Difference Between Debt Management and Debt Consolidation

What’s the difference between debt management and debt consolidation? These debt settlement strategies are different but are also more similar than you might realise.

If you’re considering a Debt Management Plan or debt consolidation, read this first.

What is a Debt Management Plan?

A Debt Management Plan (DMP) is an informal debt solution for people who are struggling to repay non-priority debts.

A non-priority debt includes debts relating to credit cards, store cards and personal loans. You pay these debts only after clearing priority debts (e.g. council tax arrears, court fines, etc.) and monthly living expenses.

The DMP is an agreement that the debtor will make a single monthly payment, which is then divided up and sent to each of the creditors.

How much of the payment goes to each creditor will be decided at the start, usually calculated proportionally.

It’s important to note that a DMP is not a legally binding debt solution. At any time, creditors or the debtor can decide to stop the arrangement, but this doesn’t stop the debt being owed.

If you want to learn more about DMPs and how to set up a plan, read our complete DMP guide.

What are debt management programmes?

A debt management programme is another term that describes a Debt Management Plan.

However, this term may also be used by commercial debt management companies and credit counselling businesses, referring to paid-for services they offer to help you get out of debt.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.99% |

£218.73 |

£26,247.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 6.95% |

£220.40 |

£26,447.92 |

| Selina | 7.5% |

£221.35 |

£26,562.50 |

| Equifinance | 7.7% |

£221.70 |

£26,604.17 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

What’s the difference between a Debt Management Plan and debt consolidation?

A Debt Management Plan is one of the most effective ways you can consolidate debt.

If debt consolidation is the overarching strategy, then a Debt Management Plan is one of the methods to achieve debt consolidation. Other strategies include:

- Debt consolidation loans

- Balance transfer credit cards

- Debt consolidation remortgages

However, there are some key differences between using a DMP for debt consolidation and the other three common methods.

Whereas a debt consolidation loan, a balance transfer card and remortgaging for debt consolidation all actually pay off debts so you have fewer creditors, a DMP does not.

When you use a DMP, you still have just as many creditors as you did before the DMP began. You might only make one monthly payment now, but this hasn’t technically consolidated debts like the other methods.

You still owe multiple creditors. Not to mention that any of them could decide they do not want to be a part of the DMP because it is not a legally binding debt solution. Then you’re back to square one.

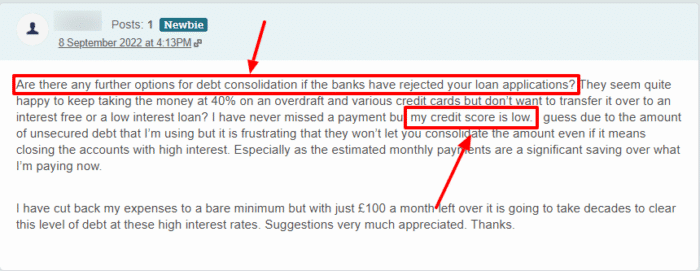

Nevertheless, it can still be a beneficial alternative, especially if you are unable to access a debt consolidation loan due to a poor credit score.

Let’s see the main differences between debt consolidation and a debt management plan.

| Debt Consolidation | Debt Management Plan (DMP) |

|---|---|

| Often offers a lower interest rate compared to individual debts | Interest and charges might be frozen, but not always. It’s up to the discretion of the creditor |

| Can initially lower your credit score if it involves closing old accounts but can improve over time with consistent payments | Will be recorded on the credit file and can affect the credit score negatively for six years |

| May have setup or origination fees. Paying older debts early might incur penalties | Often managed by third-party companies that may charge fees, though some charities offer free DMPs |

If banks have refused your request for a debt consolidation loan due to poor credit, consider asking for a Debt Management Plan (DMP). This allows you to pay off your debts at a rate you can afford.

Many free debt advice organisations like StepChange or MoneyHelper can help you decide if a DMP is right for you.

Debt consolidations loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking for a better interest rate?

- Stuck with the confusion of multiple repayment plans?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

How can they affect my credit score?

If you enter into a Debt Management Plan, there’s a good chance that the DMP will negatively affect your credit score.

DMPs are not directly reported on the credit file, but a DMP will be flagged with any smaller repayments.

Your score can be negatively affected because you’ll pay less each month than originally agreed with each creditor.

According to Experian.co.uk, those creditors are still within their right to record a default on your credit score while you make reduced payments. However, you might be able to negotiate with the creditors not to do this when you discuss your DMP.

Any payment defaults will be visible on your file for six years and then automatically removed.

Taking out a debt consolidation loan will not affect your credit score, but you will have your credit file checked before being approved for the loan.

This will leave a hard search on your file with negligible effect. The same is true if you were to apply for a balance transfer credit card. If you missed any repayments in full, you could have a default registered on your file, just as described above.

Debt consolidation vs debt settlement

Debt consolidation is moving all your debts together, whereas debt settlement is offering creditors an amount to settle your debts in one payment, usually less than the value of the debt, to save the debtor money.

You might be able to combine these methods together. If you’re using new credit to pay off smaller debts, you could save by getting these creditors to wipe some of your debt for immediate repayment in full.

Be aware that debt settlement will hurt your credit score and may not be worth the additional savings. Joining these strategies together should be done with caution.