What Is an Administration Order? Detailed Overview

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you owe people money and they’re taking you to court, you should learn about an administration order. It gives you a legally sanctioned method to consolidate and manage your debts through court intervention.

I explain everything about administration orders. Let’s get started.

Remember, you may need to source free debt advice to work out if an AO is really your best option.

What is an administration order?

An administration order (AO) is a legally binding debt solution approved and overseen by the county court or high court.

It is an agreement for the debtor to pay back a number of creditors over a set period of time, usually until all the debt is repaid – with some exceptions.

The court may put a time limit on the order, meaning you don’t have to pay back all of your debts in full. However, there are ongoing court admin costs to pay.

How does an administration order work?

An administration order works by making sure you meet repayments by paying to the court, which then pays your creditors.

The court will take 10% of each payment you make to them to cover their own admin costs.

Creditors cannot take further action against you without the court’s permission while the administration order is active.

The order remains in place, and you keep paying until all debt has been paid off, as well as any court fees.

Unless a composition order has been issued…

What is a composition order?

Sometimes, the debtor will not have to repay all of their debt. A judge can issue a composition order, which puts a time limit on the administration order because the debtor will not be able to clear their debts within a reasonable time.

A typical composition order lasts for three years. At the end of this period, all debts are cancelled, and you will not have to make another monthly payment.

Does the county court decide on payments?

The court decides how much you pay back each month. They will analyse your monthly income and let you know your monthly payment.

They will ensure the payments are fair and do not cause financial hardship.

When you make payments, you pay the court, which then distributes your money, making payments to each creditor.

You never have to pay the creditor directly yourself. Sometimes, an attachment of earnings order will be used to take the monthly payment from your salary.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

After the administration order is complete

Once the debtor has paid back all the money they owe, the administration order is satisfied and will be marked as such on the official register and subsequently your credit file.

If you want evidence that the administration order was satisfied, you can request a certificate of satisfaction. This certificate will help you if you want to apply for more credit in the future.

To get the certificate of satisfaction, you should ask the local county court office. There will be a court fee for this, currently set at £15. Contact them directly if you need this certificate.

A word on joint debts and administration orders

Administration orders can only be applied for as an individual, which causes an issue if you have joint debt.

If you successfully get an administration order for a joint debt, the other person may still be chased for money unless they also get an administration order.

The other person would need to be eligible on their own and go through the application process separately.

Consider getting free debt advice from a charity to assist with more complicated situations like these!

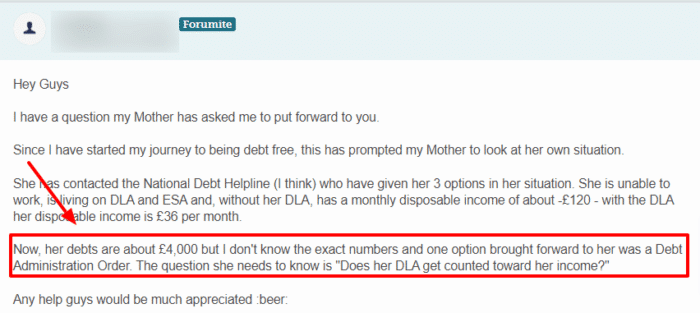

Who can apply for an administration order?

To apply for an administration order, you need:

- To have a County Court Judgment (CCJ) issued for the debt

- To have at least two outstanding debts

- To have a maximum of £5,000 of debt combined

If you don’t meet all three of these conditions, you will not be able to apply for an AO.

You can ding out your other options by getting free debt and money advice from a charity – or visit our debt solutions page!

If you’re not sure if you qualify, seek debt advice for clarification!

My total debt is not less than £5,000…

If your total debt is a little over £5,000, you may want to try asking one creditor to write off some of the debt and explain your reasoning – and then apply for an AO.

There is no guarantee this will work, but it is worth a shot for some debtors.

How to apply for an administration order?

To apply for an administration order, you must complete form N92 and then hand it in at the local county court.

You must not sign the form; a signature is required in front of a court officer only.

The form is easier to fill in if you do your homework beforehand.

You should calculate the exact amounts of debt you have, and make a monthly budget. For help making an accurate budget, consult the popular Money Nerd budgeting guide and resources.

Additional support is accessible from a debt advice charity.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What debts can be included in an administration order?

All types of debt can be included in an administration order. When you make an application, you must include all debt you owe.

A creditor can object to being included in the order, but the district judge will make the lasting decision.

It is advised to ask for mortgage and rent arrears to be excluded from an AO. Citizens Advice has a fantastic post with details on what to do in this situation. You can read it here.

How long does it take to get an administration order?

The average time for the order to be set up is four to six weeks. If there are any objections, it can take longer.

Once it has been set up, a copy will be sent to you and all creditors included. It will also be recorded on the Register for Judgments, Orders and Fines. It will remain on this register for six years.

What are the advantages of an administration order?

The benefits of an AO are:

- There is no upfront fee to pay

- It’s legally binding, so your creditors cannot change their mind

- They are typically capped at three years, meaning you may not have to repay everything you owe.

- The court decides what you repay – and it’s only what you can afford

- One monthly payment keeps things simple

You may still need debt and money advice to work out if an AO is right for you. There may be more suitable solutions, such as an IVA, which can also write off some of your debt.

What are the disadvantages of an administration order?

Of course, an AO has some drawbacks as well, namely:

- It is only available to specific debtors with more than one debt with a total debt below £5,001 and an existing CCJ. A CCJ stays on your credit file for six years.

- If you miss a payment, there are serious consequences. When this happens, you may have the money taken directly from your wages.

- You will have difficulty taking out further credit in the following years due to poor credit rating

- The court may take an ongoing fee of up to 10% of your payment. This could mean it takes longer to clear your debts.

Again, if you are suitable for an AO but are unsure if it’s the best move, always seek free debt advice from a charity or organisation such as Citizens Advice.