Payment Freeze – Detailed guide, FAQs, Tips & More

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you looking for ways to manage your debts when they become too much? You’ve come to the right place for answers.

Our website is a trusted guide for over 170,000 people each month who need guidance on debt solutions. We understand how tough it can be when you’re worried about money and can’t pay your debts for a while.

In this guide, you’ll find:

- What a payment freeze is and how it can help you.

- How to ask your creditors for a payment freeze.

- What happens if your request for a payment freeze is turned down.

- What to do when the payment freeze period ends.

- How a payment freeze affects your credit score.

We know what it’s like to struggle with debt, as some of us have been there too. This is why we’ve made this guide to help you understand your options and take control of your finances. Let’s dive in and learn more about payment freezes and how they could help you.

How to ask for a payment freeze?

To ask for your payments to be frozen for three months, you should contact the lender directly and make your request.

You will need to support your request by providing evidence that a payment holiday is needed. This can be done by showing your monthly budget, which highlights all your income and essential expenses.

You should also explain how your financial situation has changed since you signed the credit agreement, and how you plan to be able to pay again in the future.

If you need help to create a monthly budget, follow our budgeting guidance here or use the services offered by a charity!

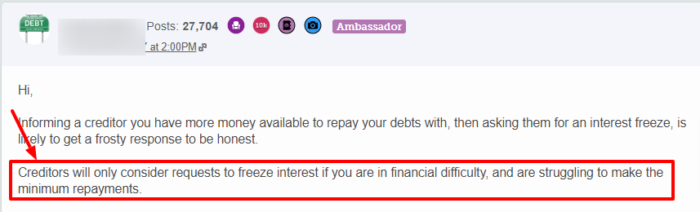

Remember, creditors may be willing to freeze your payments or interest if you can show that you’re struggling to meet your payment obligations. Be ready to provide relevant documentation that demonstrates your hardship, such as proof of job loss or unexpected expenses.

Do creditors have to give a payment holiday?

There is no obligation for any creditor to give you a payment holiday.

However, many creditors will still agree to the payment deferral, provided you can give evidence of why it is a good idea and how it will prevent you from creating debts you cannot repay.

My payment freeze was rejected, what now?

If your request for a payment holiday was rejected, you may want to ask the lender to freeze the interest instead.

You’ll still need to pay the minimum payments, but at least your debt will not be growing while you correct your personal finances or pay other debt.

We have a letter template you can download for free to help you do this!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Will my minimum payment increase after the payment freeze period?

If you received a payment holiday without having the interest frozen, your monthly payments after the payment deferral period could be higher.

This is because the amount you owe will have carried on increasing due to the interest being added, even when not making monthly payments.

If you manage to get a payment deferral on your interest payments simultaneously, your minimum monthly payments should not increase. However, it is always best to contact your lender for accurate information and support.

If you aren’t sure how interest will affect your credit, you can use my free interest calculator.

This is a guidance tool only and not an assessment. For accurate interest calculations, contact the company issuing the credit. Do not rely solely on this calculator’s results.

Will a payment freeze harm my credit score?

Your credit file will not be affected by a payment holiday.

When you have agreed to stop payments with the lender, you are not defaulting on these payments, and therefore, they should not be reported as such on your credit report account.

If you are in the middle of a payment holiday and want to make sure, you should use a credit reference agency to check.

The best credit reference agencies offer free trials to check – but don’t forget to cancel, or you’ll be charged monthly payments for the website’s services.

Will I still receive my monthly statement?

Customers are likely to carry on receiving a monthly statement even during a payment holiday. This is to keep you aware of your borrowing and your account.

If you spot a mistake, you should contact the lender directly.

Can I extend my payment freeze?

During the coronavirus pandemic, it was much easier to have a payment holiday extended as the Financial Conduct Authority and others were making it compulsory.

However, as these types of coronavirus payment freezes are coming to an end, it is difficult to get a creditor to agree on deferring further payments.

You might get an agreement to extend if you have a compelling reason.

Alternatively, your creditor might suggest other options to manage your debt, such as debt consolidation, IVAs (Individual Voluntary Arrangements), or DMPs (Debt Management Plans).

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What happens if I still can’t make my payments after the payment freeze period ends?

If you are still experiencing financial difficulty once your payment holiday ends, please contact a debt charity.

There are some excellent UK charities offering free money support and debt help services. Their services are all personalised and confidential for your peace of mind.

You may want to consider a token offer instead.

You may be able to agree to another three-month repayment holiday if you can support a second request with good reason and evidence.

Can you freeze loan repayments?

You can freeze loan payments as part of a payment holiday or payment freeze. If you pay back your loan debt monthly, you may ask your creditor to stop these payments so you can get your finances back on track.

We’ll provide a clear way to do this later in our payment holiday guide.

Can you freeze credit card repayments?

It is possible to get a payment freeze on your credit card repayment term.

If you have credit cards you are struggling to repay, consider asking one or more of your credit card lenders to give you a payment holiday for three months – or as required.