Stanford and Green Debt – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a letter from Stanford and Green about your debt? You’re not alone! Each month, over 170,000 people visit our website for guidance on tricky debt topics, just like this one.

This article will help you with:

- Finding out who Stanford and Green Debt Collection are.

- Learning how to deal with Stanford and Green Debt Collectors.

- Understanding if Stanford and Green are bailiffs.

- Learning who Stanford and Green recover debts for.

- Exploring if you could write off some Stanford and Green debt.

We know how worrying it can be when you get a letter about a debt you’re not sure about. Some of us have been in the same boat, dealing with debt collectors ourselves.

Don’t worry; we’re here to help. Let’s find out more about Stanford and Green Debt and what you can do about it.

Have you received a Stanford and Green Notice of Enforcement?

A Notice of Enforcement letter is a mandatory letter that bailiffs have to send to all debtors at the start of the debt recovery process. It is a letter that explains who they are and that they have been ordered to collect your debt. The fixed fee for sending this letter – which is £75 –

is added to your debt.

The letter is an opportunity to pay the debt or agree to a payment plan. But it’s also notice that if you don’t pay within seven clear days then the company’s enforcement officers will come out to your address. When bailiffs have to visit you, a minimum of a further £235 is added to your debt. It’s even more if you owe over £1,500.

The purpose of this visit is to seize goods you own to an equal value to the debt. They’ll be stored and sold on your behalf to clear the debt. This service includes another fee of £110.

Do I have to pay a Stanford and Green debt?

If a judge has ordered you to pay a debt, you must pay or arrange a payment plan. Ignoring Stanford and Green will only make your debt grow bigger, and you’ll have to deal with them at your doorstep, which can be stressful.

It’s best to get in touch with Stanford and Green once you receive a Notice of Enforcement letter. Don’t put it off as you could run out of time before they show up.

» TAKE ACTION NOW: Fill out the short debt form

Are Stanford and Green bailiffs?

Stanford and Green are bailiffs, but this term has become outdated within the industry. They’re now called enforcement officers or enforcement agents. Their job is to get debtors to pay a debt when they have already been told to pay by the courts (if required).

They will first try to do this without visiting you at home. But if you ignore their letter then they will come to your home and could attempt to seize goods, which are then sold to pay off your debt.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How to stop Stanford and Green bailiffs

There are two ways to stop Stanford and Green bailiffs from coming to your home. You can either:

- Pay the debt in full or agree on a payment plan

- Tell them that you’re a vulnerable person (if true)

Bailiffs cannot visit the homes of vulnerable people, which includes permanently vulnerable people and temporarily vulnerable people. For example, they cannot go to the homes of people over 65, people with disabilities and pregnant women. A comprehensive list of who qualifies as vulnerable can be found here.

You should inform them that you’re vulnerable as soon as you receive a Notice of Enforcement.

Staying On Top Of Your Debts

One of the hardest parts about being in debt is that the industry isn’t at all transparent.

One common tactic used by Debt Collectors is contacting you under multiple names and addresses.

Sometimes, it’s for practical reasons, but even then it can be confusing and intimidating. So it’s important to try to keep a level head and research what’s going on.

Some of the biggest debt collectors in the UK operate under multiple names.

- Robinson Way will sometimes contact you under the name Hoist Finance.

- Cabot Financial Group recently bought Wescot Credit Services

- Credit Style communicate as both Credit Style and CST Law.

- Lowell Financial also owns Overdales and collects debts under both names.

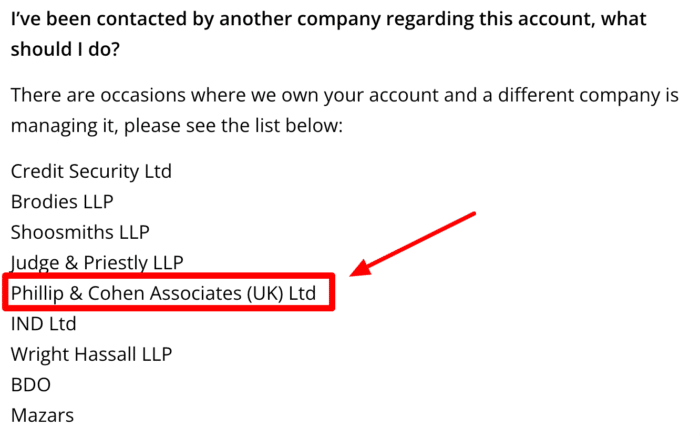

In fact, in the case of PRA Group, they’ve been known to use multiple company names. As you can see in the image below.

If you’ve been contacted by a debt collector recently, it’s worth going through your post and emails to check that you haven’t missed anything, just in case they’ve started writing to you under a different name.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Stanford and Green Civil Enforcement Contact Details

| Address: | Knightrider Chambers, Knightrider Street, Maidstone, Kent, ME15 6LP |

| Phone: | 01622 683308 |

| Fax: | 01622 683369 |

| Email: | [email protected] |

| Website: | https://www.stanfordandgreen.co.uk/ |