Simply Be Debt – All You Need to Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you seeking answers about your ‘Simply Be credit account’? We’re here to help. Each month, over 170,000 people visit our website looking for guidance on managing debts.

In this easy-to-understand guide, we’ll cover:

- Who Simply Be is

- What to do if you’re struggling with catalogue debt

- The steps to take if you can’t pay what you owe

- How to deal with debt collection agencies

We know that not being able to pay a catalogue debt can make you feel worried. But remember, you’re not alone. We’ll share all you need to know about Simply Be debt in 2023.

SimplyBe (and similar buy now pay later companies) lets you spread the cost of goods for up to 4 years. This may appear generous, but bear in mind that once the 0% deal is over, the interest rates charged are far higher than those on normal credit cards. And it’s completely legal!

Catalogue Debt with Simply Be

It’s all too easy to fall into a catalogue debt trap when you spread the cost. Simply Be lets you spread the cost by giving you credit to pay back what you owe the company over time. They will then set up a repayment schedule such that you pay a minimum amount every month to reduce the balance. This minimum payment does not include interest and other charges your loan might attract.

Naturally, the longer it takes to pay back the amount you owe for an original purchase, the more expensive it gets, especially when you’re paying higher interest rates. This is one of the credit account consequences you need to bear in mind.

As I see it, you should pay more than just the minimum monthly amount to eliminate the debt faster and save money on interest.

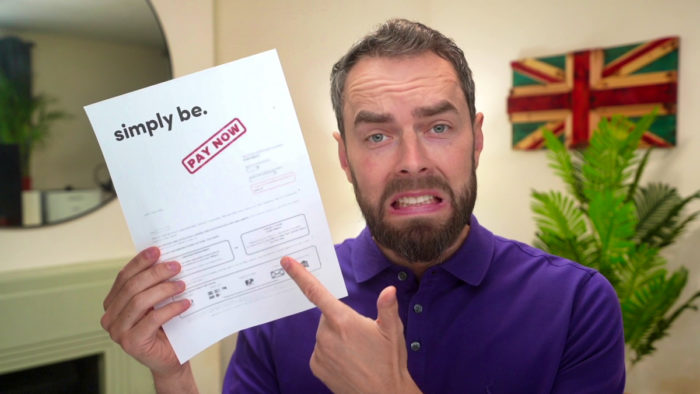

What happens when I don’t pay?

If you don’t pay an instalment when it’s due, Simply Be sends you a reminder. And you’ll have to pay an additional £12, which covers their administration fee. If you default on your payments, the company will take action to recover the amount you owe.

Simply Be uses debt collection agencies when you default, and you’ll be charged this cost too. In addition, the company may get a County Court Judgement (CCJ) issued against you. This means debt collection agencies will be used to chase you down for payments.

Furthermore, a CCJ can hurt your credit score since it will stay on your credit history for six years. As a result, a CCJ on your credit file may affect your ability to obtain further credit.

I suggest you don’t let things get to this stage. Always consider the impact of non-payment on your credit score and peace of mind. Contact the company as soon as possible to request a paydown repayment plan. It’s far easier to deal with Simply Be than with a debt collector.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What to do when you can’t pay what you owe to Simply Be

When you can’t pay what you owe to Simply Be, my advice is to stay calm and take control of the situation. First, create a budget to see how much you can realistically afford to repay, with the goal being to reduce the catalogue debt.

Only with budget planning can you see how much surplus cash is left after paying all other monthly commitments (e.g. rent, grocery, etc.). An excellent way to increase leftover cash is to make a few cutbacks on things that aren’t a necessity.

‘After drafting a budget, contact Simply Be customer support. Tell them about your situation and try to negotiate a more affordable repayment plan. Ask if they are willing to’‘freeze’ interest and charges on your account.’After drafting a budget, contact Simply Be customer support. Tell them about your situation and try to negotiate a more affordable repayment plan. Ask if they are willing to ‘freeze’ interest and charges on your account.

You may be asked to complete an Income and Expenditure form (budget planner). This information will help the company decide whether or not to give you a reprieve. If they can’t help, you should contact a specialist for debt advice. Ideally, a not-for-profit debt charity that provides free, impartial advice would be your safest bet.

Don’t forget to let Simply Be know you’ve contacted a debt charity for advice so the info is on their system.

Choosing the best arrangement when you have a Simply Be debt

Option 1: Debt Relief Order

Your catalogue debt with Simply Be may qualify for a Debt Relief Order (DRO). This is a good option if it’s unlikely you’ll be able to clear your debts.

If you successfully apply for a DRO, you will make no payments towards the debt during the DRO period (typically, it’s one year). This order also stops your creditors from taking any action against you.

Your debt under a DRO will be written off if your circumstances don’t change within a year.

Most free debt advice charities have approved intermediaries who can help you apply for a debt relief order. And the cost for a DRO is £90, and you can pay in instalments.

Option 2: Individual Voluntary Arrangement (IVA)

An IVA allows you to pay off your catalogue debt in amounts you can afford in a set period of time (e.g. 5 years). If you still owe money after this period is then written off.

Before you apply for IVA, though, verify that you have at least £70 a month to spare. This is the minimum amount that will go towards paying your creditors.

Caution: An IVA is a legally binding agreement, meaning once you sign it, you have to abide by the terms. People have faced harsh penalties for cancelling their IVAs.

You can set up an IVA through an insolvency practitioner. Again, a free debt service can help connect you with a reputable professional.

Option 3: Debt Charity

When you go to a debt charity for advice about catalogue debt, they may also try to freeze the interest and charges applied to your account. This way, the debt doesn’t increase over time. Also, they will help you set up a debt management plan (DMP) that allows you to pay only what you can afford.

You may end up paying more in total, but this option will help you keep your head above water while still reorganising your finances.

I’ve listed below a few trusted debt charities that can help you for free:

- Citizens Advice Bureau have specialist debt management teams.

- Step Change, a free debt advice telephone service

It might be worth contacting a debt management company when you have several debts, including Simply Be. However, depending on who you contact, you may have to pay for this service. That said, PayPlan provides free debt management services.

From personal experience, the outcome is usually much better when you stay on top of the situation. Choosing to ignore your debt obligations is a big mistake. Your catalogue debt won’t go away, and when you default on a debt, the info remains on your credit history for up to six years. This further harms your ability to obtain credit in the future.

Besides, your debt charity adviser may recommend government assistance programmes such as the Breathing Space scheme that gives people temporary protection from most types of debt.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Does Simply Be use debt collection agencies?

As mentioned, Simply Be is persistent when you owe them money. You’ll be chased by a debt collection agency, and they’ll send demand letters, call you and even visit you at home.

And when you continue to ignore the debt, you could receive a County Court Judgement, which is essentially a court order for enforcing the debt. A CCJ will impact your ability to get a loan, credit card, and mortgage. Moreover, your debt increases with all the extra costs, charges and fees the company applies.

Can I make a complaint against Simply Be?

Yes, you can. Simply Be has its own complaints procedure because it is regulated by the FCA (Financial Conduct Authority). Be sure to send the complaint in writing and keep a copy for your own records. If you’re still unhappy, you can contact the Financial Ombudsman Service.

If you feel like you’re drowning in debt and can’t keep up with your Simply Be monthly payments, do not despair. No matter how much your debt has accumulated, you can get help from a debt charity. Ignoring the situation won’t help much. Only seeking help will. With the right financial advice, you could get back on track with your finances sooner rather than later.

Simply Be Contact Details

| Website: | https://simplybe.co.uk |

| Phone number: | 0345 071 9018 (support) (8 am-7 pm) 0345 071 9018 (complaint) (8 am-7 pm) |

| Email: | Email here |

| Mail a complaint: | CMT, Griffin House 40 Lever St, Manchester, M60 6ES |