Provident Loans Refund, Complaints & Claims

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you wondering how to get a Provident Loans refund? This is the right place for you. Each month, over 170,000 people come to our website for advice on how to sort out their debt.

In this guide, we’ll address the following questions:

- Is Provident going bust?

- Are you entitled to a Provident Loans refund?

- What should you do if your loan was unaffordable but you paid it off?

- How can you complain to Provident Loans?

Dealing with debt can be challenging, and it’s common to feel unsure about seeking help. In fact, Citizens Advice revealed that 60% of adults facing financial difficulties hesitate to seek assistance.1

Don’t worry; we’re here to help you understand your options.

IMPORTANT UPDATE: Provident is now assessing all the claims made since the Provident Loans refund deadline for making a claim passed on 28th February 2022. To stay up-to-date with your claim, log into your Claims Portal regularly. If you think there’s a problem with the status of your claim, then it’s really important that you appeal the result quickly. You have 30 days from the day you received the claim status to appeal.

Is Provident going bust?

As of 18th December 2021, Provident has confirmed it is going bust; it will no longer be lending money or collecting debts.

If you have any outstanding debts with Provident, they will be written off completely.

However, it’s worth reading because you may be able to make a claim against Provident if you were mis-sold your loan.

I’ll explain more below about Provident mis-sold loan claims.

Are You Entitled to a Provident Loans Refund?

Provident Personal Credit Limited may have mis-sold you a loan without complying with the law, despite being regulated by the Financial Conduct Authority.

If you have a Provident loan that is ‘unaffordable’ and is driving you into debt, you might be owed a full refund under the unaffordable loan refund eligibility criteria.

For a loan to be ‘affordable’, you must be able to pay it on time while still paying your other debts, bills and living expenses.

If either of these factors were not the case, you are entitled to a refund.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Get a Refund if Provident Loans Broke These Laws!

So, if it is not just doorstep loans and home credit which can make a successful complaint, what else can win you your money back when aiming a refund for loan law breaches?

Here we outline three laws Provident Loans may have broken when providing you with a loan.

These laws compensated nearly £170 million of mis-sold loans, which is why the Financial Conduct Authority (FCA) issued Provident Loans a £2 million fine.

Law #1: Provident Loans Irresponsible Lending

Provident Loans can only provide a loan to someone who has the ability to repay it. They cannot give loans to people who struggle to repay the loan and get into debt.

To lend responsibly, a creditor must be confident that you can repay the debt:

- In full and on time

- Without having to borrow more money

- Without falling behind on your existing commitments, and

- Without causing you financial hardship

The best way for Provident Loans and other lenders to ensure this will not happen is to check your credit score.

Here, they can identify if you are good at handling money and budgeting to continue making the full repayments each month and on time.

But checking your credit file is not the only obligation of Provident Loans.

They must assess your circumstances to ensure nobody signs for their loan who shouldn’t. The Provident Loans lending assessment has not always been fully above board.

Doorstep Loans are often seen as an aggressive tactic for forcing a loan on someone who has not considered it and would usually make the loan unaffordable.

If you received a doorstep loan or applied successfully online, you could be due a Provident refund.

We’ll explain how to make your case within a complaint after discussing some other laws that may be able to get you your money back.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Law #2: Price Cap on Interest and Charges

One way that taking out a loan gets people into debt more often than not is through interest and charges.

Some loan providers will add sky-high interest to their loans, often much higher than they advertise initially, and then charge fees because borrowers do not pay back the interest in time.

Sometimes this means debtors ask to borrow more money, and Provident have been known to oblige. This is just another example of further irresponsible lending and is illegal.

The better news is that the Financial Conduct Authority has implemented a price cap to tackle unfair interest rates and charges. These are:

-

A maximum charge cap per day of 0.8% is in place on the amount borrowed. You can only be charged 0.8% daily in any situation, including interest charges and other fees applied.

- If you default on payments, the maximum fee that can be charged is £15. However, this may be much lower if you borrowed a small amount due to the above 0.8% daily cap rule.

-

A total maximum charge of 100%. What does this mean? It states that you can never be asked to repay more than 100% of the money you borrowed for short-term loans.

For example, imagine you borrowed £1,000 over one year from Provident Loans. In this case, Provident can never ask you to pay back more than £2,000.

These rules apply to all credit agreements with interest rates above 100%.

There could be many cases where customers can use these interest and fee caps for Provident loans to claim their loan was unaffordable and illegal. Your lender might owe you money back and have to pay back the interest you paid too!

Law #3: Continuous Payment Authority (CPA) Laws

When you take out a loan with any lender in the United Kingdom, they will try to get you to agree to let them take repayments directly from your bank account.

Most people oblige because they are excited to get the necessary funds, making repayments convenient.

These repayments are usually taken with a method known as a Continuous Payment Authority (CPA).

The problem is that most people do not know their rights when agreeing to let Provident Loans take money directly from their accounts or the Provident Loans payment authority rules.

Here are some rules you need to know because you may be able to complain about their behaviour and, ultimately, get a refund.

- Provident Loans must give their customers notice when they will collect the repayments.

They are committing a serious offence if they fail to warn you and you cannot afford essentials like rent, a utility bill and food.

- Provident Loans can not take part of the repayments you owe if they cannot collect the full amount.

For example, Provident Loans might try to collect a repayment and are rejected by the bank because you do not have the funds.

Consequently, they may take less than the full amount to get some money and clear your account.

This is not legal because Provident Loans cannot leave you without money to pay for food, your upcoming utility bill and rent.

You can permit them to if you prefer them to collect some money and avoid more interest and charges.

-

The third time is not a charm. Provident Loans cannot try and take any payments if the previous two attempts were unsuccessful.

At this stage, they must contact you to see what is going on with your repayments. We recommend contacting a Provident customer service agent first to discuss your situation.

If you have struggled to repay the loan you received from Provident and subsequently experience these problems when they collect repayments, you could claim a refund.

So, let’s dive into how to make a complaint…

My Loan Was Unaffordable, But I Did Pay It Off

This may sound impossible, but some lenders will provide a loan that is not affordable, but people and families live in bad conditions with no heating or not enough food in the cupboards for months just to pay the loan off.

Even if you paid the Provident Loan off, you still may be able to get a refund on the full amount and the interest you paid because the loan was unaffordable.

A loan is only affordable if you manage to pay it back without going into serious hardship and poverty.

If you honour the agreement and experience hardship, the loan could still be unaffordable.

The Provident’s responsible for spotting when a loan will be unaffordable during the application process.

You meet the refund eligibility for repaid loans, including the interest you paid if you repay the Provident loan within the last six years.

How Do I Make a Complaint to Provident?

Provident has gotten so used to handling complaints regarding irresponsible lending that they have their own website area dedicated to submitting a Provident Loans complaint, so you could use their website, but there are other options.

They claim to give you a response within three working days or will write to you within five working days of your complaint.

This is quite fast for a UK lender.

I guess they have streamlined the process by handing back around £170 million in compensation.

They state you can call them or make a complaint online using their special complaint form. However, I recommend writing to them to tell them you are requesting a refund for irresponsible lending.

But don’t worry. You will not need to develop a legal letter as I have already written it.

If you want to ask Provident Loans for your money back, use my template letter. Simply copy the text and add your name and other details about your loan case file.

Access my template and other key info in my request a loan refund guide!

After You Make a Claim to Provident…

After you have written to Provident claiming your loan was unaffordable, do not expect the lender to cave in and provide you with a loan refund simply.

Most of the time, a lender will reply saying they do not believe they owe you a refund.

They do this because they think you will not go any further and give in, and are common loan refund rejection tactics.

Provident Loans may now be less likely to use these tactics because of the bad press they have received, and they do not want any complaints to be escalated further.

But if they reject your claim, that’s exactly what you should do. It’s time to call on the FOS!

Escalate Your Claim to the Financial Ombudsman Service (FOS)?

Whether you are claiming doorstep loans, a home credit loan or simply the loan was unaffordable, you can escalate your complaint and refund request to the Financial Ombudsman Service (FOS).

The FOS will ask you to complain to Provident Loans before following the refund request escalation process, which you will have already done at this stage.

You should then supply all relevant information to your claim, including your credit record if needed to show the loan was unaffordable and should not have been provided.

The FOS will then analyse the situation independently and decide what happened and if Provident Loans negated the law during the application process or when making repayments.

If the FOS finds that the lender has provided a loan when they should not have, they could request that Provident give you a refund and compensation. This includes the interest you paid and late fees.

The Financial Conduct Authority may take further action with Provident Loans.

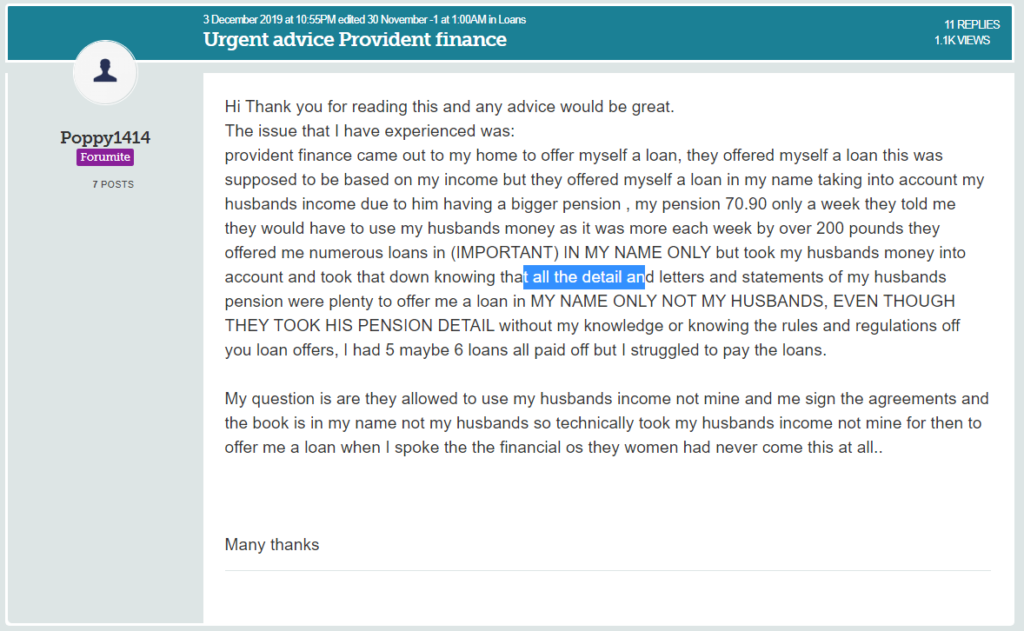

Provident Loans Home Credit Case Study

The below case study is one of the hundreds that exist online about their doorstep lending illegal practices:

This experience by Popp1414 is worrying. Provident Loans came to offer doorstep loans to people basing the loan on people not named on the loan.

The agent who did this is not abiding by lender regulations, especially considering the forum user had not requested someone to come to their home and discuss a loan.

These doorstep loans are illegal, and the practices used to get people to sign up for the home credit loan are worrying.

Use this information to guard yourself against illegal lenders!

» TAKE ACTION NOW: Fill out the short debt form

Can I Write Off My Provident Loan in Other Ways?

Not many people know this, but there are many ways to write off debt in the UK.

What if Provident Loans say you cannot get a refund on your loan and the interest you paid, and you have been unsuccessful in proving the loan was unaffordable to the Ombudsman?

Well, you might still be able to improve your circumstances through the following debt write-off alternatives:

You might be able to use an Individual Voluntary Arrangement (IVA), which can consolidate home credit, personal loans, credit card debt, and other debts into one repayment plan.

You will make monthly repayments that cover all your debt, but this is arranged through an expert known as an insolvency practitioner.

At the end of this lengthy repayment plan (five or six years), all remaining money owed will be written off. Some people with lots of debt manage to wipe thousands off their total debt and walk away without any more debts to their name.

And if you do not have a lot of debts, you can still find a way to wipe off what you owe.

Those without a high income and who do not own their own home can use something called a Debt Relief Order.

Your lender will be blocked from contacting you for 12 months, and if your finances have not improved during the year, you can wipe off all debt owed and never have to repay the loan taken out with Provident.

However, it is important to note that getting a write-off on your debt is likely to hurt your ability to get credit in the future for up to six years.

Struggling to Afford Your Next Payday Loan Repayment?

If you are struggling to afford your loan repayment, you might be able to find a solution directly with Provident by explaining your situation.

Maybe you cannot pay a utility bill or rent, and asking for a cheaper plan could work. In fact, Provident is legally obliged to listen to your offer and consider it.

If you are finding it difficult to make your loan repayments each month, and your lender is not assisting, you might need the help of a UK debt charity.

They will provide help with dealing with loan repayment difficulties.

They can provide advice and information specific to your circumstances and help you make a complaint to the FOS.

I also have a guide to assist you in complaining to the FOS!

A debt charity can talk you through the options available if you cannot keep up with repayments. They may try to negotiate cheaper repayments directly with Provident Loans (or another lender), and you might get a better deal.

Alternatively, they could recommend a formal debt solution to save you money on debt repayments.

You can make your debt affordable in the United Kingdom in many ways. See my debt solutions page for a complete rundown of these excellent methods!