Council Tax Summons Procedure – Step by Step

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Dealing with council tax debt might seem hard. But, don’t worry, you’re in the right place for answers. Every month, over 170,000 people visit our website seeking advice for their debt problems.

In this article, we’ll explain things simply:

- What happens if you can’t pay your council tax.

- How to understand council tax bands.

- Ways to ask the council to write off your council tax debt.

- What not paying your council tax means for your credit score.

- What the law says about not paying council tax.

The average council tax debt among those seeking support from Citizens Advice has remained stable at £1,100 over the last year.1 So rest assured, you’re not alone in this.

We’re here to help you understand your options and put your worries about a council tax summons to rest.

What is a summons council tax?

If you do not pay your council tax arrears when asked by the council, they can apply for the court to make you pay.

The process starts with a court summons, asking you to attend the court if you disagree with the council tax arrears.

You do not need to attend the court hearing if you acknowledge you owe the money.

If you receive a summons but then pay the amount you owe including costs for the hearing, you do not need to attend court. Also, if you make an arrangement to pay with the local authority beforehand, you don’t have to attend court either.

The court will automatically issue a liability order if you agree you owe the amount of council tax that the council claims.

What is a liability order?

A liability order is a legal document given to the council from the Magistrates’ Court. It makes you legally responsible to pay your council tax.

And it gives the council permission to enforce the debt in other ways if you still don’t pay your council tax bill.

You will need to pay the costs associated with the issue of a liability order, which is around £20.

If you think there is a mistake and want to avoid this, make sure to go to the court and explain your case.

Is a council tax summons a CCJ?

It is not the same as a County Court Judgement (CCJ), and council tax court summons do not lead to a CCJ being issued.

Does it affect credit rating?

If you have received a council tax court summons for not paying your council tax, this will not affect your credit rating

» TAKE ACTION NOW: Fill out the short debt form

Debt Solutions to Try

If you’re struggling with council tax arrears, there are different debt strategies that can help you manage your finances effectively. I’ve put together this quick table that explains each one of them.

| Debt Strategy | How It Can Help With Council Tax Arrears |

|---|---|

| Flexible Payment Arrangements | Local councils often offer the option to spread council tax payments over 12 months instead of the standard 10. |

| One-Off Payment | If feasible, pay council tax in full and potentially negotiate a slightly reduced amount. |

| Hardship Schemes | Council Tax Reduction (CTR) Discretionary Relief Hardship Funds Support for Vulnerable Individuals COVID-19 Specific Support Charitable Grants |

| Discounts and Exemptions | Check for eligibility for discounts (e.g., single-person discount of 25%) or exemptions (e.g., properties unoccupied due to the resident’s death, properties where everyone’s a full-time student, or a resident has severe mental impairment) |

| Deferred Payments | Some councils allow deferring payments wherein you’ll pay less now and make up for it later. |

| Challenge your Council Tax Band | If you believe your property’s council tax band is incorrect, you can challenge it to potentially lower future payments and refund previous overpayments. |

| Debt Solutions | Certain formal debt solutions like Debt Relief Orders (DRO), Bankruptcy, and Individual Voluntary Arrangements (IVA) can potentially write off council tax arrears, |

| Professional Debt Advice | UK residents can seek free advice from debt organizations and charities for council tax guidance tailored to their specific financial situation. |

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Summons process

#1: Letters

If you have not paid what you owe, the local authority will send a reminder asking you to pay within 7 days. If paid, your payments carry on as normal.

A second letter will be sent if you have not paid in full the amount. If you pay within 7 days, you can still carry on paying in instalments.

If a third reminder notice to make a payment has to be sent within the same fiscal year, you lose the right to pay your council tax in instalments. And you can be asked to pay the full amount of municipal tax owed for the rest of that year.

The bottom line? Make a payment as soon as possible or further action will be taken.

Some people cannot afford to pay but they can agree to a payment arrangement to make it more affordable.

And remember, you might be able to claim deductions to your account if you live alone or receive benefits like pension credit, universal credit, employment and support allowance etc.

Or you can claim a reduced amount by challenging the band your property is placed in. it could have been added to the wrong valuation list.

#2: Court summons

The local authority can ask the Magistrates’ Court to consider a liability order if you still don’t cough up, which simply makes you liable to pay.

The summons is issued at least 14 days before the hearing date.

Do I need to go to the court hearing?

You do not need to go to the court hearing if you pay the full amount; the new total amount will be what you originally owe plus costs from the liability order and the Magistrates summons.

Or you won’t have to attend if you make an arrangement to pay. You also don’t need to go to the court if you agree about the amount you owe.

#3: Liability order

Once the liability order is issued, the local authority can enforce the debt recovery in various ways, namely:

- Charging order

- Enforcement officers (bailiffs!)

- Attachment of earnings

- Bankruptcy proceedings

Keep in mind that some councils will have different procedures. Some could even have some extra support available to people with council tax debts.

You should check with your local council to be sure.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Enforcing the liability order

The local authority is most likely to enforce the debt using enforcement officers or the attachment of earnings.

The latter is when the court asks the debtor’s employer to take money from their wages and send it to the court to pay back the debt. The same can be done to DWP income, such as deducting money from your income support or pension credits.

Enforcement officers are also common.

They will try to get the money back in full or offer to make an arrangement where repayments are secured against your valuables, i.e. if you miss a payment your possessions will be taken and sold. If you fail to pay or agree to a payment arrangement, they will come to your home and attempt to seize your goods to pay the debt back.

When this happens they give 7 clear days’ notice.

The added costs when enforcement regents are involved can be eye-watering.

Charging orders and bankruptcy are less common but still possible. Seek advice if you are facing any of these methods to recover your debts.

Can bailiffs force entry for council tax debt?

Enforcement agents cannot force entry to collect local authority tax unless they are seizing goods within a Controlled Goods Agreement (CGA) that you have failed to stick to.

Even then, they can only force entry under certain conditions.

What if you still don’t pay your council tax?

What happens when you avoid enforcement and still haven’t cleared the debt? The local authority can ask the Magistrates’ Court for a further hearing, which you must attend or an arrest warrant may be issued.

The Magistrates will decide if you willfully neglect or reject the debt, and if they agree you do, they can send you to prison for up to 90 days.

Can I Write Off My Council Tax Debts?

You might be able to write off some of your council tax debts with a debt solution.

Even if these debts can’t be covered, getting a debt solution might help you get back in control of your finances enough to pay back the council.

There are several different debt solutions available in the UK, so I recommend speaking to a debt charity as soon as possible. Their advisors will be able to look at your finances in detail and help you work out which debt solution will work best for you.

I have linked a few charities that offer these advisory services for free below.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors.

You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.

If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

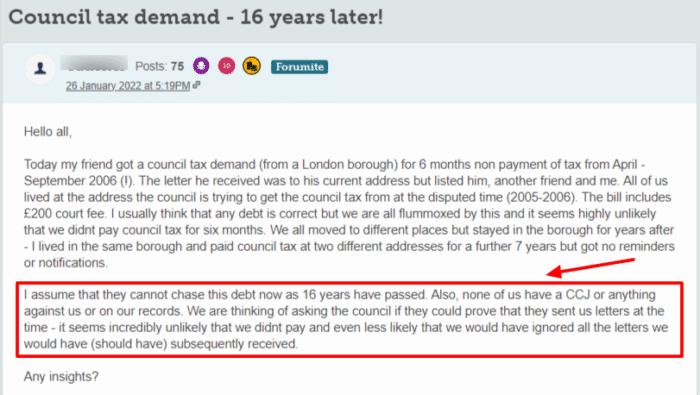

Statute-Barred Debts

If it has been 6 years – or 5 years in Scotland – since you last paid towards your council tax debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

In this example, it is very unlikely that the debt is enforceable!

If you are unsure about the status of your debt, you can contact a debt charity for some advice. Their advisors will be able to look at the debt in question, determine its status, and advise you on your next steps.