Proof of Debt Form – Here’s What You Can Send

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re trying to get a proof of debt form, don’t worry; you’re in the right place. This form is needed if money is owed to you from a state that cannot pay. Over 170,000 people come to our website each month to learn about debt solutions, so you’re not alone.

In this article, we’ll go through:

- What proving a debt means.

- Why you need to prove a debt.

- How to fill out the proof of debt form properly.

- What to do if you’re having trouble paying your debt.

- Answers to common questions you might have.

We understand that this can be a worrying time. You might be scared about paying a debt that may not even be yours. Our team has offered advice to lots of people in your shoes, so we know how to handle the situation.

Let’s dive in and learn more about the proof of debt form and how it can help you.

Why is the Proof Required?

Sometimes your credit card isn’t enough to pay your dues. A proof of debt is required when a company that files an insolvency form and is declaring bankruptcy owes you some money.

In such a situation you have to contact an insolvency practitioner or an office holder in an insolvency service.

There are currently 1735 people in the UK working as insolvency practitioners. This number is divided into people who work with government services and others who act as a trustee in dealing with creditors who are owed money by a bankrupt company.

Insolvency means that an entity has outstanding payables that outweigh its assets.

Government services or a practitioner should be able to help if someone is dealing with the dues of an insolvent deceased person. Usually, their national insurance can be used to pay off their dues.

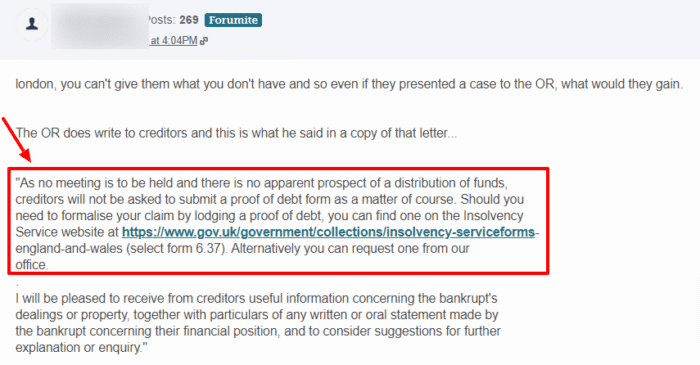

Creditors are typically asked to submit a proof of debt form when the insolvency practitioner has received their claim and is ready to distribute assets or when they are otherwise verifying the claims of all creditors, such as in a liquidation or administration.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How to Fill the Proof of Debt Form Correctly?

It is advised that you consult your lawyer regarding this or if you are using an insolvency service, you should definitely consult with them and explain your dues in detail.

Also ask for help while filling the form and naming the number which is owed.

If you are filling the form on your own make sure you are familiar with technical jargon like policy support links and Chattel leasing.

Other than that, make sure you aren’t filling the form hastily and have a good 1 or 2 hours on your hand so you make no mistakes.

If you want to submit the form electronically, make sure you have a stable internet connection.

Do anything you can to make the particular website work in time, otherwise you may miss out on the initial meeting of creditors.

What are the Contents of the Form?

- Firstly creditor details such as contact information and email address are filled.

- Then there are some preliminary questions regarding your claim. This is like a multiple choice questionnaire in which you have to tick boxes that apply to your specific case. The boxes ask extensive questions.

- Then comes the quantity of your claim. You write the number that is owed to you and this part also seeks a statement regarding your potential claim.

- There’s also a further information section. If you are a creditor, you must provide the information that is required in this section. This information includes the particulars about how and when the loan was incurred.

- Lastly the signature is required.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

There’s a deadline for submitting your claim if you want to participate in an initial meeting where all the creditors meet and decide the fate of how the target company’s assets are to be divided.

The asset can even be in the form of national insurance or fixed assets such as buildings.

There is also an option of an electronic submission which is probably the best option if you’re in crunch time.