Taking Control of Goods Fees Regulations 2014 – Laws

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Worried about council tax debt and what happens if you can’t pay? This article is here to help and discuss the Taking Control of Goods (Fees) Regulations from 2014. This is a law about how much money a bailiff can ask for when they help to get back debt payments.

Each month, over 170,000 people come to our site for advice about their money troubles, so you’re not alone. In this article, we will cover:

- What the Taking Control of Goods (Fees) Regulations 2014 law is.

- What to do if you are worried about it.

- How much a bailiff can ask you to pay.

- If this law always applies.

- How you might be able to get rid of some debt.

We understand how you feel and know it’s hard when you can’t pay your council tax and are worried about legal action. But don’t worry; we’re here to discuss your options and what your next steps should be to improve your current situation.

Let’s dive in.

What is the Taking Control of Goods (Fees) Regulations 2014?

The Taking Control of Goods (Fees) Regulations 2014 limits the amount debtors can be charged by enforcement officers – also known as bailiffs – for enforcing debts for a creditor as per a court order. Debtors are faced with various fees when dealing with bailiffs and this simplifies and caps what they can be charged.

More information can be found in the Tribunals, Courts and Enforcement Act 2007.

Does Taking Control of Goods (Fees) Regulations 2014 always apply?

The Taking Control of Goods (Fees) Regulations 2014 dictates what can be charged in most debt enforcements, such as instructions by county and tribunal courts. However, the above fees are not relevant when an enforcement agent is executing a ‘writ of control’ for the High Court. High court debt enforcement is subject to another fee structure.

The Taking Control of Goods (Fees) Regulations 2014 also includes exceptions for vulnerable people. If you are classed as a vulnerable person as per the Taking Control of Goods (Fees) Regulations 2014, you will not have to pay one of the above charges – and you might not have to face enforcement agents at all.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Taking Control of Goods (Fees) Regulations 2014 and vulnerable debtors

The Taking Control of Goods (Fees) Regulations 2014 protects debtors who are vulnerable to some taking control of goods practices. And these debtors can even avoid charges.

First, as per Regulation 12, if an enforcement agent attends a premises and deems the debtor as a vulnerable person, they should not be taking control of goods. Instead, they should provide the debtor with contact details for debt charities and support. Moreover, the bailiff can no longer charge the enforcement fee.

However, the bailiff is allowed to request payment; they just cannot take control of any goods until debt advice has been provided.

Does the Taking Control of Goods (Fees) Regulations 2014 say I’m vulnerable?

Vulnerability, per the Taking Control of Goods (Fees) Regulations 2014, can be either permanently vulnerable or temporarily vulnerable debtors. For example, someone with learning difficulties would be classed as permanently vulnerable and Regulation 12 will always apply, whereas someone who is pregnant is only temporarily vulnerable and will only benefit from it for a set period.

You might be considered vulnerable if:

- You are elderly or seriously ill

- You have been made unemployed

- You are overcoming a bereavement

- You are a single parent

- You cannot speak or read English

Vulnerability is assessed on a case-by-case basis. You might want to contact debt charity services for guidance.

Tell enforcement agents you’re vulnerable

Don’t wait until the enforcement agents turn up at your door to claim you’re a vulnerable person. It is advantageous to tell the enforcement company about your vulnerability in advance by calling them or sending an email.

By doing this, you will not have to deal with enforcement officers at your door, and arrangements can be made remotely.

Will I need to prove vulnerability?

You will need to show evidence that you are vulnerable, such as a doctor’s note or evidence from DWP showing related state benefits.

What can a bailiff legally charge you?

If you have agents coming to your property to enforce a debt as instructed by the court (maybe via a creditor), there are certain fees they can charge during each stage of the process:

- Compliance fee

The “compliance stage” is when the agent must give notice to debtors to pay the outstanding money, known as a Notice of Enforcement. It is called the compliance stage because they are complying with their legal obligations using the notice.

The debtor must be given seven days to act and make the payment, not including Sundays or national holidays. If the payment is recovered, debt collection is complete and no further action is taken.

This compliance notice will also state that enforcement officers will visit the debtor at their home address or business premises to take control of goods if they do not receive payment in time.

The fee for this is £75 which is added to your debt.

If the debtor does not repay within those seven days, an enforcement agent will come to the debtor’s home, known as the “enforcement stage”. They will be charged for the enforcement agent coming out and executing a repossession, but as per Regulation 11, they can only be charged once even if the enforcement agent is enforcing multiple debts.

The enforcement fee for this is £235 + 7.5% of the value of the debt being enforced above £1,500.

- Sale fee

The bailiff can make another charge to the debtor for taking control of goods and preparing them for sale, known as the sale stage or selling stage.

The fee for this is £110 + 7.5% of the value of the debt above £1,500.

However, additional fees may be charged if the enforcement agent needs the services of a locksmith or storage facility. If any goods are disposed of, there is a disposal stage which also comes with additional fees. Different Disposal stage charges can apply depending on what is being disposed of.

Given the above information, the combined full fee paid to enforcement companies can certainly be high!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How do I complain about being overcharged?

If you think that you have been overcharged, you should make a complaint as soon as possible. There is lots of help available – from debt charities giving specific guidance to my free letter template.

But before you can actually complain, you need to make sure that you actually have been overcharged.

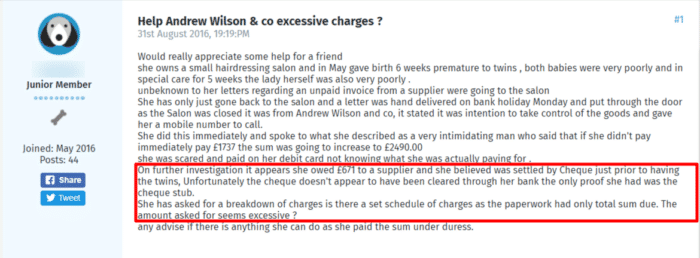

In this example, we don’t know for certain that the business owner has been overcharged. She needs to wait for her bill breakdown and look at it in detail. If she has been overcharged, she can move on to the next stage, which I have outlined below.

Make your first complaint to the bailiff’s company or agency directly so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, the bailiff may be fined. You could even be owed compensation.

If the bailiff’s company or agency is not registered with the FCA, you can make your secondary complaints to the Civil Enforcement Authority (CIVEA). CIVEA has its own set of guidelines and procedures for dealing with complaints against its members.