Yuill and Kyle Debt – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

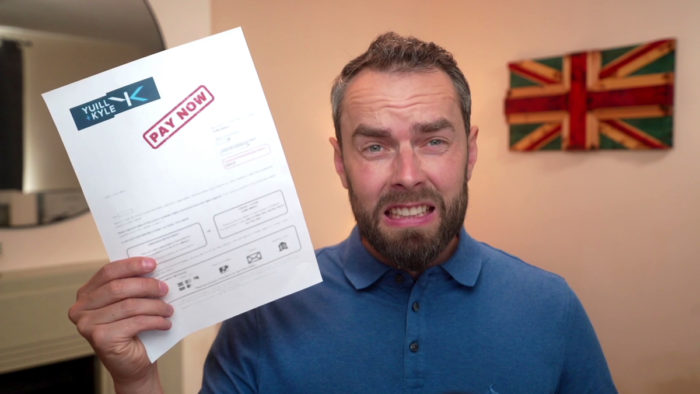

Have you received a surprising letter from Yuill and Kyle Debt Recovery? We understand how you feel. You might be wondering where this debt came from and if you really need to pay it.

You’re not alone. Each month, over 170,000 people visit our website seeking advice on debt matters.

In this article, we’ll explain:

- Who Yuill and Kyle Debt Recovery are and who they work for.

- What to do if you get a letter from them.

- If you might need to pay the debt or if you could write some of it off.

- What might happen if you don’t pay the debt.

- How to reply to a Yuill and Kyle debt letter.

Knowing about debt and how to deal with it can be hard. But we are here to help. Understanding your debt and knowing how to handle it is a big step towards feeling better about money.

Have you received a Yuill and Kyle debt letter?

Yuill and Kyle Debt Recovery will make contact with you in multiple ways. The most important communication you’ll receive from them is a Letter Before Action (LBA).

An LBA is a letter giving you an opportunity to pay a debt by a fixed deadline. They’ll then state that not paying by this deadline will or could result in legal action. Their client may decide to take you to court if you don’t pay and ask a judge to issue you with a court order to pay.

Ignoring a court order can lead to enforcement action, including the use of bailiffs. So it’s best to avoid legal proceedings when possible.

Prove the debt letter template

Most people should ask Yuill and Kyle Debt Recovery to prove that they owe the debt. When your request this proof, they must send you evidence of the debt for you to have to pay. This evidence should be a copy of an agreement you signed when suitable. If they don’t provide this proof, you won’t have to pay until they do.

There’s a slight chance that they won’t supply the proof but later you’ll be taken to court. If this happens you should show the judge evidence that you asked for proof of the debt and that Yuill and Kyle Debt Recovery didn’t supply it.

Download our free prove the debt letter template to make asking for proof of the debt quick and easy!

Yuill and Kyle sent me proof – what next?

If they send you evidence that you owe the debt, it’s a good idea to pay or agree on a payment plan. If you don’t you could be taken to court. It’s a risk to assume you won’t be.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Will Yuill and Kyle take me to court?

It’s always unknown whether Yuill and Kyle, or more precisely their client, will take you to court. Some clients may have the intention and desire to take you to court, especially if you owe a lot of money.

But sometimes any legal threats are only made to make you panic and pay the debt quickly. Unfortunately, even empty legal threats are effective and many people simply feel intimidated and pay.

» TAKE ACTION NOW: Fill out the short debt form

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Yuill and Kyle Contact Details

| Address: | Capella, 60 York Street, Glasgow, G2 8JX DX: GW70 Tel: 0141 303 1100 Fax: 0141 332 8886 10 George Street, Edinburgh, EH2 2PF DX: ED203 Tel: 0131 229 5046 Fax: 0131 229 0849 |

| Website: | https://www.yuill-kyle.co.uk/ |