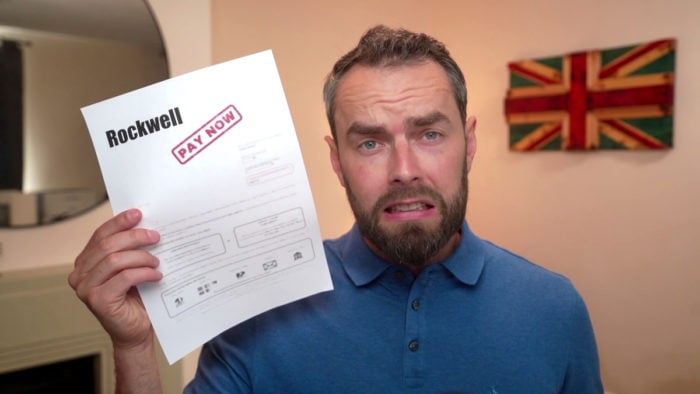

Rockwell Debt Collection Agency – Do You Need to Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you feeling worried about a sudden letter from Rockwell Debt Collection Agency? You might be asking, “Do I need to pay this?”

Good news! You’re not alone. Every month, over 170,000 people visit our site for help with debt problems.

In this article, we’ll discuss:

- Who are Rockwell Debt Collection Agency.

- How to check if the debt is really yours.

- Ways to deal with debt owed to Rockwell Debt Collection.

- How to handle your communication with debt collectors.

- Tips on seeking professional advice if you’re struggling with unaffordable debt.

Some of us have been in your shoes, dealing with debt collectors. So, we know how it feels.

Don’t worry; we’re here to help you learn more about Rockwell Debt Collection Agency and your options for handling this situation.

Dealing With Debt Owed to Rockwell Debt Collection

If you are struggling to pay the debt you owe, there are a number of other options available to you, so don’t worry – all is not lost.

One such option is to enter into a debt management plan, where you arrange to pay your debt back in instalments.

Another option is an IVA, where you pay back some of the money you owe, but write off most of it.

There are several courses that are open to you, and some will suit your own situation better than others.

It is important that you choose what the best option is for you, as an IVA means you will be unlikely to get credit for the foreseeable future.

A ‘logbook loan’ may be another option, and this is where the loan is secured against your car. You keep the car, and the cash!

Alternatively, you may look at a no-credit-check guarantor loan. This is a loan where someone asks as a guarantor, and it is ideal if you have a poor credit history.

If you are looking to start a debt management plan, we have access to a number of debt management services.

» TAKE ACTION NOW: Fill out the short debt form

Rockwell and What You Need to Know

Rockwell Debt Collectors Limited are a debt collection agency that buys your debt from another company to which you owe the original debt. This is most commonly a bank or credit card company.

As they don’t make a profit until you make payments, they can be quite relentless in their pursuit for the money.

They may call you persistently, even at strange times of the day, or they may send a number of letters, emails and texts, to try and get your attention.

Although they’re allowed to contact you about the debt, they have no right to harass you, and if they are doing this, they could be breaking the law.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How to Handle Your Communication With Rockwell Debt Collectors

- Know that Rockwell debt collectors should not harass, pressurise, or mislead you

- Record dates, times, and details of all communications with them

- Request all communications to be in writing

- Tell Rockwell the specific times they can contact you

- Contact Citizens Advice or any other reputable debt charity for assistance

- Propose an affordable repayment plan to the debt collectors

Remember, it is vital to seek professional psychological help if dealing with debt collectors is impacting your mental health.

If you do not recognise the debt, or you are unsure if it is the right amount, ask Rockwell Debt Collectors Limited for a copy of the original agreement.

If you are looking to register for an IVA or debt management program, you can use the IVA Test to find out if you qualify. There is no charge for applying, and you are protected by the consumer laws.

Rockwell Debt Collection Contact Details

| Also Known As: | Rockwell Southend on Sea, Rockwell Debt Dollectors, Rockwell Debt Agency Ltd. |

| Address: | PO Box 66, Southend on Sea, SS1 2GX |

| Telephone: | 0870 6060807 (but you shouldn’t phone them) |

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.