Persistent Debt – Everything You Need to Know with Tips

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about persistent debt? You are not alone. Every month, over 170,000 people come to our website seeking guidance on how to manage their debts. Persistent debt can feel like quicksand but don’t worry; we’re here to help.

In this article, we’ll show you:

- What persistent debt is and how it can affect your credit score.

- Why you might be falling into persistent debt despite making minimum payments.

- What to do if you keep getting letters about persistent debt.

- How to get out of persistent debt using different payment options.

- Ways to avoid getting into persistent debt in the first place.

Our team understands how worrying debt can be. We’ve been in your shoes and know how it feels. So, let’s take this journey together and find a way out of the debt trap.

What Happens if You’re in Persistent Debt?

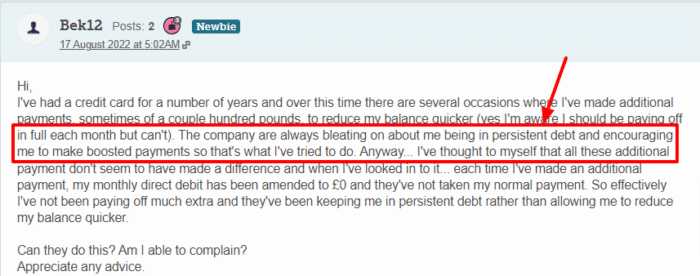

The FCA has instructed every credit card company registered in England to let their customers know as soon as possible if they’re stuck in persistent debt.

The company makes you aware that you’re in persistent debt and that you should try to increase your payments.

They also provide you with additional credit card plans where the repayment might be easier. The company also tells you what would happen if you keep things the way they are and your debt is prolonged.

If you’re in persistent debt, the credit card issuer is instructed to get in touch with you and offer you some kind of help and guide you in choosing a plan better suited for your needs.

If the payments still don’t increase and your debt keeps increasing, the company first halts any activity on your card. Then, if you don’t clear your balance, they revoke the card and ask you in court (through a County Court Judgement) to pay the balance and additional payments in full.

I Keep Getting Letters Regarding Persistent Debt.

If you receive a letter regarding your debt, contact your lender as soon as possible and explain to them that you’re calling about the persistent debt letter they sent.

If you have a plan that is unaffordable, you have the right to challenge it. The payment plans should be reasonable and sustainable as instructed by the regulator.

If you can’t afford any plans, you can try asking the lender to freeze the interest.

This can happen in cases where it is impossible to pay the debt if the interest on it isn’t frozen. So, it is definitely worth a shot to ask your lender to freeze your interest.

If your lender doesn’t freeze the additional fees, tell them to give you a plan where the payment is affordable.

Lenders are instructed to treat you as fairly as possible when it comes to helping you out as a customer. Let your lender know your situation and see what they have to say about it.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How do I Get Out of Persistent Debt?

Firstly, contact your lender. They may be willing to freeze your interest and not charge any additional fees on your loans.

Moreover, stop spending on your credit card until you’ve cleared your dues completely.

You should also work out and review your budget to see how much you can actually afford to pay to your lender.

Additionally, you should visit online credit card repayment calculators and work out how much you owe and how much you should pay monthly if you plan on repaying your loan on time with the additional charges on it.

These calculators also have a percentage calculator that can instantly tell you the amount of your additional charges and how long it will take to pay those off.

Also, start smart spending and budgeting to avoid falling into persistent debt even deeper.

‘Voluntary Payment’ Option

This is an amount that shows on your credit card statement. It tells you how much you need to pay that month in order to stay right on track.

This amount is worked out so that at the end of 18 months, you have cleared your dues entirely.

Taking this option will also mean fewer additional fees and the clearing of your dues sooner as compared to the minimum payment option.

Direct Debit Option

This option gives you an amount that you have to pay each month to completely stay on track.

This amount is usually a fixed amount, and it is optimised as such that your additional payments are reduced, and the debt is also cleared in time.

This is a good option if you have a constant stream of income and can stick to the payment of a fixed figure.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.