Can I Transfer Catalogue Debt to a Credit Card?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you trying to find out if you can move your catalogue debt to a credit card? This guide is here to help. Each month, over 170,000 people visit our site seeking advice on debt solutions.

In this simple guide, we’ll explore:

- The process of transferring catalogue debt to a credit card

- The benefits of this kind of debt transfer

- Other ways to manage or reduce your catalogue debt

- What might happen if you stop paying your catalogue debt

We know it can be worrying if you can’t pay your catalogue debt. It can be hard to know what to do or who to talk to. Citizens Advice says that catalogue shoppers who miss payment deadlines get charged very high fees, sometimes more than twice what they borrowed.1

But remember, you’re not alone. We’re here to help you understand your choices and make the best decision.

How can I transfer it?

Many credit card companies, especially those with 0% interest rates, don’t allow you to transfer catalogue balances directly to a credit card.

However, the interest on cash withdrawals on your credit card may still be less than you are paying on your catalogue.

Read on to find out how you can transfer your catalogue debt onto a credit card.

Balance transfer options

I’ve listed some balance transfer credit cards worth considering here:

- NatWest offers a No fee balance transfer card with a 19-month balance transfer period and a 23.9% representative APR

- Sainsbury Bank’s low balance-transfer fee credit card with long NO fee (some people may pay a 1% fee) with a 14-month balance-transfer period and 23.9% representative APR. (some people could be offered a 12 month deal)

- MBNA No fee balance transfer card with up to 15-month balance transfer period and a 22.9% representative APR

I suggest you seek advice from a debt expert when considering your credit card balance transfer options.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What are the benefits of doing it?

By transferring a catalogue debt to a credit card, you could benefit from a lower interest rate. It’s one of the debt management strategies worth considering.

For example, many catalogues charge up to 40% APR, whilst credit card interest rates are normally much lower. And sometimes 0%.

You could also benefit from fewer monthly payments by consolidating catalogue debt meaning that things are easier to keep track of.

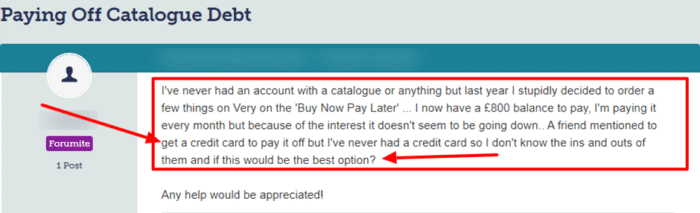

Case Study: Very credit card debt

See this question one person with a catalogue debt asked on a popular online forum.

Source: Moneysavingexpert

If you already have one

If you already have a credit card, you can check what interest rate you are paying on that card. Then compare it to the interest rate being charged by your catalogue company.

If the interest rate on your credit card is lower, you can check with your bank to see if you can use your credit card to pay off your catalogue debt.

If your bank does not allow direct balance transfers from catalogues, you can still check if the interest on cash withdrawals is charged at a lower rate than your catalogue interest rate.

In these cases, you can borrow the money from your credit card and use those funds to pay off the catalogue debt.

In effect, you’re transferring your catalogue debt amount to your credit card.

Applying for a new card

You may want to apply for a credit card to either transfer your catalogue debt or allow you to pay it off.

There are some interesting balance transfer cards which allow you to borrow money at 0%. It could be an option worth considering.

You can use that money to settle the catalogue debt. The added benefit is that you may not have to pay a balance transfer fee.

Even if you can’t get accepted for a 0% card, your catalogue balance may still be better off moved onto a credit card with a lower interest rate, so you save on interest.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Are there any drawbacks to balance transfers?

There are some drawbacks to transferring catalogue debt to a credit card. I’ve listed some of them here:

- Some balance transfers charge a fee

- A low or 0% interest won’t last forever

- It could add to your existing debt

- You may need a good credit score

What happens if I stop paying?

A catalogue company can chase debt in the same way as any company. They take handling catalogue arrears seriously.

It happens if you miss a payment, or can’t make the agreed payment (but still pay less) and signed an agreement to pay certain amounts on specific dates.

If you stop paying your catalogue, or don’t pay the agreed instalment amount, the company will normally first ask you to pay these arrears.

If you can’t pay the arrears, your account will be placed in “default“. Your account is frozen to stop you from purchasing any more goods and therefore adding to the debt.

» TAKE ACTION NOW: Fill out the short debt form

The catalogue company could also add to the debt by charging you penalty fees and administration costs.

Your individual contract with the catalogue company will detail any charges or fees on defaulted accounts within the terms and conditions.

It is a good idea to check your agreement if you cannot afford to pay your monthly instalments, so you are aware of the terms and what costs could be added.

If you can’t pay the arrears, or keep up with your monthly payments, the account will default and further action could be taken against you.

To avoid missing payments and incurring further debt, please take a look at the table below, which contains some common debt solutions you can take advantage of.

| Debt Solution | Description | Formality | Debt Type | Debt Range | Legally Binding | Impact on Credit Score | Asset Risk | Monthly Payment | Duration | Creditor Agreement Required |

|---|---|---|---|---|---|---|---|---|---|---|

| Debt Management Plan (DMP) | Agreement to pay back non-priority debts in one monthly payment. | Informal | Non-priority debts | Any amount |

No | Yes | No | Varies | Varies (until debt is paid) | No (but creditors must be informed) |

| Individual Voluntary Arrangement (IVA) | Agreement to pay back all or part of your debts over a set period. | Formal | All or part of debts | Usually over £10,000 | Yes | Yes | Possible | Fixed | Fixed period, usually 5-6 years | Yes (75% by debt value must agree) |

| Debt Relief Order (DRO) | Freezes debt for a year and be potentially written off. | Formal | Non-priority debts | <£20,000 debt | Yes | Yes | No | None during freeze | 12 months | No (court approval needed) |

| Bankruptcy | Legal status for those who cannot repay debts, potentially writes off debts. | Formal | Unmanageable debts | Any amount, typically high debt | Yes | Yes | High | None during bankruptcy | Usually 12 months, then discharge | No (court process) |

| Consolidation Loan | Taking out a new loan to pay off all existing debts. | – | Multiple debts | Based on loan amount | Varies | Yes | Depends on loan type | Fixed | Depends on loan terms | No |

| Payment Holiday | Temporary relief or reduced payments offered by creditors. | – |

short-term financial difficulties | Any | No | Yes | Low | Reduced or paused payments | Break of up to 6 or 12 months, depending on circumstances, payment history, and creditor’s policy. | No |

| Informal Negotiation | Direct negotiation with creditors for reduced payments or extended terms. | – | All debts | Any | No | Possible | No | Negotiable | Until agreement terms are met | No |

| Statutory Debt Repayment Plan (SDRP) | Plan to repay debts over a reasonable time, with protections from creditor action. | Formal | All debts | Varies | Yes | Yes | No | Fixed | Varies, based on ability to pay | Yes |

| Equity Release | Homeowners release equity from their home to pay off debts. | – |

Debts of homeowners, typically older individuals aged 55+ | Varies and depends on property value | Yes | Yes | Asset (home) is used as collateral | Varies | 8-10 weeks timeframe from application to fund disbursement. Lifetime; repaid on house sale/death. | No |

Common myths debunked

I’ve listed some myths about being in debt here:

- I’ll be blacklisted for missed payments – NOT NECESSARILY TRUE

- I could go to prison for my debts – NOT NECESSARILY TRUE – depends on the type of debt

- My water or energy supply gets cut off when I don’t pay – NOT NECESSARILY TRUE – water can’t be cut off

- All Buy Now Pay Later (BNPL) plans are the same – NOT TRUE

- If I get married, my partner’s debts become mine too – NOT NECESSARILY TRUE

- You have to pay for debt advice – NOT TRUE

- If someone who lived at my address had debts, it’ll affect me as well – NOT TRUE

- Creditors can send bailiffs to my house to recover payments – NOT TRUE

References

- Citizens Advice – Catalogue customers hit hard for missing interest free deadlines