Secured Loan Calculator – All You Need to Know

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Are you trying to figure out how much you’ll have to pay for a secured loan and what the process to get one is? You’re not alone! Every month, thousands of people visit our website looking for answers to similar questions.

In this article, we’ll cover:

- Where to find a secured loan calculator.

- Who can help you get a secured loan.

- Whether you can get a secured loan with a bad credit score.

- The risks of getting a bad secured loan.

Our team has a lot of experience dealing with situations like this, as many of us have been in your shoes and we know how to help you figure things out. Let’s dive in to learn more about secured loans and what your options are.

Where can I find a secured loan calculator?

Secured loan calculators can be found on the websites of banks and loan providers offering these loans. These calculators are programmed to include their own APR representative example and can help when comparing loans.

You might also find secured loan calculators on generic websites that want to help you understand loans and how they work.

Is a secured loan calculator accurate?

A secured loan calculator is to help the user understand how their loan repayments would work, but it is not possible to make these calculators tailormade to each user and their personal circumstances.

This is why they are programmed with representative APR repayment terms. Note that the representative example does usually change based on loan amounts and the loan term, which, therefore, does provide a small degree of personalisation.

Yet, the representative rate is what 51% of applications were offered if successful. Therefore, 49% of applicants do not receive the representative rate and are offered a lower or higher rate. Thus, a secured loan calculator is not accurate nearly half of the time.

Should I avoid using an online loan calculator?

This doesn’t mean you should avoid using them to compare monthly repayments with different lenders. If you have an average credit score, then it could be a greater reflection of what you could be offered.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 6.34% |

£219.34 |

£26,320.83 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 7.99% |

£222.20 |

£26,664.58 |

| Selina | 8.45% |

£223.00 |

£26,760.42 |

| Equifinance | 9.95% |

£225.61 |

£27,072.92 |

| Evolution | 10.2% |

£226.04 |

£27,125.00 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

Secured loan calculator vs loan quote

A secured loan calculator is not the same as receiving a personalised quote for a loan, which is becoming more popular with some lenders. These quotes take into more of your personal situation – such as income and debts – without completing a hard search on your credit file.

The quote will then crunch numbers to provide a forecast of monthly repayments should you be approved.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

Who can help me get a secured loan?

If using secured loan calculators isn’t helping you compare, you should consider using comparison websites and even commercial broker services. There may be a broker fee in either case, but it could save you time and possibly money.

Secured loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking to fund a home improvement project?

- Dreaming of finally taking the once-in-a-lifetime trip?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

What credit score is needed for a secured loan?

Regarding your credit score, there is no benchmark you need to hit to be approved for a secured loan. Each lender makes its own independent decision regarding your credit score. Some lenders will still approve people with a lower-than-average score – and you may have to pay a higher interest rate – whereas others could reject you.

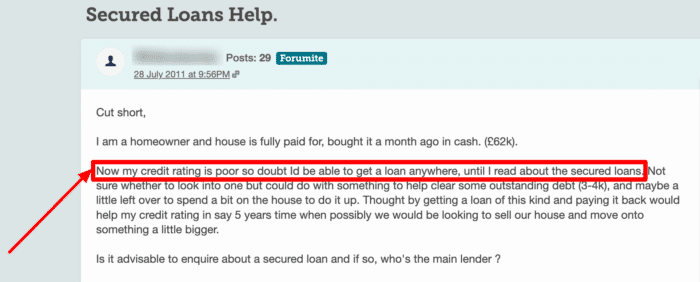

As you can see here, this forum user on MoneySavingExpert is looking for advice on whether they will be able to get a secured loan with a poor credit rating.

Your credit history is looked at in conjunction with the rest of your application, especially your debt-to-income ratio, which is used to work out the proposed loan’s affordability.