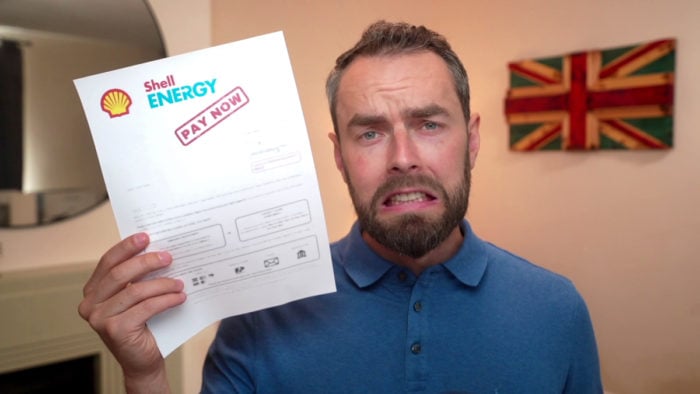

Shell Energy Debt Collection – Do You Have to Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about a debt you have with Shell Energy? You’re in the right place for answers. Each month, over 170,000 people come to us for advice on their debt problems. Citizens Advice reports a record number of people seeking help for energy debts, with almost eight million borrowing money to pay their energy bills in the first half of 2023.1

In this guide, we’ll explain:

- If the debt letters from Shell Energy are real.

- How to deal with Shell Energy debt collectors.

- What to do if you don’t owe the money they say you do.

- How you could cut down some of your energy debt.

- If you have to pay a debt that is very old.

We’ll also talk about ways to stop debt collectors from getting in touch with you, what happens when bailiffs come for unpaid debt and other choices you might have. If you struggle with too much debt, we can show you how to legally write it off. We understand this is a hard time, but remember, you’re not alone.

Let’s get started and figure out what your next steps should be.

Are Shell Energy Debt Collection Letters Genuine?

You might be unsure about the legitimacy of the letters you’ve received. Be advised, that Shell debt that is outstanding is passed on to debt collectors. The debt collectors are there to help energy suppliers to collect money that remains unpaid. If you’re unsure, contact Shell Energy to discuss your account and any debt you have.

Ask Debt Collectors for Proof of Debt

You’re within your rights to request proof of debt and I recommend that you do so. Ask for proof of the debt during your first contact and before you agree to anything or make any payment. The proof is commonly the contract created between you and Shell Energy.

If the debt collectors have no proof of the debt, it won’t be possible for them to demand payment, threaten court action or issue a CCJ. Use the Money Nerd ‘Prove It’ letter template I created to ensure you get the proof, even if you know you owe the money.

Receiving Debt Collection Letters for Money You Don’t Owe

“I am so distressed. Can anyone give me advice? I am being hounded by debt collectors, for an energy debt, for the previous tenant, who died over a year before I moved into the property. “

There are examples of customers receiving letters for energy debts they don’t owe. If the Shell Energy debt collection letter contains incorrect information, it’s possible to dispute your case. You’ll need to prove that the debt isn’t yours, but if you can do so they will write off what you owe.

How Can I Pay Shell Energy Debt Collection Debt?

If you can afford to pay the total amount you owe in full you can clear the debt immediately. For many people, this option of instant full payment isn’t possible. Doing so could result in serious hardship for your household. Make a household budget to establish what you can afford to pay and request payment by instalment. Explain how much you can afford and what you’re willing to pay to clear your debt.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

I Can’t Afford to Pay Shell Energy Debt Collection

What can you do if you can’t afford to pay? There are many debt management solutions available that are suitable for solving this type of debt. It is important to seek independent advice regarding debt solutions as there are positives and negatives to consider.

Steps to follow if you can’t afford to pay what you owe:

- Contact a money advice service provider

- Create a household budget

- Contact the debt collectors and discuss the suitable solutions with them

There are many debt solutions out there. Here’s a list of some of them to help you figure things out.

| Energy Debt Solution | How It Can Help Pay Off Your Energy Bills |

|---|---|

| Installment Plan | Pay in smaller and more manageable monthly amounts until the debt is cleared |

| One-Off Payment | Reduce debt, and possibly get a discount, by paying a lump sum |

| Appealing for a Bill Reduction | Get a reduction by providing evidence of errors in your energy bill or a detailed explanation of your situation |

| Negotiate Contracts | Ask for a temporary reduction in tariffs, a pause on payments, or a longer-term payment plan |

| Switch Providers | If your current energy tariff is too high, consider switching to a cheaper provider |

| Energy Supplier Hardship Funds or Schemes | British Gas Energy Trust EDF Energy Customer Support Fund OVO Energy Fund Scottish Power Hardship Fund npower Energy Fund E.ON Next Energy Fund |

| Government Grants and Schemes | Winter Fuel Payment Warm Home Discount Scheme Cold Weather Payments Local Council Support Child Winter Heating Assistance Breathing Space Scheme |

| Support for Alternative Fuels | If you utilise alternative fuels like oil, LPG, wood, coal, or biomass to heat your home, you may qualify for extra financial help. Speak to an adviser or check with your local council for potential grants or schemes. |

| Seek Advice from Debt Charities | Debt charities offer free advice and practical solutions – they can help you understand your options, negotiate, and set up payment plans with energy providers. |

Other Options to Consider

There are other options remaining If you are unable to create an affordable payment plan that the debt collectors agree to.

- IVA

An IVA reduces the debts you owe including energy debt. IVAs are not an option for everyone so it’s vital that you seek impartial advice before considering an IVA.

- Bankruptcy

Bankruptcy works to resolve debt problems for those who cannot pay. Bankruptcy does have long lasting implications. There are free impartial money advice services available so you can find the correct money management solution for your personal situation, such as Citizens Advice or Step Change.

- Debt Relief Order

You may be able to gather all your debts together and use manageable payments and stop the accruement of future debt with a Debt Relief Order.

Shell Energy debt collection letters may leave you feeling threatened, scared and stressed. There is light at the end of the tunnel, so don’t bury your head in the sand. Ignoring the letters can result in larger debt and even court action. There are money advice services and UK debt charities available for you to use to find the correct solution for you.

Shell Energy Contact Details

| Address: | Shell Energy House, Westwood Way, Westwood Business Park, Coventry, CV4 8HS |

| Phone: | 0330 094 5800 |

| Website: | https://www.shellenergy.co.uk/ |

When Can Bailiffs Come for Unpaid Shell Debt?

Failing to pay or come to an agreement could result in a County Court Judgment or CCJ. A CCJ can result in bailiffs being sent to your property. Without a CCJ it is impossible for law enforcement officers to come to your home. Remember, debt collectors are not enforcement officers themselves.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can I Stop Debt Collectors from Contacting Me?

If the debt is genuine, there’s no way to stop receiving letters. However, if you get in touch with them, you can stop the constant bombardment. Have your account number on hand and prepare for the conversation by working out the budget for your household.

Explain your circumstances and tell them how much you can afford to pay. Other debt solutions are available if instalments are not a workable option in your circumstances.

» TAKE ACTION NOW: Fill out the short debt form