Sygma Bank Debt – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

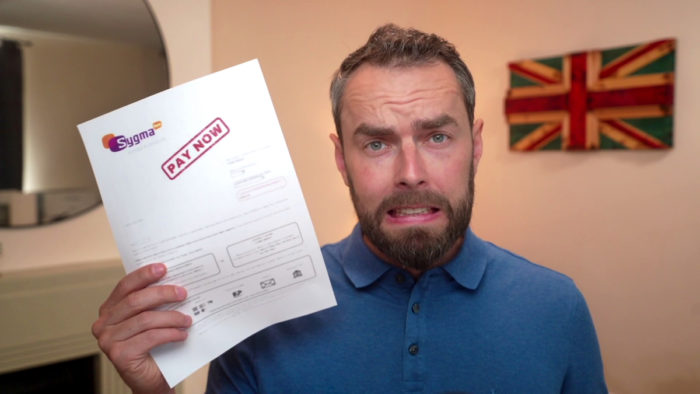

Are you puzzled by a letter from a debt collector about Sygma Bank debt? This can be worrying, but you’re not alone. Over 170,000 people visit our website each month seeking advice on debt matters.

In this article, we’ll cover:

- Who Sygma Bank UK are.

- What it means when your account is in debt.

- Whether you should pay a Sygma Bank debt.

- How to potentially write off some Sygma Bank debt.

- Steps to take if you lose in court.

It’s normal to feel unsure about where this debt has come from or if you should pay. Perhaps you’re even questioning if it’s real.

Sometimes, you might not need to pay Sygma Bank debt, but ignoring it can lead to bigger problems. So, let’s get to the bottom of this together. With our help, you can make sense of this situation and find the best way forward.

Have you got a Sygma Bank debt?

If you have an unpaid debt to Sygma Bank, then this debt will now be owned by Creation Financial Services – unless they have sold it on to a debt collection company. Creation Financial Services or the debt purchasing company will contact you to ask for full payment or threaten court action.

They do this by sending you a Letter Before Action, which as the name suggests gives you an opportunity to pay before taking legal action against you. Only, there is no way of knowing whether they will genuinely take you to court over the debt or not. It could be just a way of scaring you into making the payment.

Ask for proof you owe the money

You don’t automatically have to pay your Sygma Bank debt just because you’re being chased and it’s not statute barred. You have the right to ask for proof you owe the debt before paying. The proof must be a copy of the credit agreement you signed when taking out the Sygma Bank store card.

This can be difficult for Creation Financial Services to provide because you may have taken it out a long time ago with Sygma Bank. If you send a letter asking for proof and they don’t reply or supply the proof, you can use this against Creation Financial Services if they do eventually take you to court.

A former Sygma Bank customer has discussed receiving a copy of his signed agreement when asking for this proof on the Legal beagle forum. However, he believes he wasn’t given the proper documentation to sign and may use this to get out of the debt. You may want to look into the same loopholes.

Should you pay a Sygma Bank debt?

You might end up having to pay Creation Financial Sevices for your historic Sygma Bank UK debt. But there are two avenues to explore before making a payment.

First of all, you should check if the debt has become too old to be recovered. Because Creation Financial Services took over Sygma Bank UK many years ago, there is a chance you don’t have to pay because the debt is too old. This is known as a statute barred debt.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What is a statute barred debt?

You cannot be taken to court over a statute barred debt. The courts wanted to make sure they weren’t bogged down in old debt cases, so they put restrictions on what debts can go to the courts. If the debt is:

- At least six years old

- And, has not been paid in part within the last six years

- And, has not been acknowledged by the debtor in writing in the last six years

- And, has never been the subject of a court order

Then the debt should qualify as statute barred. Because you can’t be taken to court you can never be forced to pay. If your Sygma Bank debt is too old to be collected, simply let Financial Creation Services know in a reply. And tell them you won’t be paying.

» TAKE ACTION NOW: Fill out the short debt form

I lost in court – should I pay my Sygma Bank debt?

If you’re taken to court by Creation Financial Services and lost, you should do all you can to pay the debt. This may involve agreeing to a payment plan.

If you ignore the court’s order to pay the Sygma Bank debt, the judge may authorise the use of debt enforcement action. This may include the use of enforcement agents, commonly known as bailiffs. And when bailiffs get involved it becomes a lot more expensive to get out of your debt.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Other Debt Collectors

You should check for more outstanding debts that you may have with other companies or debt collectors. Here are four steps you could take:

- Check your credit report for other defaults

- Check your email and post for reminders or overdue notices

- Check the court records for CCJs against you

- Check your bank statements for the names of other debt collectors

There are hundreds of debt collectors in the UK and each works with different companies to collect debts.

For example, Cabot Financial have been known to collect for the DVLA while Lowell Financial and PRA Group buy debts from various credit card companies like Barclaycard.

If you see a name on your bank statement that you don’t recognise then you can search MoneyNerd to see if they’re a debt collector.

Sygma Bank Contact Details

| Address: | 4th – 6th floor Wellington Buildings, 2-4 Wellington Street, Belfast, BT1 6HT |

| Website: | https://www.creation.co.uk |

| Phone: | 0800 783 5881 |

| Email: | [email protected] |