Trust Deed Rules – What You Need To Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you need to know about trust deeds and their rules, you’re not alone. Many people have worries about debt and trust deeds.

In fact, over 170,000 people visit our website every month seeking advice on debt solutions. We’re here to help you understand trust deeds better.

In this article, we’ll talk about:

- What a trust deed is

- How much debt you need to have to get a trust deed

- What happens if you get extra money while you have a trust deed

- If you can get credit while you have a trust deed

- How to know if you can get a trust deed

We know it’s hard to have debt. But don’t worry; our team knows a lot about trust deeds. We can help you understand them better.

What are the rules of a trust deed?

If you are in a trust deed, you have to follow the rules and regulations.

- It is crucial that you make your monthly payments on time.

- Some trust deeds may suggest that you can not be a company director. However, you could speak to your trustee and get permission.

- In case you receive new money or property (e.g. windfall), you have to inform your trustee about it.

- Moreover, it is essential you cooperate with your trustee. Otherwise, they could force you into a sequestration.

How do I know I am eligible for a trust deed?

The trust deed criteria are simple:

- You are expected to either be a Scottish resident or have lived in Scotland for over a year.

- Moreover, you should have unsecured debts of at least £5,000.

- Furthermore, it needs to be demonstrated that you have been unable to pay off your debts for a significant period of time. You should also be aware of what a trust deed Scotland wage increase entails. As such, you should speak to an adviser before entering into a trust deed.

How much debt do I need to enter into a trust deed?

You need to have a minimum amount of £5,000 worth of unsecured debt. However, if you have debts less than this, your trustee could suggest an alternative debt solution. This may include:

- Debt Arrangement Scheme (DAS): A scheme set up by the Scottish government to pay off debts. In this case, your interest and charges are frozen. However, this could affect your credit rating.

- Sequestration: You will be expected to make payments over a period of time only if you can afford them.

- Debt Consolidation Loan: Withdrawing new credit to pay off your current credit.

Do I have to inform my trustee if I receive a windfall?

Yes, it is crucial that you inform your trustee about any sort of increased income. This can include a lottery or a windfall.

If you fail to do so, you could find yourself in a risky situation which may impact your trust deed’s validity.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can I make amendments to my trust deed?

You could be allowed to make an amendment to your trust deed under certain conditions.

These conditions include:

- Your financial situation has improved, and you want to pay off your debts differently in relation to the financial adjustment.

- Your financial situation has worsened, and you are now unable to make monthly payments.

- You have received a windfall.

- You want your trust deed to become protected.

It is important to understand your trustee will only make the changes if your creditors agree.

Can I get credit while in a trust deed?

You may be able to get credit during your trust deed, and this will not be included in any trust deed repayments. However, this process will be difficult, and it may impact the success of the trust deed (because you will have to focus on multiple repayments).

It’s also important to note that in the first two years after you have been discharged, you may struggle to get any form of credit.

Can I apply for a moratorium while in a trust deed?

You could apply for a moratorium through the Accountant in Bankruptcy if your trust deed is not yet protected. This will prevent your creditors from forcing you into making payments.

However, a moratorium only lasts for 6 months. Moreover, you can only apply for a moratorium once in 12 months.

» TAKE ACTION NOW: Fill out the short debt form

Are there any other options?

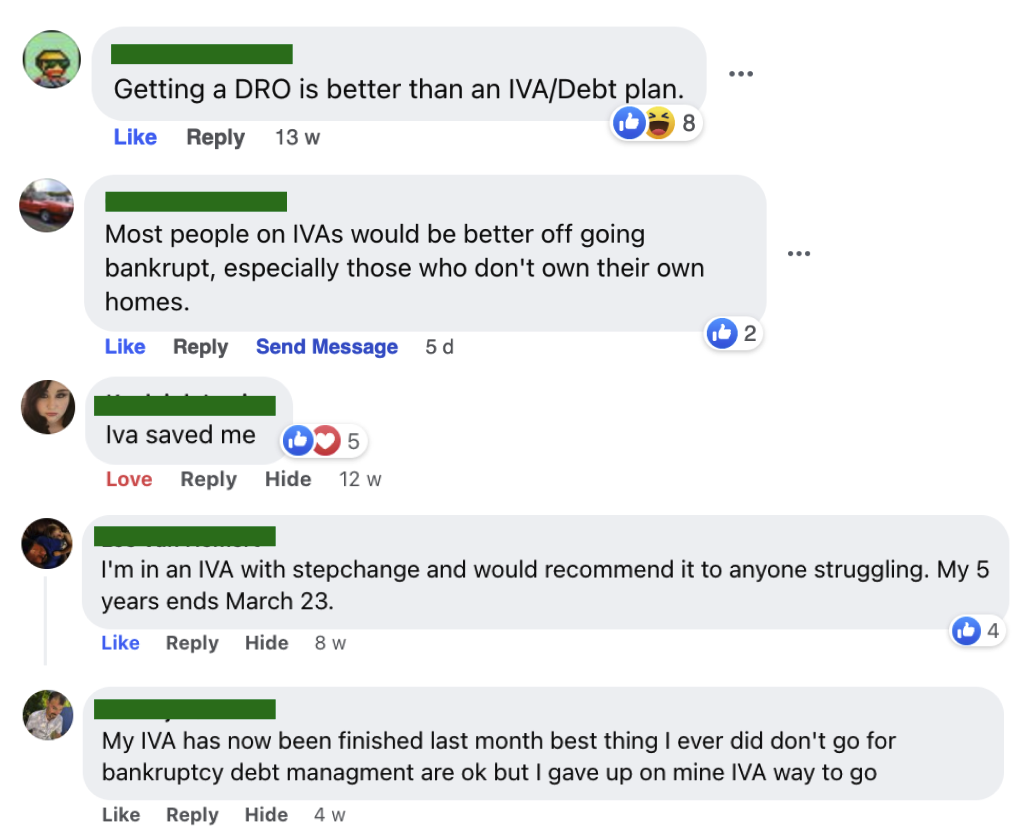

Deciding how to tackle your debt is a very personal decision and you certainly can’t get the answer through a simple blog post.

It’s made worse by the strong opinions you’ll often find online.

The best option is to get help from a debt expert to find out all your options and see which is right for you.

I’ve partnered with The Debt Advice Service and you can access their expert support by filling out the short form below.

Get help from The Debt Advice Service.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can I apply for a trust deed if I run my own business?

According to the trust deed regulations, you might not be allowed to run your own business.

However, your trustee could arrange for someone to run your business for you for a certain period of time while you are working through the trust deed.

Please note: If your financial condition worsens, you could be forced into selling your business.