RBS Debt Consolidation Loan Reviews & In-depth Info

Debt consolidation is one method of managing your debts. We’re here to chat about the Royal Bank of Scotland (RBS) and their debt consolidation loans.

Each month, our website guides over 170,000 people on dealing with money issues, so we have a lot of helpful advice to give.

In this article, we’ll tell you about:

- What an RBS debt consolidation loan is.

- How to check if you can get one.

- The facts about how much it may cost.

- The steps to apply for one.

- Our view on whether this is a good option for you.

We know that worrying about debt can be hard, but remember, you’re not on your own. There are lots of ways to handle debt, and we’re here to help you get to grips with them.

Let’s dive in and learn more about RBS debt consolidation loans.

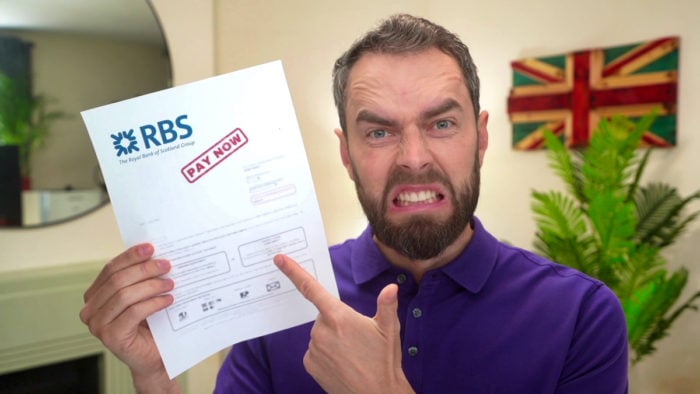

What Is the RBS Debt Consolidation Loan?

The RBS debt consolidation loan is a personal loan you can apply for to pay off your existing debts and consolidate.

Banks put limits on what a personal loan can be used for, but RBS, like many other renowned UK banks, have personal loans that can be used to consolidate debts.

RBS currently offer loans between £1,000 and £50,000 with different APR rates depending on your circumstances. Smaller loans have a maximum repayment period of five years, while any credit above £7,500 can be repaid over a maximum of eight years.

However, if you need to consolidate lots of debt and foresee these debts getting out of control, you might be better off using a different debt solution.

Speak with debt charities for advice. Also, consult our debt options page for more tips on how to get rid of problem debt.

What Are the RBS Loan APR Rates?

The representative APR rate promoted by RBS is currently 7.1% for amounts between £7,500 and £14,950 (as of August 2023).

This is quite within the range of competing banks and building societies, which tend to offer between 6.4% and 7.3%. However, it is not the worst either, with Barclays offering a much worse 9.9%.

However, these rarely matter as most customers will be offered a rate much higher. The maximum APR rate offered by RBS is 26.9%, the joint highest rate around right now.

HSBC currently have the lowest maximum RPR on personal loans at 21.9%.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 6.34% |

£219.34 |

£26,320.83 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 7.99% |

£222.20 |

£26,664.58 |

| Selina | 8.45% |

£223.00 |

£26,760.42 |

| Equifinance | 9.95% |

£225.61 |

£27,072.92 |

| Evolution | 10.2% |

£226.04 |

£27,125.00 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

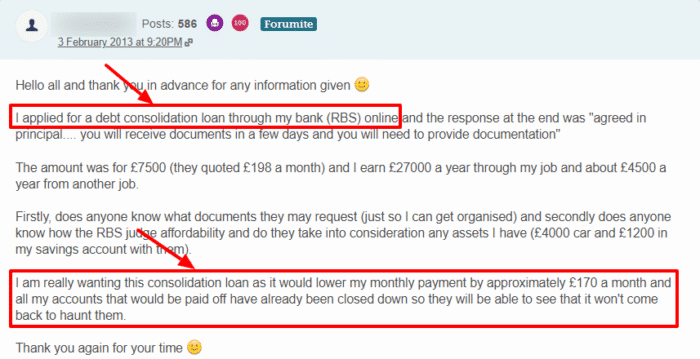

Am I Eligible for an RBS Debt Consolidation Loan?

The eligibility criteria for a personal loan in the UK is standard across the big banks. You must live in the UK and be at least 18 years old. Some banks require you to be 21 years old – but not RBS.

However, there is one criterion that may stop lots of debtors from being suitable to apply. You need to be a current RBS customer with an account you opened at least three months ago.

This will likely deter a lot of people from applying and is not an uncommon requirement among the biggest banks.

There are alternative options that don’t require you to be a current retail customer to apply, including HSBC and Santander.

How Do I Apply for an RBS Debt Consolidation Loan?

To apply for their debt consolidation loan, you must fill in an application form online.

If you have RBS digital banking details, you can import lots of personal data to make the process quicker and smoother. If not, you have to automatically fill in questions and it takes longer.

You can expect a decision on your loan application almost immediately in nearly all cases. And depending on the time of the day you apply, you could have the funds in your bank on the same day.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

Is There an RBS Debt Consolidation Loan Calculator?

They do have a calculator online. It gives you an idea of how much you could borrow and what repayments you might be subject to.

The online calculator does not give you any advice about consolidating your debts. This advice can be obtained for free by speaking with any independent UK debt charity, such as:

Besides, these calculators are not always accurate. The APR rate you are offered will depend on your circumstances and may not be as appealing as the one seen on their calculator.

Debt consolidations loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking for a better interest rate?

- Stuck with the confusion of multiple repayment plans?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

The Better Side of an RBS Personal Loan

If you are an RBS customer and have not been put off by the potentially higher APR rates, you might be boosted by another benefit of the RBS loan.

RBS offer a repayment holiday for up to the first three months of the loan to some people. This is especially advantageous to people in debt as it gives them a chance to catch up on payments or build up more savings to overpay.

Not all banks offer holiday repayments on debt consolidation loans, so RBS do well here.

RBS Contact Details

| Registered Address: | 36 St Andrew Square, Edinburgh, EH2 2YB |

| Website | RBS website |

| Phone number | 0345 724 24 24 |

Our Verdict on the RBS Debt Consolidation Loan?

The RBS personal loan is exclusively available to RBS customers and is therefore not suitable to most debtors in the UK. The representative APR rates and maximum APR rates are not the best around either.

The major positive we see in this loan is the potential repayment holiday you can get at the start of the loan.

It is probably best to look around for better rates and payment terms across the industry before committing to any of them.