Can I Get a Black Horse Finance Payment Holiday?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you wondering if you can get a Black Horse Finance Payment Holiday?

You’ve come to the right place for answers. Each month, more than 170,000 people visit our website seeking advice on tricky debt issues.

Here’s what we’ll cover:

- What a Black Horse Finance payment holiday is

- How to get a car finance payment holiday

- Legal aspects of a Black Horse payment holiday

- What happens if you miss a payment with Black Horse

- How to change your Black Horse payment date

While making car finance payments can be a big worry, it’s common to feel unsure about seeking help. In fact, Citizens Advice revealed that 60% of adults facing financial difficulties hesitate to seek assistance.1

But you’re not alone; we’re here to help you determine how to handle your Black Horse Finance deal in a way that makes sense for you.

Can I get a payment holiday granted?

Black Horse might grant you a payment holiday if you’re struggling to meet the payment arrangement temporarily.

For example, if you are switching jobs and there is a period where your household income has been significantly reduced.

To find out the different ways Black Horse can support customers with managing financial stress, you should log in to your Black Horse account online. From here, go to the Help Centre and click on the “Money Worries” tab.

You’ll then be confronted with a series of questions. I recommend answering these truthfully to help Black Horse determine the ways they can help you.

Budget Advice

If you’re struggling with debt, there are certain actions that can help you lower your expenses and avoid the stress that comes with missed payments.

This table provides ten budgeting tips:

| Budgeting Advice | How You Can Lower Your Expenses |

|---|---|

| Arrange a Debt Repayment Plan | To negotiate, contact your creditors via phone, email, or letter to explain your financial situation, and offer to pay an amount you can afford. |

| Save on Utility Bills | Compare energy providers to find a cheaper deal. Use energy-efficient appliances. Reduce water usage with low-flow fixtures. |

| Save on Groceries | Shop with a list to avoid impulse buys. Buy store brands instead of name brands. Look for sales and use coupons. |

| Cut Back on Non-Essentials | This includes dining out, entertainment, subscriptions, and luxury items. Look for free or low-cost entertainment options and cook meals at home. |

| Transportation Costs | If possible, use public transportation, carpool, or consider biking to work. If you own a car, maintain it regularly to avoid costly repairs. |

| Negotiate Bills | Contact service providers (like phone, internet, and cable) to negotiate a lower rate or switch to a cheaper plan. |

| Consolidate Debts | If you have multiple debts, consider a debt consolidation loan or a balance transfer credit card (with caution) to lower interest rates. |

| Sell a Financed Car | When you sell a financed vehicle, the proceeds can be used to pay off the remaining loan balance. |

| Use Cash Instead of Credit | To avoid accumulating more debt, use cash or a debit card for your purchases. |

| Seek Professional Advice | If you’re struggling, consider contacting a debt advice service like StepChange or National Debtline. They offer free, confidential advice. |

Legal Aspects of a Black Horse Payment Holiday

A payment holiday might sound exactly what you need, and for many people, it can be very useful.

However, a payment holiday can affect your credit score and how lenders perceive you in the future.

It’s also worth checking your terms and conditions or any legal considerations to see the consequences of a payment holiday with Black Horse.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

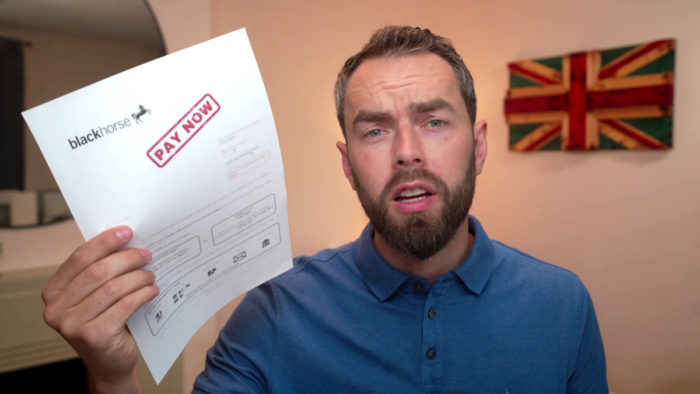

What happens if you miss a payment?

If you miss a payment to Black Horse Finance, they will charge you late payment fees.

These fees are explained in a letter they will send and can also be found in your vehicle financing agreement.

Within the letter sent by Black Horse, they will explain your options and encourage communication if you’re having financial problems.

» TAKE ACTION NOW: Fill out the short debt form

Can I change my payment date?

You can change your Black Horse Finance payment date.

To do this, you need to log into your online customer account and select “change payment date” from the menu. Follow the instructions to change the date your payment is taken.

This may stop you from needing a Black Horse car finance payment holiday!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can I give my car back to them?

You can voluntarily terminate a Black Horse finance agreement by returning the vehicle.

However, you can only do this once you’ve paid at least 50% of the total credit agreement’s value, which includes capital, interest and other fees.

Check Black Horse’s vehicle return policy for the terms and conditions.

Black Horse Finance Contact Details

| Website: | https://www.blackhorse.co.uk/ |

| Phone number: | 0344 824 8888 |

| Hours of operation: | Monday to Friday 8:30am – 6:00pm Saturday: 9:00am – 1:00pm |

| Contact by mail: | Black Horse Finance Customer Services St William House, Cardiff, CF10 5BH |

Learn about your car finance rights with MoneyNerd!

Head to our debt info page to learn more about car financing agreement rights and other ways to solve financial insecurity.