Secured Loans for People With Bad Credit

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Are you wondering, ‘Can I get a secured loan with bad credit?’ You’re in the right place! Each month, over 6,900 people visit our site seeking advice on secured loans.

In this easy-to-follow guide, we’ll cover:

- What a secured loan is.

- How a secured loan works.

- The possible dangers if you fail to pay back the loan on time.

- The difference between secured and unsecured loans.

- How to get a secured loan if you have bad credit.

We know that you might be worried about the risks of a secured loan. Perhaps you are already in debt and need some help. We’re here to help you with clear, simple advice.

Let’s explore secured loans together.

Can you get turned down for a loan?

You can be rejected for a secure loan if you do not meet the lender’s affordability checks or because you have a bad credit history. People with poor credit history may still be able to get a secured loan, with some lenders even offering secured loans for bad credit.

Naturally, you will not be able to take out a secured loan without an asset to list as collateral or without a relevant asset. For example, a home equity loan requires the applicant to have sufficient home equity.

Is a credit score check required?

When you apply for any type of loan, legitimate lenders always carry out a credit score assessment. They will look at your score along with your credit history to get a full picture of how you have handled your finances and debt repayments.

There is no fixed credit score that you require to be approved by any lender. Each lender can set different benchmarks for approval, but they’ll also need to consider wider factors, not least an affordability check.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.84% |

£218.47 |

£26,216.67 |

| Selina | 6.34% |

£219.34 |

£26,320.83 |

| Equifinance | 6.59% |

£219.77 |

£26,372.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 7.4% |

£221.18 |

£26,541.67 |

| Norton | 9.05% |

£224.05 |

£26,885.42 |

| Masthaven | 9.65% |

£225.09 |

£27,010.42 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

Can I get it with bad credit?

If you prove you can afford the loan comfortably, the lender may still approve your loan even if you have bad credit. Having bad credit can make you a greater lending risk in the eyes of the lender, but they’ll consider all components of your application before making a decision.

That being said, if your credit score is too low, the lender may still reject your offer even when you can afford the loan repayments. Or they might offer a loan with much higher interest. It all comes down to personal circumstances.

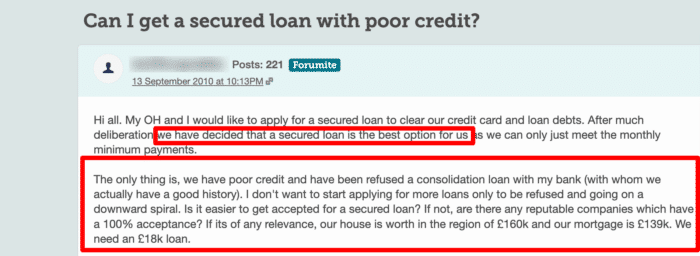

This forum user on MoneySavingExpert wants to know whether you can get a secured loan with bad credit and whether they are likely to be accepted for one – something many others also want to know.

Where can I get one?

As mentioned earlier, opting for a secured loan with bad credit rather than an unsecured loan reduces your perceived lending risk and can help you get approved. You could get approval from any of the well-known secured loan lenders, such as high-street banks.

However, if you are specifically looking to apply for bad credit secured loans, you’ll probably have to skip the big banks and look online. Secured loans for bad credit are typically advertised by online lenders online. Start by searching for these terms online to see what you find.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

Rebuilding Your Credit Score

If you are able to wait to apply for a secured loan when you have bad credit or if you get turned down for a loan, it can be a good idea to try and improve your credit score as much as you can before you apply for a loan or apply again.

You can do this by making timely bill payments and using credit cards responsibly. You should also maintain a healthy debt-to-credit ratio, avoid making frequent credit applications and check your credit report from a UK-based credit reference agency like TransUnion.

Secured loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking to fund a home improvement project?

- Dreaming of finally taking the once-in-a-lifetime trip?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

Can you borrow against your house?

There are many types of secured loans that use property and property equity as collateral within the credit agreement. The most obvious examples are first charge mortgages, second charge mortgages and secured homeowner loans that are usually taken out to complete home improvements.

Borrowing against your house or home equity is still possible with bad credit. The fact you’re willing to secure the loan with such a valuable asset will reduce perceived lending risk. However, those doing so may still have to pay higher interest compared to securing a loan against your home with good or excellent credit.

If your credit score is too low, the lender may reject your secured homeowner loan for your own safety.

Affordability checks

Affordability checks are in place to make sure you can comfortably afford the loan you wish to take out. These tests take into consideration the applicant’s income and any existing debts, such as a mortgage or an ongoing loan elsewhere.

The lender will want to know what percentage of the applicant’s income can cover all existing debt and the proposed secured loan repayments. It is not just a matter of having greater income than debt because the lender wants to make sure you can comfortably afford all other essential living expenses.

Does it affect your credit score?

Unless you apply for many secured loans at once, applying for and taking out one of these loans will not have a negative effect on your credit rating.

In fact, quite the opposite is true. Taking out any loan and making repayments on time can improve your credit rating. It shows that you can manage finances and debt repayments effectively, increasing the likelihood of being approved for other loans and credit cards in the future.

Your credit rating will only be damaged if you fail to make repayments on your personal loan as agreed or do not repay the full loan amount.