Statute Barred Debt Credit File – How It Affects Your Rating

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Understanding your credit file and how a statute barred debt might affect it can be confusing. You may be asking ‘Is my debt statute barred?’ or feel worried about what this means. This article is here to help explain these points.

Every month, more than 170,000 people seek guidance from us about their debts. We understand your concerns and want to help you make sense of things. Here’s what we’ll cover:

- What a credit score is and why it matters.

- How to understand if you have a good credit score.

- The meaning of a statute barred debt.

- The impact of a statute barred debt on your credit score.

- Ways to manage unaffordable debts.

Remember, it’s okay to ask for help when dealing with debts. We’re here to support you, share useful knowledge, and help you make the best decisions about your financial situation.

Let’s get started.

What is a Credit Score?

Your financial dealings, such as any debts you took on, are recorded within your credit file (or credit report). Your credit report contains all information about your debts and your punctuality in paying them back.

The more regularly and reliably you pay off your debts, the better your credit score will be. However, if you miss scheduled payments towards your debts, these will be recorded within your credit history, and as a result, your credit score will suffer.

Your credit report is an important variable in lenders deciding whether or not to approve your loan. All lenders will look at your credit report to get an idea of how reliable you are when making monthly payments towards your debt.

If you have a good credit score, you will have a higher chance of getting approved for mortgages, car loans, personal loans, etc.

However, if you have a poor credit score, you will have a harder time finding a loan you get approved for.

Even if you can get approved for a loan with a poor credit score, it will likely have a very high-interest rate. Unfortunately, this is the main impact of unpaid debts on a credit score.

What is a Good Credit Score?

The amount considered good or bad depends greatly on the service you use to acquire your credit score. The United Kingdom has three major credit reference agencies: Experian, Equifax, and TransUnion. These agencies collect and maintain credit information about individuals and businesses, which lenders and other organisations use to carry out a creditworthiness assessment. Each agency has its own scoring system and unique characteristics that can impact credit scores.

Experian

For Experian, a credit score of 880 or above out of 999 is considered good.

Equifax

For Equifax, a credit score of 420 or above out of 700 is considered good.

Transunion

For Transunion, a credit score of 604 or above out of 710 is considered good.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How do I Maintain a Good Credit Score?

If you’ve been in debt for a while and you’ve been struggling, there’s a chance that your credit score may have deteriorated a lot. It it important to take action to improve your financial health and debt.

Opting for a debt solution such as an Individual Voluntary Arrangement (IVA) or a Debt Relief Order (DRO) also has a severe negative impact on your credit score.

However, once you’ve entered such a debt solution, you can improve your credit score. You do this simply by making your scheduled payments on time. If you continue to do this time and time again, your credit score will improve drastically.

Thus, by the time you get out of your debt solution, you will not only have taken care of your debt but also be improving your credit rating.

What is Statute-Barred Debt?

As we’ve discussed in the past, statute-barred debt refers to debt that isn’t enforceable anymore. Your creditor cannot use court action against you to recover their debt.

According to the Limitations Act 1980, a limitation period must be fulfilled for a debt to become statute-barred. The limitation period for debt is typically six years for most unsecured debt but twelve years for some debts, e.g. mortgage shortfalls.

The Limitations Act 1980 also determines the conditions for the limitation period. Your limitation period resets if you make a payment towards the debt or if you acknowledge the debt in writing. This would mean it would be another six (or twelve) years from that date for the debt to become statute-barred.

You must also remember that if your creditor has a County Court Judgment (CCJ) against you, it doesn’t matter how many years go by. The limitation period becomes irrelevant, and your debt will not become statute-barred.

A County Court Judgment (CCJ) prevents any limitation period from being placed on a debt. Not making your payments to your CCJ on time will also have far more severe consequences. Thus, if you have a CCJ against you, I highly suggest you do your best to make your payments on time.

Once your debt is statute-barred, your creditor cannot pursue court action against you. However, they can still contact you regarding your debt if the Financial Conduct Authority does not regulate them.

If the FCA regulates them, and you’re sure your debt is statute-barred, you can write them a letter and ask them to stop. If they persist, you can report them to the FCA.

However, if the FCA does not regulate your creditor, you won’t get them to stop contacting you about your statute-barred debt. While they won’t be able to pursue you in court for it, they will still have the right to contact you outside of court. In this case, your best action would be to make arrangements to pay off your debt to get the creditor off your back.

Remember that you must treat some debts, such as Council Tax debt and Tax Credit Overpayments, as priority debts. This is because creditors such as HM Revenue and Customs don’t need to go to court to pull money from your wages and benefits to compensate for your debts.

Certain debts are exempt from becoming statute-barred, meaning the time limit does not apply to them. These include:

- Student Loans: In the UK, student loans issued by the Student Loans Company (SLC) are not subject to the statute of limitations. They can be collected even after the usual limitation period has passed.

- Tax Debts: Debts owed to HM Revenue and Customs (HMRC) for income tax, VAT, or other tax liabilities are not subject to the statute of limitations. HMRC can pursue tax debts even after the usual limitation period has expired.

» TAKE ACTION NOW: Fill out the short debt form

How does Statute-Barred Affect My Credit Score?

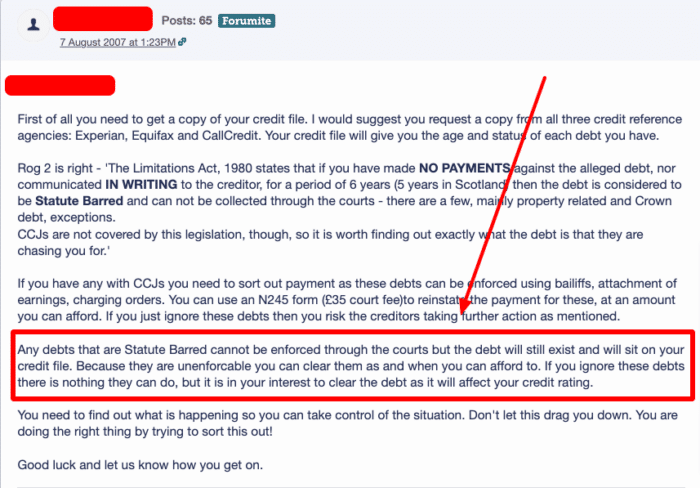

As I mentioned, any missed payments and defaults on your account will appear on your credit report. These stay within your credit report for six years; throughout that duration, they play a part in bringing your credit score down.

While a statute-barred debt is not mentioned on your credit report, any late payments, missed payments, defaults and payment breaks will definitely be mentioned.

All of these stay on your credit report for six years after the date they were registered.

For example, the limitation period on your debt would start once you receive a Default Notice. If you haven’t made a payment or acknowledged the debt for six years after receiving the default notice, then the debt would become statute-barred.

At the same time, the mention of the Default Notice would also be removed from your credit report.

Conclusion

When your debt is statute-barred, it can be confusing to think about its effects on your financial situation. The confusion stems from the fact that you can’t be pursued in court for the debt now, but the debt still technically exists.

Ultimately, you don’t have to worry a lot about your credit score regarding unenforceable debt. You can definitely maintain it and even improve once your debt becomes unenforceable.