Rossendales Debt Collectors – Must You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

When a letter from Rossendales Debt Collectors lands on your doorstep, it can be a bit of a shock.

But don’t worry, you’re in the right place to find answers. Every month, over 170,000 people visit our website for help with debt issues.

In this easy-to-understand guide, we’ll explain:

- Who Rossendales Debt Collectors are and what they want

- How to work out if the debt they say you owe is really yours

- If it’s possible to write off some of your Rossendales debt

- Ways to pay the debt, if you can afford it

- How to stop the debt collectors from making your life hard

We know how worrying it is to be chased for a debt; some of us have been there too. That’s why we want to help you understand your options and find the best way forward.

Let’s take a step-by-step look at what to do if you’re contacted by Rossendales Debt Collectors.

What do Rossendales Debt Collectors want?

If Rossendales Debt Collectors are contacting you about an outstanding debt, you may be wondering who they are, and why they are contacting you – and quite rightly so!

The chances are that you have never even heard of this debt collection company before, as they will be contacting you and chasing debt on behalf of another organisation.

These debt collection companies often fail to act according to the legislation. Even The Office for Fair Trading (OFT, 2010) say that poor practices “appear to be widespread”.

How do I know if it is my debt?

The first thing you want to find out is whether this is your debt, especially if you have never seen the debt before. Ask for proof of debt.

It is worth bearing in mind that the value of the debt may be more than what you initially had, as there could be interest and other fees added.

If in doubt, write to Rossendales Debt Collectors and ask for a copy of the original agreement. Do not pay until you have this, even if you do recognise the debt.

» TAKE ACTION NOW: Fill out the short debt form

Can you pay the debt?

If you can pay the debt, then the best action is to pay it, or at least arrange to pay it back through a repayment plan with Rossendales Debt Collectors.

A partial repayment is another option they may be willing to accept.

It is essential to communicate with debt collectors and negotiate a reduced repayment plan. Use our free sample letter templates to ensure you respond to Rossendales Debt Collectors more effectively.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How to deal with Rossendales Debt Collectors

If you are in debt with Rossendales Debt Collectors, and they are chasing you for payment, these are some ways to deal with the situation.

1. Speak to them

It may seem like an obvious one, but if Rossendales Debt Collectors are contacting you about the debt, the best thing you can do (for your own sanity) is to answer their calls.

No doubt if you don’t, they will just continue to phone anyway, which will just cause you more stress in the long run.

Try to deal with Rossendales Debt Collectors in a patient, calm manner, even if you don’t particularly feel that way!

It is not worth your own mental health to get worked up and stressed about the situation.

2. Devise a payment plan

The best way to deal with the debt from Rossendales Debt Collectors is to pay it all off, but, of course, this is not always an option.

If you can’t pay it, then you should try to devise a payment plan. Most debt collectors will accept any payments, although they may not be entirely happy about it. They may ask for proof of your income and expenditure, though.

If the frequency of contact by the debt collectors is becoming unbearable, you can get some help and support. You have the right to report such behaviour to the Financial Ombudsman.

The best way to contact the Financial Ombudsman is by phone on 0800 023 4567 or 0300 123 9123

Fed up with the calls

If you are receiving lots of calls, texts, emails or any other kind of contact from debt collectors, and it is becoming unbearable, you have the right to file a complaint about the behaviour – you don’t need to just accept it.

It can be difficult to take a stand on behaviour like this, but you have the right to report it to the OFT using this online complaint form.

They spoke to my colleague about the debt

If the debt collection agent hasn’t been able to contact you and has decided just to speak to your family member/colleague about your debt, they are breaking the law, unless you have given them consent to do so.

It breaches both OFT guidelines, and other privacy laws.

Report them to the Financial Ombudsman on 0800 023 4567 or 0300 123 9123

Additional Fees and Charges

It’s important to note that when you refuse to pay Rossendales, and they end up taking legal action against you, then fees will be added to your debt for the legal proceedings as well.

This is why it’s important to identify your debt and determine whether it’s real or not. If it’s legitimate, you’re better off paying it back before things escalate.

If they do end up taking legal action against you, then you’ll have legal fees to deal with as well.

These include:

- Liability order, which costs £300

- Lump sum deduction order, which costs £200

- Regular deduction order, costing £50

- Deduction from earnings order -the cost is £50

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Getting rid of debt

You can write much of your debt off by entering into an Individual Voluntary Arrangement (IVA). You will pay some of your debt back, but a chunk of it will be written off.

Find a local licenced IVA insolvency practitioner here.

Another option is a Debt Relief Order (DRO). You must meet certain requirements to be eligible for this.

You can apply for a DRO through an authorised debt advisor. This is a list of authorised debt advisors to contact.

Rossendales Bailiffs Contact Details:

| Company Name: | Rossendales Ltd |

| Other Names: | Rossendales, Rossendales Bailiffs |

| Address: | Wavell House, Holecombe Road, Helmshore, Rossendale, Lancs, BB4 4NB |

| Contact Number: | 0845 644 4100 |

| Alternative Phone number: | 0844 701 3980 |

| Fax: | 0844 701 3982 |

| Website: | www.rossendales.com |

| Email: | [email protected] |

| Opening hours: | Monday – Friday: 8:00 am – 8:00 pm Saturday – Sunday: 8:00 am – 1:00 pm |

In conclusion

Dept collection agencies have the right to contact you about debt, as they have bought the debt from another company.

However, they cannot harass you. If this is the case, you should contact the Financial Ombudsman and inform them straight away. They may even lose their licence for such behaviour.

Staying On Top Of Your Debts

One of the hardest parts about being in debt is that the industry isn’t at all transparent.

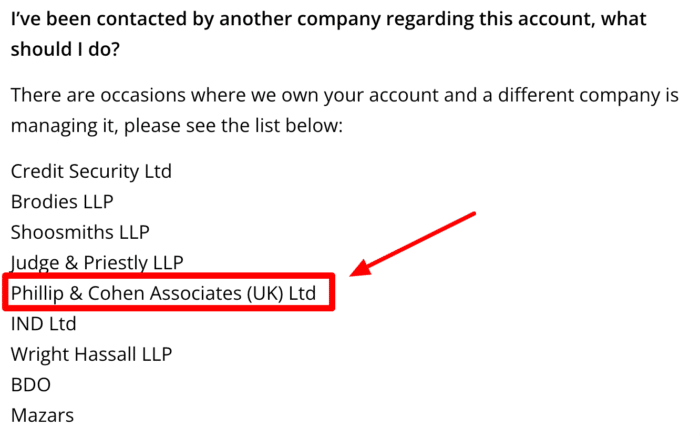

One common tactic used by Debt Collectors is contacting you under multiple names and addresses.

Sometimes, it’s for practical reasons, but even then it can be confusing and intimidating. So it’s important to try to keep a level head and research what’s going on.

Some of the biggest debt collectors in the UK operate under multiple names.

- Robinson Way will sometimes contact you under the name Hoist Finance.

- Cabot Financial Group recently bought Wescot Credit Services

- Credit Style communicate as both Credit Style and CST Law.

- Lowell Financial also owns Overdales and collects debts under both names.

In fact, in the case of PRA Group, they’ve been known to use multiple company names. As you can see in the image below.

If you’ve been contacted by a debt collector recently, it’s worth going through your post and emails to check that you haven’t missed anything, just in case they’ve started writing to you under a different name.