Snowball Method For Debt – Complete Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re worried about your debt and looking for a way to reduce it, you’re in the right place. The Snowball Method for Debt might be the solution you need, as it’s a step-by-step way to help you get on top of your debts, starting with the smallest.

Here on the site, we’ve offered guidance to over 170,000 people each month, helping them find answers to their debt questions. You’re not alone, and we understand your concerns.

In this article, we’ll explore:

- What the Snowball Method is.

- Who it’s best for.

- Possible downsides to consider.

- Why and how it works.

- Its effect on your credit score.

We know debt can be scary and stressful, as some of our team have been in your shoes and used methods like the Snowball Method to manage their debts.

Take a deep breath and keep reading. You’re taking the first step to a brighter financial future.

What Is the Snowball Method?

The snowball method is ideal for people who have multiple debts.

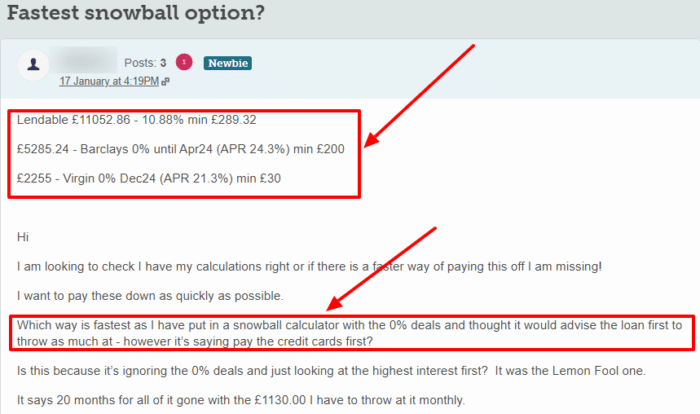

The idea is that once you have paid the minimum repayment on each debt, if there is any spare money, you should use that towards clearing the smallest debt rather than using it towards clearing the debt with the highest interest.

As an example, let’s say you have three credit cards:

- Credit Card 1: £100 outstanding, £5 minimum monthly repayment, 10% interest

- Credit Card 2: £200 outstanding, £10 minimum monthly repayment, 20% interest

- Credit Card 3: £500 outstanding, £25 minimum monthly repayment, 30% interest

Let’s also say that you have £50 per month that you can use towards debt repayment. You need £40 to cover the minimum monthly repayments across all three of your credit card. This leaves you with an extra £10 that you can use towards clearing your debt.

Arguably, you should use that £10 to reduce the outstanding balance on Credit Card 3, as that’s the credit card with the highest interest rate. But that’s not how the Snowball method works.

The snowball method says that you should pay that extra £10 towards clearing Credit Card 1 (smaller debt) until Credit Card 1’s balance had been paid off completely. In other words, you’d be paying £15 each month rather than the £5 minimum monthly payment.

Once Credit Card 1 has been completely paid off, you would have £15 spare, so you would increase your monthly payment on Credit Card 2 to £25 until Credit Card 2 had been paid off completely.

You would only start to make more than the minimum monthly repayment on Credit Card 3 once the balances on both Credit Card 1 and Credit Card 2 had been completely cleared.

The reason is called the snowball method is because the monthly repayment on the smallest debt increases over time, in the same way, that a snowball grows if you roll it in snow.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

So Why Does It Work?

The main difference between the Snowball method and other debt repayment techniques is the fact that the Snowball method gives you regular, achievable targets to hit.

In the credit card example above, if we ignore the interest that will be applied each month, it would take 16 months to clear the debt (£800 divided by £50).

But during those 16 months, you will be paying off three separate credit cards each month. For some people, that can be soul-destroying.

By concentrating on the smaller debt first, your first credit card is cleared by the seventh month. That feels like an important milestone and leaves you with just two debts remaining.

Because you can now increase the repayments that you are making towards your second credit card debt, that debt will be cleared six months later. Two down, one to go. Another morale boost.

At that point, you’ll be paying twice as much towards your final credit card’s outstanding balance. So you’ll see that outstanding balance falling a lot more quickly than you would, had you only been paying £25 each month.

Again, this is a boost to your morale. You can see the progress that you are making. It feels like you are on the final lap, and for many people, that encourages them to finish their debt repayment plan.

» TAKE ACTION NOW: Fill out the short debt form

Who Is The Snowball Method Suitable For?

The snowball method is an early intervention debt management strategy.

It is ideal if you have realised that your debts have started to get out of control, but they haven’t actually got to the point where you are unable to make the minimum repayments each month.

Use the snowball method to clear your debts only if you are able to make additional repayments towards your debts each month.

If all of your debts have fixed monthly repayments, the snowball debt payment method cannot work. If your lenders charge fees if you clear your debts early, that could also mean that the snowball technique isn’t suitable.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

The Downside of the Snowball Method

The problem with the snowball method is that because you aren’t paying off the debts with the highest interest rates, you will end up paying more interest over your repayment period than you would have had you repaid those high-interest debts first (debt avalanche method).

Because the interest on the high-interest debts is being added to the outstanding amount each month, this also means that it will also take you longer to completely repay your debts.

In other words, from a purely mathematical point of view, it would appear that the snowball method makes absolutely no sense.

In addition, because it is not a formal arrangement, it does require willpower and financial discipline.

It can be tempting to use any surplus money to treat yourself rather than to make an additional repayment towards your smallest debt. Obviously, if you do this, the Snowball method won’t work, and your debts will take much longer to clear.

But studies from Northwestern’s Kellogg School of Management and the Harvard Business School have shown that actually, the Snowball method does appear to be more effective for debt clearance.