Trust Deeds Disadvantages – All You Need to Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you keen to learn about trust deeds and their drawbacks? Well, you’re in the right spot. We’ve written a clear guide to help you understand the impact trust deeds may have on your credit rating, your assets, and your future loans.

Each month, more than 170,000 people visit our website seeking advice on debt solutions. We understand the worry that comes with debt.

In this easy-to-read article, we’ll explain:

- What a trust deed is and what it means for you

- How a trust deed might change your credit rating

- What could happen to your house if you have a trust deed

- How your trust deed could impact your future loans

- What to do if your trust deed fails

We know how hard it can be when money is tight, but we have lots of experience with debt problems. We’re here to help you make sense of it all.

What are the drawbacks of a trust deed?

I will list down the most significant disadvantages of a trust deed for you.

These include:

- You will have to make monthly contributions for an estimated period of 4 years.

- Your credit rating could be significantly reduced.

- A trust deed could affect your credit rating for approximately 6 years.

- It could be difficult for you to get a mortgage loan in the future.

- You could be forced into selling your assets to pay off your creditors.

- Your trustee could assign someone else to run your business for you.

- In case you receive a windfall, it could be used to pay off your unwanted debts.

- Your trustee and your creditor could force you into applying for sequestration or bankruptcy.

- Your employment position could be affected in some cases.

- Your details are entered in a public register. This is known as the Register of insolvencies. This can be accessed by anyone.

- An insolvency practitioner is expensive, which only adds to the cost.

Will I lose my house in a trust deed?

If you are a homeowner, you could be asked to release the equity of your home.

In case you are unable to keep up with your monthly payments your trustee could sell your house in the benefit of your creditor.

However, this is highly unlikely. As long as you cooperate with your trustees and make your payments, you do not have to worry.

» TAKE ACTION NOW: Fill out the short debt form

What will happen if my trust deed fails?

A failed trust deed may force you into a sequestration.

Your agreement could be terminated and the creditors might not approve on making another agreement with you

Moreover, the amount of interest and charges that were suspended before could be reapplied.

Furthermore, you may have to sell your assets to pay off your creditor.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Do I have to sell my home whilst in a trust deed?

In case you are the owner of your home, you could be asked to sell it in order to raise money to pay off your debts.

However, if you have little or no equity in your home you could be able to set up a protected trust deed.

How will I be affected if I am a guarantor?

Since a guarantor receives no protection, your creditor could directly approach you to make payments.

Moreover, if you have unsecured loans that have not yet been paid, your house could be at risk. The creditor could force you into selling your house to receive their share.

Can my trust deed affect my credit rating?

Yes, your Scottish trust deed is likely to have an impact on your credit rating.

Your credit score could be affected for an estimated period of 6 years. This could make it difficult for you to take out credit in the future.

Will my protected trust deed affect my credit rating?

Yes, a protected trust deed could decrease your credit score significantly.

However, you could be able to rebuild your score after you have received your letter of discharge.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

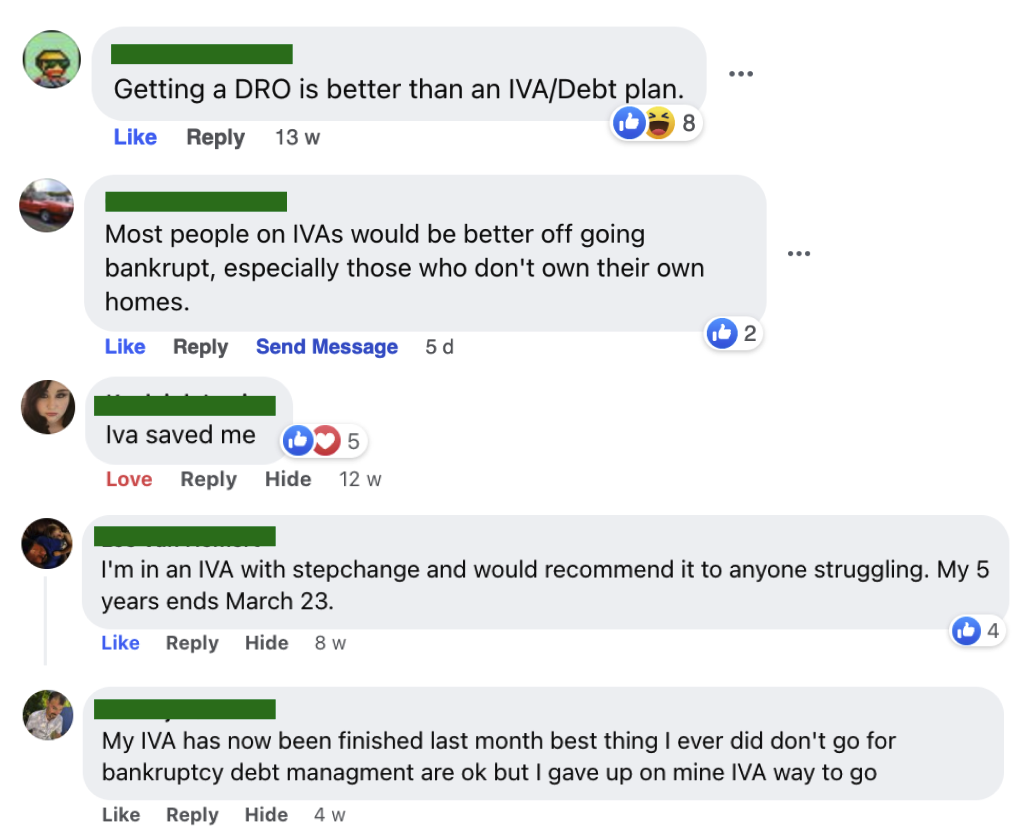

Are there any other options?

Deciding how to tackle your debt is a very personal decision and you certainly can’t get the answer through a simple blog post.

It’s made worse by the strong opinions you’ll often find online.

The best option is to get help from a debt expert to find out all your options and see which is right for you.

I’ve partnered with The Debt Advice Service and you can access their expert support by filling out the short form below.

Get help from The Debt Advice Service.