Security Trust Deed – Complete Overview, Tips & FAQs

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you curious about a security trust deed? Maybe you already have one, or you’re thinking about getting one. You’re probably wondering what it is, who is involved, and how it could help with your debt.

You’re not alone. Each month, more than 170,000 people visit our site seeking advice on debt solutions.

In this article, we’ll explain:

- What a security trust deed is

- Who’s involved in a security trust deed

- What to do if you’re worried

- The role of the trustee and the debtor

- What happens if you can’t make the payments

You might be worried about your debt. That’s okay; some of us have been there too. With our experience, we’ll help you figure things out.

So, let’s get started and learn about security trust deeds.

What is a Security Trust Deed?

A trust deed is essentially a document detailing a legal transfer of property from a borrower to impartial trustees, who act as the holders of the property for the lenders. The trustee will repay the borrower’s debt on their behalf.

The document has the details of the property and the terms and conditions under which the property is to be transferred to the lenders. This document gives certain powers to the security trustee.

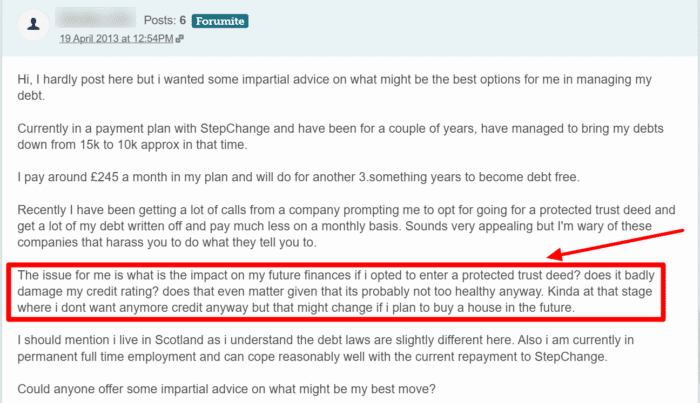

While it can be a good debt solution for some, the exact details of the agreement can be complicated, as this forum user has also found out:

It’s important to have all of the information before deciding which debt solution is right for you.

Who is involved in a security trust deed?

The trustee can transfer the ownership of the property (with rights reserved) to the lenders, in the case that the terms and conditions of the security trust deed aren’t met. There is also a trust manager who coordinates the terms and conditions with the security trustee, the borrower, and the lenders.

The security trustee looks over the legal side of the security trust deed. They act as a holder of the security (agreed-upon collateral) and also act as a middleman between the borrower and the lender.

In case the security in question is secured property, the deed is known as a security trust deed.

Role Of The Trustee

The trustee is essentially a third-party person in the agency agreement. They gain no benefit from this deal.

Under the jurisdiction of the law, the security (collateral) in question is to be held in the name of the trustee, but the borrower will still be responsible for whatever happens within the premises until the debt is paid off.

The trustee will receive the benefit that they gain from the security within the time period of the agreement. This benefit will go to a trust fund, which is held between the borrower and the lender.

If the loan is successfully paid off, the amount in the security trust fund will go to the borrower. In case of default, the third-party security deed trustee is to transfer the funds to the lender. In essence, a security trust deed is only slightly different from a traditional mortgage.

The manager of this whole agreement is the security agent. They oversee the security trust deed and will provide assistance in case any complications arise.

In accordance with the provisions of the Facility Agreement, the security trustee is to be completely neutral. The trustee also has some additional responsibilities in excess of holding the property. These are explained in the Facility Agreement.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

In Case Of Defaulting

The details and information of every security trust deed are given within the document. In addition to that, there is also a note trustee. This note trustee gives directions to the trustee and makes them aware of their powers in this security trust deed.

The deal in practice here is that the lender will gain ownership of the property in case the borrower defaults and the trustee is to receive no benefit (with respect to law) in this security trust deed.

In case the debtor defaults, the trustee is to sell the security and give the lenders their due amount. Any money in addition to this is given back to the debtor. This transaction is overlooked by the security trust deed manager.

The security trust deed contains all of the information about this deal. It perfectly documents the security interests and any relevant covenants. The security trust deed also has legal noteholders who hold all information about the security interests and the involved covenants.

The duties of the debtor and lenders are also given in the security trust deed. This document also has the legal rights and the duties of the security trustee.

It is important to make sure that the security trustee is a third-party neutral person, as any leverage given to the lender or the debtor will be dealt with legally by the security trust agent.

Role of the Debtor

A security trust deed is a good option for you to consider if you cannot afford other debt management plans. It is also better than a mortgage since it includes a neutral third-party security trustee who has possession of the property.

The agent who is overlooking the security trust deed is also a qualified professional and will help you eliminate your debt. Their job is to satisfy both the lender and the debtor, so that all parties are managed fairly in the trust.

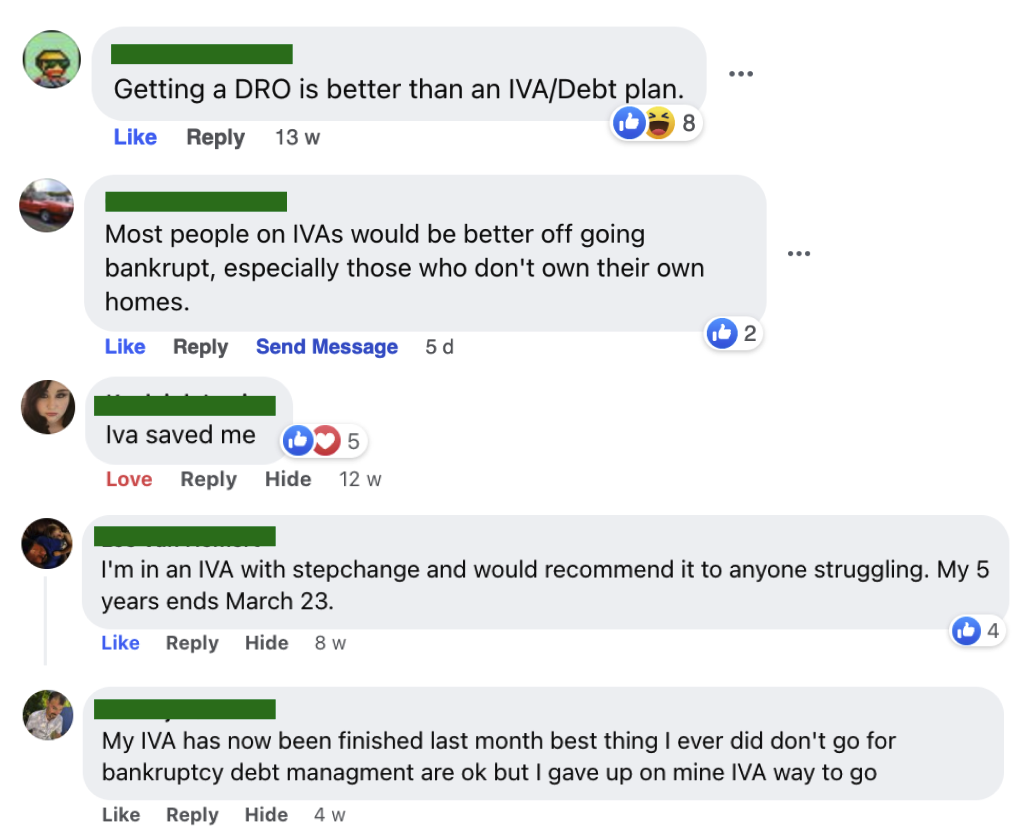

Are there any other options?

Deciding how to tackle your debt is a very personal decision and you certainly can’t get the answer through a simple blog post.

It’s made worse by the strong opinions you’ll often find online.

The best option is to get help from a debt expert to find out all your options and see which is right for you.

I’ve partnered with The Debt Advice Service and you can access their expert support by filling out the short form below.

Get help from The Debt Advice Service.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Key Points to Consider Before Opting for a Security Trust Deed:

If you’re thinking of entering a Security Trust Deed, it’s important to remember:

- The property will be sold if you fail to clear your dues.

- Ensure you understand all of the terms and conditions – it may be worth going through the terms with a licensed financial professional beforehand.

- Ensure the trust deed is registered.

For more information, I would recommend contacting a licensed financial advisor to discuss your options with you. Additionally, you can contact Citizen’s Advice Scotland for free and impartial advice.