re going through and we’re here to help.

In this helpful guide, we’ll clarify:

- What a temporary repayment plan is.

- How interest rates affect your repayment plan.

- The importance of knowing your credit score.

- How a Debt Payoff Calculator can help you.

- The pros and cons of a temporary repayment plan.

Don’t worry; we’ve got your back. We’ll help you explore your options and find a solution that’s right for you. We’re committed to helping you find your way through the jungle of loan repayment plans.

Let’s get started.

What is a temporary repayment plan?

Finding yourself in a situation where you can’t pay back a loan can be scary. If, for whatever reason, you cannot make payments for the next few months, you may want to consider a temporary repayment plan.

When making a temporary repayment plan, you basically tell your loan company that you can’t pay right now, but you’ll be able to make payments in the future. This is always a better plan than not paying at all. There will still be interest on the loan, and you may even be faced with added interest.

Ensure you know what you’re getting into before signing any contracts.

Read what to do if you can’t pay back your debt.

Interest rates and temporary repayment plans

When borrowing money from a lender, you are charged interest for doing so, and the amount you must repay depends on the interest rate associated with the loan and any additional fees.

When it comes to temporary repayment plans, you might be able to come to an agreement to stop the interest and charges with your lender. However, it is important to note that they do not have to do so if they don’t want to.

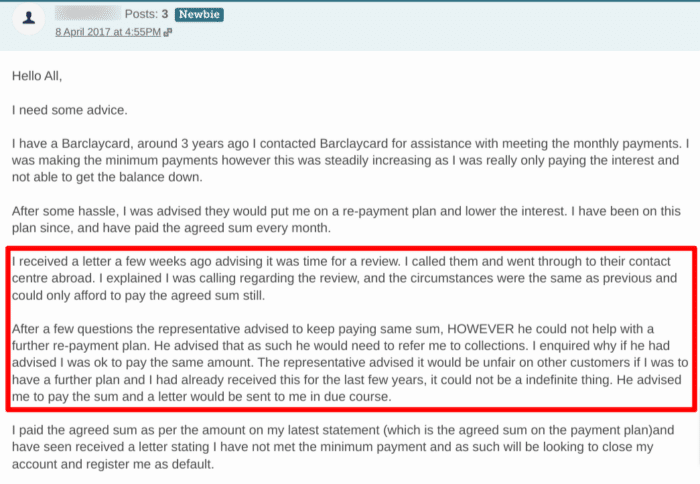

As you can see above, this MoneySavingExpert forum user was placed on a temporary repayment plan where they could pay a lower interest rate. Unfortunately, after a few years, the creditor referred the borrower to their collections team as they could no longer extend their plan.

What are the pros of a temporary repayment plan for a loan?

There are benefits to the temporary repayment plan. It allows you to pay less money for a short period of time. This will enable borrowers to earn more money and get back on their feet. Once the time period has run out, borrowers may find themselves in a better financial position.

Rather than speaking to the bank, you can try communicating with your loan company directly.

A temporary repayment plan provides borrowers with enough money to live. Your agreement will ensure you have enough funds for bills and food. This can be helpful if times are demanding in terms of money. The agreement can also help protect your account from further charges. This means that you’re less likely to be charged more by the company.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Are there risks with a temporary repayment plan?

You should be aware of certain things when you get a temporary repayment plan.

First of all, your loan company doesn’t have to agree to your repayment plan at all. This is something you’ll want to avoid where possible.

Secondly, your credit file will be altered to show you had to take out the repayment plan. It can hurt your credit score and may make it harder for you to take out credit in the future. Missed payments, defaults and partial settlements can leave a mark on your credit report for six years.

Finally, you need to make sure you make the revised payments. If you don’t, your credit score could take a dive, and you will still need to pay back everything.

Real life stories:

Its total ripoff. Asked Moorcroft agent to change my payment plan date to the end of the month as i wont be able to make any payment towards the beginning of the month. They have attempted it twice this month to take money out of my account and my account is in minus now. Seriously !!!!

Sachin Sugathan – Consumer Action Group

So how do I actually set up a temporary repayment plan?

Setting up the plan involves a few simple steps.

- Find out how much you can repay by working out how much income you’re bringing in. This includes any tax credits or child benefits you currently receive. Offer this figure to the loan company in a written proposal.

- Figure out exactly how much you need to survive in terms of bills and food. Don’t include any allowances for things like credit cards. To find out how much you can pay, take away the cost of your essentials from your income. This will give you the amount you can pay the loan company.

Make sure you write down how much you earn and how much it costs to live, as these are figures that you’ll need to have in your repayment plan.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Setting up multiple payment plans

The rules are slightly different if you want to set up multiple payment plans, as you’ll need to ensure that you can pay each creditor the same amount. This may mean paying everyone less to ensure everyone receives a fair amount each.

Each creditor needs to be aware that you’re setting up multiple plans and make sure that you clearly explain to everyone why you cannot pay the full amount. This will help them decide whether to approve the payment plan.

So what happens if I can’t make my loan payments still?

If you still can’t pay, speak to your loan companies immediately. Explain the situation and give them a compelling reason why you can’t pay the revised payments. From my experience, this can have a negative impact on your finances, and you may have to default on your payments.

This will impact your credit score and make it difficult for you to get credit in the future. You could even be issued a County Court Judgement (CCJ) and legally forced to repay your debt.

So is a temporary repayment plan the best choice for a loan?

The temporarily reduced payments could give you the chance to get back on your feet. It is essential that you know how much you have in the bank and how much you can actually pay. You need to be sure you can pay the new payments. Otherwise, you could risk falling further into debt and lowering your credit score.