Remortgage for Debt Consolidation – Everything You Need To Know

Dealing with unpaid debts can be tough. You might be considering a debt consolidation remortgage to help manage your money problems. If that’s the case, you’re in the right place. Each month, over 170,000 people use our website to find guidance on debt solutions. Here’s what we’re going to explore:

- Understanding debt consolidation remortgage.

- The true cost of a bad debt consolidation loan.

- How to remortgage for debt consolidation.

- The benefits and drawbacks of a debt consolidation remortgage.

- Answering common questions about debt consolidation remortgages.

We know money worries can be stressful, so we’re here to provide clear, easy-to-follow advice. We understand what you’re going through.

Let’s learn about debt consolidation remortgages together.

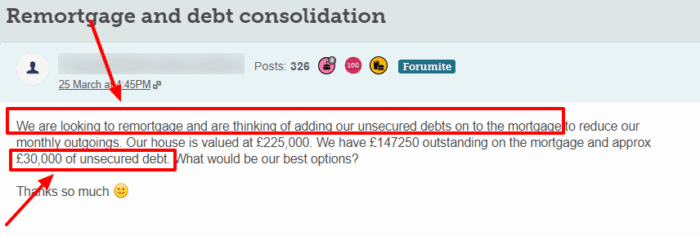

Can I remortgage for debt consolidation?

It is possible to consolidate debt by remortgaging your property to clear debts. However, you’ll need to remortgage with additional borrowing, which means taking out a mortgage for an amount greater than your remaining mortgage balance. This is called capital raising mortgage. Always speak with an adviser who can discuss your options.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

Ways to remortgage for debt consolidation

- A complete remortgage, or

- A second charge loan is taken out to the value of the home equity

Is it a good idea to remortgage to pay off debt?

What debts can I consolidate when remortgaging?

If you do decide to remortgage to consolidate debts, you can consolidate personal loans, credit cards, store card debt and many other forms of unsecured debt.

How you manage to pay off debt is flexible to the options available to you.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.99% |

£218.73 |

£26,247.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 6.95% |

£220.40 |

£26,447.92 |

| Selina | 7.5% |

£221.35 |

£26,562.50 |

| Equifinance | 7.7% |

£221.70 |

£26,604.17 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

Can I remortgage with bad credit history?

If you apply for a new mortgage, whether it is with your current mortgage provider or another lender, your credit file will be checked.

The lender will need to (re)determine how you manage your finances and if you are a lending risk.

If you have a poor credit history, you’ll find it more difficult to find a remortgaging deal or have fewer options. You might still be able to remortgage to consolidate your debts but the interest rates available won’t be as lucrative.

The interest rates on offer will go a long way to determining if this is a good debt management strategy. Thus, having a poor credit score could make a remortgage for this purpose not worth it.

Can you remortgage on a Debt Management Plan?

You can remortgage to pay off debts included within a Debt Management Plan (DMP).

A DMP is an informal debt solution where the debtor has agreed to pay a monthly payment until the debt is cleared, sometimes with interest frozen to ease any financial difficulty.

You can use any funds raised from a remortgage to pay off the debts included in the DMP.

As a DMP is an informal and non-legally binding agreement, either party does not have to stick to the arrangement.

Paying back all of the debt will also be welcomed by the creditors. However, you may want to consider a debt settlement offer to try and save some money while clearing these debts.

How many times can you remortgage?

There are no limits on the number of times you can remortgage or how often you can remortgage within a set period of time.

If you have remortgaged before or recently, you may still be able to consolidate existing debts in this way.

Even if you don’t wish to consolidate debts using this method, it might be worthwhile checking the market regularly to see if you can improve on your current mortgage deal.

Are there tax benefits of remortgaging to consolidate debts?

As of 2023, the tax benefits of consolidating debts in a buy-to-let mortgage have been largely erased.

It used to be the case that landlords could write off the interest they paid on buy-to-let mortgages as expenses of their rental income. This saved them huge amounts on their tax bill. And it simultaneously meant that if you consolidated debts by remortgaging a buy-to-let, you could save on all the interest of your debts.

However, this loophole was gradually phased out between 2017 and 2020. Now, landlords can only claim a basic 20% rate, and higher rate taxpayers are paying more tax in this area.

Is remortgaging easy?

Remortgaging is a straightforward process once you have found a new deal to apply for.

If anything, the process of remortgaging is slightly easier and less stressful than getting an initial mortgage for a property.

You are not under strict time constraints or don’t have the added worries associated with moving home while remortgaging compared to your getting the first mortgage.

Debt consolidation remortgage benefits

1. Easier to manage

2. Potential to save money on interest

3. Easier to access

Debt consolidation remortgage disadvantages

1. Debt secured against your property

2. You will pay back for longer

3. Additional mortgage fees and expenses

Debt consolidation remortgages and LTV

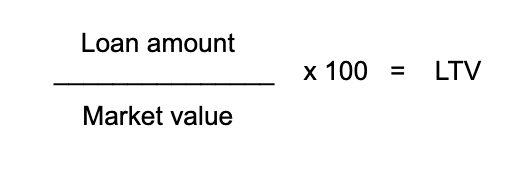

Aside from your credit score, the mortgage provider will calculate your Loan to Value (LTV) ratio.

This assessment is used on any secured loan to determine how much of a risk you are based on the loan value.

The lower the LTV, the better, with many mortgage providers refusing to award mortgages to those with an LTV above 80-85%.

How to calculate Loan to Value

If you want to work out your LTV ratio, it’s really easy.

The LTV calculation is the amount you want to borrow divided by the value of your property and then multiplied by 100 to give the percentage.

Debt consolidations loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking for a better interest rate?

- Stuck with the confusion of multiple repayment plans?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

How to decide on remortgaging for debt consolidation

To determine if you should remortgage to pay off debts, consider a matrix of factors and compare what’s on offer to your current situation.

Do not just accept the first deal you come across. Even if you’re happy with your current lender, it’s always a good idea to compare their terms with other offers in the market.

Go to MoneySavingExpert or CompareTheMarket for tools to help you compare remortgage deals.

Apart from comparing deals, you should also evaluate other debt mitigation strategies.

This is very difficult to do alone, especially if you’re not a professional mortgage advisor or financial planner. You may have to pay for debt or mortgage advice services to get a clear picture.

Although this is probably not an expense you wish to pay, it could save you from troubling pitfalls down the line.

Some mortgage advisors do not charge a fee and only collect a commission if one of their partnered mortgage lenders offers you a deal. You may want to use their services to save money.

I suggest you begin by getting free debt advice from an independent UK debt charity like Citizens Advice or National Debtline.

These charities can assess your situation early and provide alternative options that are more beneficial based on your personal circumstances.

All conversations and information you provide to UK debt charities are confidential.

Alternative consolidation options

If remortgaging isn’t an option, but you still want to consolidate multiple debts, there are alternatives. You could be suitable for:

- An unsecured consolidation loan – This is an unsecured personal loan that doesn’t carry as much risk because you will not automatically lose your home if you fail to keep up repayments. You will need to be accepted for the loan and that also means having your credit file checked.

- A balance transfer credit card – This is a special credit card that allows you to transfer the balance from other credit cards to this one, consolidating credit card debts only. There may be some additional fees to consider, including a balance transfer fee of around 3%. Note that not all credit cards will allow you to make the balance transfer, and you should ensure the card you choose allows this before applying.

- A Debt Management Plan (DMP) – Earlier, we discussed how you can still remortgage DMP debts. But a DMP is also a type of consolidation method in itself.