The best Secured Loan Direct Lenders

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

In this guide, we’ll help you understand secured loans. We know you might have questions about homeowner loans from direct lenders. We also know you may have worries about possible risks. Don’t worry, you’re not on your own!

Each month, over 6,900 people come to our website for advice on secured loans. We are here to give clear and simple answers.

In this guide, we’ll talk about:

- What a secured loan is.

- How secured loans work.

- The good and bad points of a secured loan.

- How to get a secured loan from a direct lender.

- What to do if you can’t make your payments.

We know this can be a lot to think about, but you’re not alone. Many people need help understanding secured loans. We’re here to help you. Let’s learn about secured loans together.

What is a direct lender?

A direct lender is a company that provides the person with a loan directly. They are the company that gives the borrower the loan money and receives repayments with no middlemen involved.

In my experience, it can be quite easy to be fooled into thinking you are dealing with a direct lender when you are, in fact, dealing with a type of credit broker company.

Is Ocean Finance a direct lender?

One example of a secured loan broker that appears like a direct lender at first glance is Ocean Finance. Ocean Finance captures your preferred loan and searches from over 100 loan providers to find the best loans that you’re eligible for. They don’t provide you with the loan themselves as a direct lender would.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

Are secured loans from direct lenders cheaper?

Secured loans from direct lenders are usually cheaper than using a credit broker or indirect lender site to find a suitable loan because there are no additional fees to pay.

A broker or indirect lender will usually take a commission from your loan repayments or even charge you to search for loan options. Thus, doing the work yourself to find the best deals can save you money, although it is likely to take longer.

Benefits of using a broker

Using a broker or indirect lender to find your loan may help you find a deal that you might have missed. In these instances, using an indirect lender could save you money despite any additional fees you have to pay.

But this depends on if the company searches the whole of the market. If they only search through partnered loan providers, which is usually the case, then the broker company may cause you to miss a better deal from a lender that they are not partnered with.

The bottom line is that using a direct lender for a secured loan may or may not be cheaper. It all depends on personal circumstances.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.99% |

£218.73 |

£26,247.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 6.95% |

£220.40 |

£26,447.92 |

| Selina | 7.5% |

£221.35 |

£26,562.50 |

| Equifinance | 7.7% |

£221.70 |

£26,604.17 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

Secured loan direct lender – best examples!

The best examples of direct lenders of secured loans are UK banks, such as Santander, Nationwide, Halifax, HSBC and many more. All UK banks provide secured loans themselves, and no other company is involved.

There are also scores of online loan providers that are also direct lenders. But it is on the internet where you are more likely to find companies operating as brokers trying to masquerade as direct lenders.

They are not doing anything illegal, and the likes of Ocean Finance make it clear what service they provide. However, there are others that try to conceal the fact they are not a direct lender.

Is OPLO a direct lender?

OPLO is an online loan provider in the UK and declares itself as a direct lender. OPLO provides the secured loan itself with no other company involved. These secured loans are available from £5,000 to £100,000 and are a type of homeowner loan that uses the property as collateral in the loan agreement.

Secured loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking to fund a home improvement project?

- Dreaming of finally taking the once-in-a-lifetime trip?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

Is Evolution Money a direct lender?

Evolution Money claims to be both a direct lender and a credit broker. They state on their website that if your application doesn’t meet their requirements, then they will pass on your information to other lenders and brokers. They offer secured homeowner loans using your property and home equity as collateral.

The benefits of getting a secured loan from a direct lender

A potential benefit of using a direct lender is that you can save money compared to using a credit broker or other type of indirect lender. By avoiding these middlemen companies, you deal directly with the company that is providing the loan, slashing fees and the overall cost of your loan.

Another benefit of using a direct lender is the simplicity of communicating with your loan provider. It is often easier to speak about your loan and receive swift customer service when you are dealing with your loan provider directly. This may be even more noticeable if you need to call up and renegotiate your loan repayments due to unforeseen financial difficulty.

Understanding loan terms and conditions

It’s really important to make sure you read and understand the loan terms and conditions, especially when you aren’t using a broker. Make sure you are aware of any extra fees, such as application fees, appraisal fees, early repayment fees, and late payment fees.

What are the best direct lender secured loan rates?

The best interest rates offered on secured loans through direct lenders are between 2% and 10%. To secure a lower interest rate like these, you’ll need to have strong personal finances and a good credit history.

When you search for secured loans with direct lenders, you’ll notice they advertise their loans with a representative interest rate. This is the highest rate offered to 51% of their applicants. The representative example changes based on the total amount of money you want to borrow.

When you compare secured loans with direct lenders, it is essential to remember that these interest rates are not guaranteed, and almost half of loan applicants receive a higher interest rate.

If you see a loan rate that is exceptionally low, be cautious of that lender. It may be that they are a scam lender and not operating legally.

Can I get a direct lender secured loan with bad credit?

It is still possible to be approved for a secured loan with a poor credit score. If you have poor credit but are still approved, it is likely that the lender will offer you a loan with a higher interest rate because you are considered more of a lending risk.

There is no fixed credit score required to get approval, and each lender applies its own judgment based on everything included in your application.

And now, there are more lenders popping up targeting people with an unsatisfactory or poor credit history. These lenders are specifically advertising secured loans for bad credit individuals. A bad credit secured loan should increase your chances of getting approved if you fall within this category, but nothing is guaranteed.

Can you get a secured loan without a broker?

You do not have to use a credit broker when taking out a secured loan. It is possible to search the market yourself by looking online and contacting banks to find out what they offer, and then you can compare different loans to find a beneficial deal for your personal circumstances.

Using a broker can be advantageous to some people, and for others, they are not needed. If you decide to do the hard yards yourself, remember to only look at loans from lenders that are authorised and regulated by the Financial Conduct Authority.

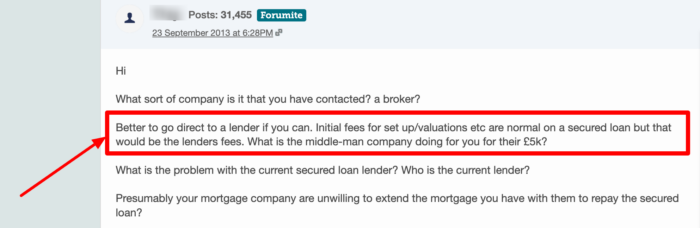

This forum user on MoneySavingExpert is advising another user to go directly to the lender for a secured loan if they can, as they will likely save on fees. Whether this is right for them or not would depend on their circumstances.