Sigma Financial Group Debt – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Feeling unsure about a surprise debt letter from Sigma Financial Group? Wondering if you really need to pay? Don’t worry, we’re here to help. Each month, over 170,000 people visit our site to find answers to their debt problems.

In this article, we’ll help you understand:

- Who Sigma Financial Group are, and what they do.

- How to check if they can still collect your debt.

- The steps to take if your debt is proven.

- How to deal with unaffordable debt.

- Where to find more help if needed.

We’ve got lots of useful facts about Sigma Financial Group, which we’ve gathered from lots of different places. We’ll help you understand what’s going on and how to make the best choices for your situation.

Dealing with debt can feel hard, but remember, you’re not alone. Many people have been in your shoes and found a way out. Let’s work this out together.

Have you received a Sigma Financial Group debt letter?

A Sigma Financial Group debt letter is a letter to tell you that the company is now chasing a debt on behalf of the other company you had dealings with. They will state how much is owed and when it needs to be paid (usually within a week or two).

The letter will continue to state that if you don’t pay you could be taken to court, which may incur additional charges. It’s hard to know whether this is a legitimate possibility or an empty threat so you pay faster. It often depends on how much you owe, but people have been taken to court for small amounts in the past.

Check that they can still collect your debt first

Some debt cases in the UK cannot be taken to court. And if a judge can never ask you to pay, you won’t be made to – although it can still harm your credit file. Many debts become too old to go to court after six years, providing no payments have been made towards the debt in the last six years. This is called a statute barred debt.

If your debt is statute barred, you should inform Sigma Financial instead of paying. We’ve even made a statute barred letter template just for this situation.

Sending a prove the debt letter

If your debt isn’t statute barred, you can ask Sigma Financial Group to prove you owe the debt. This requires them to provide you with a copy of the agreement you signed that you have supposedly defaulted on. If they don’t provide this evidence you don’t need to pay.

And if they ignore your request and you end up benign taken to court, you should tell the judge that they ignored you. It could help you win the case!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Should you pay Sigma Financial Group?

So, should you pay Sigma Financial Group or take the risk that they won’t take you to court? Although you may end up having to pay, there are some things you can try first. You should check to see if the debt is still enforceable, and you should make Sigma Financial Work to receive your money. Read on to find out more.

Sigma Connected proved my debt – what now?

If the Sigma Financial Group prove you owe the debt and it’s not statute barred, you might have to pay. Hoping they don’t take you to court and stop chasing you is a risk. If you cannot pay the full amount, you should get in touch to discuss payment plans, which are usually offered.

Or you could read about the other debt solutions, which may be more beneficial if you have multiple debts and arrears.

Are the Sigma Financial Group bailiffs?

» TAKE ACTION NOW: Fill out the short debt form

The Sigma Financial Group are not bailiffs, which are known as enforcement agents in modern times. They are simply a company that takes over the debt collection process before a case might go to court. Enforcement agents are only used after a court case when the debtor still refuses to pay their debt.

Sigma Financial Group reviews

Sigma Financial still run the Sigma Connected website and have some alarming reviews from previous and current employees. Most people complain about the working conditions, but this comment was especially interesting when considering their debt collection tactics:

“[…] I worked there for 6 months the putrid smell of body of odour from staff who were trying to get as much money from Lil old ladies as possible by scaring them. Stating that they will receive court action and a visit from debt collectors if they do not pay up. […]”

- Toby A (Google review)

As we just mentioned, debt collection companies are not bailiffs so they are reported to be making inappropriate and empty threats which should be investigated by the Financial Ombudsman Service (FOS).

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Will They Give Up Chasing?

After all that you might be wondering whether you can just wait it out and hope they stop chasing you.

Sadly, that’s probably not going to happen. Most debt collectors are persistent.

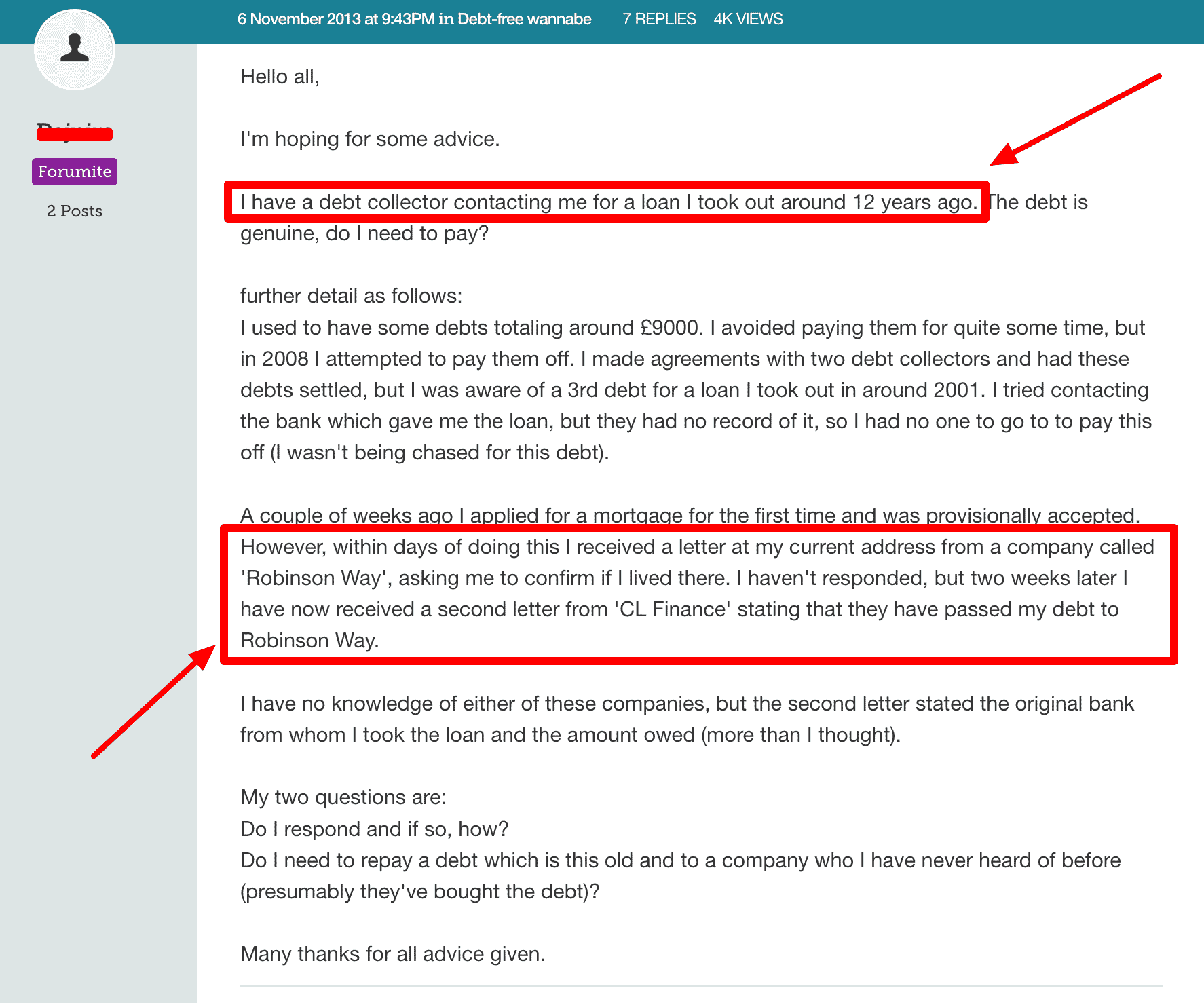

Source: Moneysavingexpert

As you can see Robinson Way starting to chase a debtor mere days after their mortgage application and a full 12 years after the debt was originally chased.

Other agencies like Lowell Group, Portfolio Recovery and Cabot Financial are constantly being accused of buying Statute Barred debts and then chasing people for payment.

Sigma Connected Contact Information

| Postal Address: |

In Birmingham The McLaren Building, Birmingham, B4 7LR, UK In Redditch Grosvenor House, Prospect Hill, Redditch, B97 4DL, UK |

| Phone: | 01527419107 |

| Website: | https://www.sigmaconnected.com/ |

Sigma Financial Group debt FAQs

Can the Sigma Financial Group take me to court?

The Sigma Financial Group will not take you to court, but it’s possible that the company you owe will take you to court. They do this to get a court order which makes it your legal responsibility to pay the debt.

Can The Sigma Financial Group come into my house?

No, despite what some Sigma Connected employees may have said to you, they have no right to visit you or come inside your home. This is illegal without your permission.

Where can I get more help dealing with Sigma Connected?

Get more information to deal with the Sigma Financial group on our debt help page, or access free bespoke support from a UK debt charity.