Paying Council Tax Late – What Are The Consequences?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about the effects of paying your council tax late? You’re not alone. Each month, over 170,000 people come to our site seeking guidance on their debt problems. This article will give you clear, easy-to-understand advice on:

- What council tax is and why it’s important.

- What to do if you’re finding it hard to pay your council tax.

- How to get in touch with your council about your tax.

- Whether paying your council tax late can change your credit score.

- The serious things that can happen if you don’t pay your council tax.

We know that being in debt can be scary and tough, but we’re here to help you understand your options and what steps you can take next. This article will give you the facts you need in a way that’s easy to understand. It’s important to know what can happen if you pay your council tax late, but also how to get help if you need it.

Let’s dive right in.

Does it affect credit rating?

Local authorities do not report debt to the various credit scoring agencies. Thus, if you have failed to pay any arrears, it will not be visible on your credit report. However, further legal action taken by the local authority could be.

This is because companies use your credit file to see if you are a ‘high-risk’ customer – someone who might have difficulty paying their bills on time. If you have a CCJ for any debt, including council tax, you have had such trouble paying back your debt that someone had to go to court about it.

If you have an earnings arrestment as well, you:

- Haven’t paid off your debts according to your original credit agreement

- Got taken to court over your lack of repayment

- Got a CCJ against you

- Didn’t pay according to the terms of the CCJ

- Forced your creditor to go back to court for an earnings arrestment.

Understandably, companies are going to be reluctant to give you credit!

After 6 years, it is no longer visible on your credit report, and you should find it easier to get credit again.

What happens if you don’t pay on time?

If you do not pay your council tax on time, maybe because you are finding it hard to pay straight away, the council can apply for a liability order to enforce the debt with bailiffs or other means.

Most councils will follow the same process to recover tax payments when they have not been paid on time.

Read on to find out what happens when you don’t pay straight away:

#1: They send you a reminder

The council will send you a reminder asking you to pay as soon as possible if 14 days have passed since you were supposed to make a payment. When they send you a reminder, you are given a further seven days to pay.

If you cannot afford to pay, make sure you contact them within these seven days to pay to discuss other options.

If you pay the money you were behind, no further action will be taken. If you are finding it tough, you have the right to pay back what you owe in affordable instalments.

You will lose the right to pay in instalments if you do not make contact to discuss your arrears after they sent the reminder. Do this as soon as possible if you are struggling to pay.

If you still do not make a payment to clear the amount you are behind within those seven days, the local authority will send you a second reminder.

But the second reminder is even more demanding…

This time they will ask you to pay the remaining year’s worth of tax – which can be a substantial amount. You may also lose the right to pay with an instalments arrangement.

For this reason, it is best to pay as soon as possible if they send you a reminder.

#2: Court action

If you do not make a payment to get your account up to date, or agree to an affordable arrangement of instalments, the local authority can ask a court to issue a liability order. The liability order makes you responsible to pay the whole amount you owe, and thus, allows the council to enforce the debt.

The council can use the liability order to enforce debt recovery either:

- Using bailiffs (they give you seven clear days to pay or agree to a payment plan – or seize goods)

- Using an attachment of earnings (taking money directly from wages and DWP payments)

- Charging order (take payment from any property sale you make)

- Make you bankrupt

You might be able to avoid any of these by agreeing to pay as soon as possible.

Bailiffs are one of the most common tactics used to enforce these debts.

They will ask for a full payment straight away or give you the option to agree to a Controlled Goods Agreement, which is like any other instalment arrangement but payments are secured against your valuables and can be seized if you fail to pay.

#3: Further action

But what happens if you evade any of the methods above?

The local authority can apply for a hearing at the Magistrates’ Court. Here you will be asked why you have not made payments to clear the debt straight away. The court will look to find out if you willfully neglected the debt or a repayment arrangement you made.

If they believe you have, the judge can send you to prison for up to 90 days.

If you have found it difficult to pay your council tax due to financial difficulty, this is not a reason alone to send you to prison.

» TAKE ACTION NOW: Fill out the short debt form

Can you get away with not paying it?

No, you can’t get away with not paying your council tax bill. Not paying your council tax or not clearing your council tax debts can leave you dealing with serious problems.

If you don’t pay your council tax, your council may send you some reminders and the option to create a repayment plan.

If you carry on ignoring the council and still don’t pay your tax, your council can apply to get a CCJ against you.

A County Court Judgement (CCJ) is an order from a judge that states you have to pay the debt. This means that the court agrees with your council, and you owe the money.

Your judgement will include the following:

- How much you owe

- How you should pay

- Who you should pay

- Your deadline to pay.

Unless you pay within one month of the CCJ being issued, it will be recorded in the Register of Judgements, Orders and Fines for 6 years. If you pay off your debt within these 6 years, you can request that your judgement is marked as ‘satisfied’ on the register.

CCJs are also visible on your credit file for 6 years. This will make it almost impossible for you to get credit during this time.

If you don’t comply with the CCJ, the council can go back to the court to get an Attachment of Earnings Order (AEO). An AEO against you means that money is to be taken from your wages or salary to be given to your council.

This will continue until all of your debt has been paid.

It is the court that will decide how much you have to pay, and your employer will be legally obliged to take this money out of your pay. But there are a few exceptions to when an order will be granted.

I have listed some of these exceptions below.

- You owe the creditor less than £50.

- You are registered as self-employed.

- You are currently unemployed.

- You are currently serving as a member of the UK armed forces.

- You work on a boat (although not a fishing boat).

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

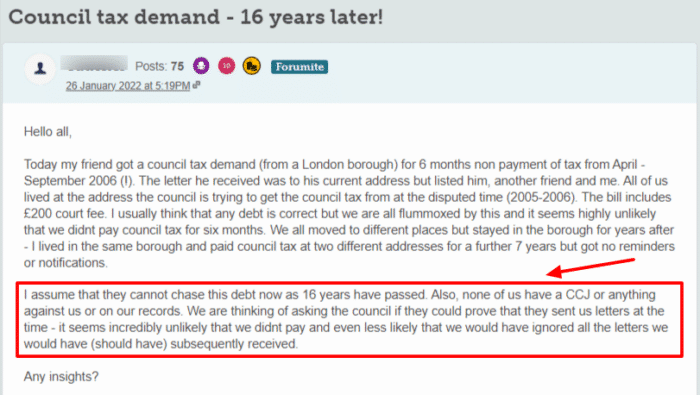

Can it become statute-barred?

Yes, council tax debts will become statute-barred.

If it has been 6 years – or 5 years in Scotland – since you last paid your council tax debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

If you are in a similar position as this forum user, you should contact a debt charity for some advice. They will be able to tell you if your debts are enforceable, and advise you on your next steps.

Can you write off the debt?

Local authorities do have the power to write off these debts, but this only happens in severe financial difficulty.

You might be able to write off some of your council tax debts with a debt solution. Even if these debts can’t be covered, getting a debt solution might help you get back in control of your finances enough to pay back the council.

There are several different debt solutions available in the UK, so I recommend speaking to a debt charity as soon as possible. Their advisors will be able to look at your finances in detail and help you work out which debt solution will work best for you.

I have linked a few charities that offer these advisory services for free below.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.

If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.