Token Payment Plan or No Offer of Payment – Letter Template

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you seeking help with a ‘token payment plan letter’? You’re in the right place! Every month, over 170,000 people visit our website to get guidance on dealing with debt problems.

In this easy-to-read article, you will find:

- What a Token Payment Plan (TPP) is.

- The steps to get a TPP.

- How to write a letter to your creditors.

- Tips for talking with the people you owe money to.

- A letter template you can use.

We know that dealing with debt problems can be scary. But don’t worry! With our expertise, we’ll help you learn how to handle your debt issue with a token payment plan letter.

Letter Template

To Whom It May Concern

Regarding Case #: [your case number]* (required)

Since making the above agreement with you, my circumstances have changed. I cannot now afford to make the agreed monthly payments for the following reasons.

[include a paragraph outlining the special circumstances you have that you want the creditor to take into account.]* (required)

I enclose a budget summary which shows my total income, and my total outgoings. As you can see, I have no money left to make offers of payment to my creditors.

Because of my circumstances, please agree to [suspend payments for six months/accept a token offer of £1 a month for the next six months.]* (required)

If you are adding interest or other charges to the account, I would be grateful if you freeze these so that the debt does not increase.

If my circumstances improve, I will contact you again.

Please send a [paying-in book/standing order form]* (required) to make it easier to pay you.

I look forward to hearing from you as soon as possible..

I look forward to hearing from you.

Yours sincerely

Downloadable Resource

The download links below take you to a Google document template where you can make a copy or save it in any format you like. Note you may have to log in to your Google account.

Download – Single (for one person)

Download – Joint (for couples)

What is a Token Payment Plan?

A Token Payment Plan is a temporary payment arrangement for people with extreme financial difficulties. If you cannot repay your debt significantly each month, a TPP is a way to pay £1 each month until your financial situation improves and you can begin making more substantial payments.

A TPP is a short-term repayment plan and is usually only available for six months. The creditor will expect you to be able to make a more substantial debt repayment once your financial distress has eased.

Can creditors reject a Token Payment Plan?

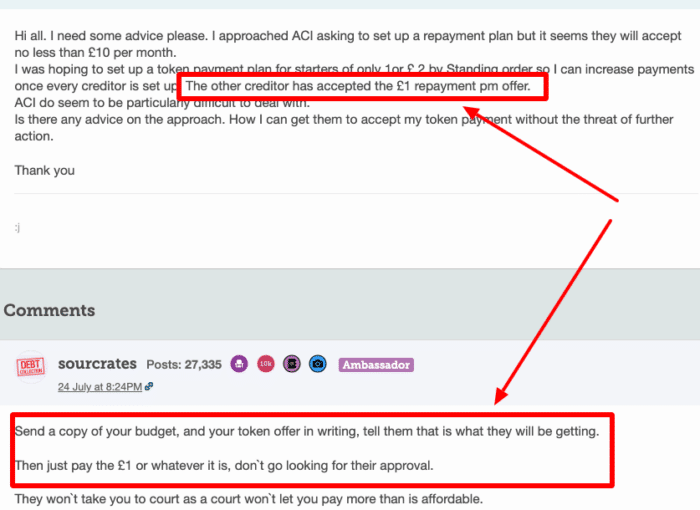

Creditors can reject a TPP if they want, but when this happens, debt charities will urge you to make the TPP to them anyway. This will stop your account from falling too far behind and could be used as evidence to show you have done your best in difficult circumstances.

If the alternative is a no offer of payment, creditors may be more inclined to agree to the TPP.

If they do reject it, you can try the following – but remember to keep paying the TPP anyway:

- Explain your circumstances again and enclose a copy of your personal budget.

- Apply for breathing space. This will give you temporary relief from payments, stop most types of enforcement and also stop most creditors applying interest and charges for 60 days. You can find out more about the breathing space application here.

- Speak to debt professionals about other debt solutions in the UK, such as IVA, debt relief orders and debt management plans.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How do I get a TPP?

You can get a TPP by asking for it yourself using our free letter template. Alternatively, you can ask a debt charity to go about obtaining a token payment plan on your behalf. You might consider using a commercial debt management company to negotiate one for you, but these businesses may charge you one-off and ongoing fees for applying for a TPP, meaning you will pay more.

Top tips for communicating with creditors

Talking to creditors can feel scary and intimidating, but as part of their lending responsibitites, they have to be prepared to work with you if you are finding it hard to make payments, so bear that in mind. They are also human, and many can be more sympathetic then you think!

Here are some tips to make effective creditor communication a little easier:

- Get all the paperwork in order before you call or write, including your personal budget, reference numbers, dates and amounts

- Consider using online chat or email if you do not feel comfortable talking in person

- Keep a pen and paper next to you to make notes of who you spoke to and any key points

- Keep copies of any correspondance and note down the times and dates and who you spoke to in your diary

- Ask for written confirmation of any agreements that you make

- Give permission to a trusted friend or family member to speak to them if you find it difficult interacting with creditors comfortably – you will need to speak first to confirm this or write, giving permission but they can then handle it from that point onwards

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Should I take out more credit to pay my debts?

Most of the time, taking out taking additional credit for debt repayment or using credit to settle debts is a bad idea and will lead to bigger debts. There are some situations when it can be an effective tactic to get out of debt, such as using a balance transfer card to reduce credit card debts. If you consider doing this, always speak to a debt charity first. They can advise if it is a good idea for you and tell you more about the effect of borrowing on your debt situation.

Do creditors have to freeze interest?

You will notice that in my letter template, I also request that your creditor freeze any debt interest. This interest freeze on debts is so your debts do not grow even if the company agrees to give you some breathing space or accept the £1 per month token payment.

Creditors do not have to agree to freeze the interest on your debt, but many will agree. Sometimes they will agree to this part of your request even if they do not agree to a £1 token payment, improving your situation.

Speak to debt professionals for further advice

The following free debt advice services can offer free, impartial debt guidance and can help you set up a token payment plan with your crediors, as well as offer debt negotiation strategies and credit negotiation guidance.

| Organisation | Website | Phone number |

| Stepchange | http://www.stepchange.org | 0800 138 1111 |

| National Debtline | http://www.nationaldebtline.org | 0808 808 4000 |

| Citizens Advice | http://www.citizensadvice.org.uk | England: 0800 144 8848 Wales: 0800 702 2020 |