Can I Get a Secured Loan without My Husband Knowing?

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Secured loans can be a tricky topic. The PwC’s UK Consumer Credit Confidence report states that about 80% of UK household debt is property-secured.1 You may be asking, ‘Can I get a secured loan without my husband knowing?’ The short answer is, if your husband is a registered owner of the property you plan to use as security, you can’t take out a secured loan without him knowing.

But don’t worry, there are other options. Each month, over 6,900 people visit our site seeking advice on secured loans, so rest assured, you’re not alone.

In this simple guide, we’ll cover:

- What a secured loan is.

- The true cost of a bad secured loan.

- The credit score needed for a secured loan.

- What happens when you apply for a secured loan.

- Options for loans without your husband’s knowledge.

Maybe you’re worried about the potential consequences of a secured loan, or perhaps you’re dealing with debt. We understand these concerns, and we’re here to give you the information you need to make the best decision for your situation.

Can I get one without letting my spouse know?

Unless your husband isn’t a registered owner of the property being used as collateral, it’s not possible to take out a secured loan without him knowing.

This is because the owner of the property will be required to sign the paperwork included in the loan application.

If they aren’t on the deeds of the property, it would be possible to take out a secured loan against the property without making him aware.

However, some lenders need to send surveyors to the property to value the home to work out its current market value. This could be noticed by your partner. Not all lenders need to do this. Some can calculate the value of the property with accuracy using sophisticated technologies.

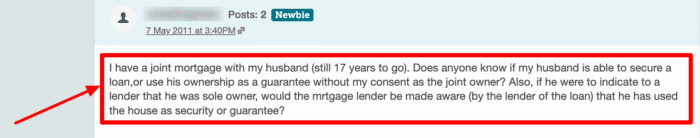

This forum user on MoneySavingExpert wants to know if her husband is able to take out a secured loan against their property without her knowing or giving her consent.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.69% |

£218.21 |

£26,185.42 |

| Equifinance | 6.2% |

£219.10 |

£26,291.67 |

| Selina | 6.34% |

£219.34 |

£26,320.83 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 7.4% |

£221.18 |

£26,541.67 |

| Norton | 9.05% |

£224.05 |

£26,885.42 |

| Masthaven | 9.65% |

£225.09 |

£27,010.42 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

Case Study

There are many different types of secured loans out there. To help you better understand how secured loans work and the process they typically follow, here’s a quick case study.

| Category | Details |

|---|---|

| Background |

Borrower: John, a homeowner in the UK. Financial Situation: Stable income, owns a home, needs additional funds for home renovation. Loan Requirement: £20,000. |

| Loan Process |

Application: John applies for a secured loan from a bank or a financial institution. Property Valuation: The lender assesses the value of John’s home to determine how much they can lend. Credit Check: The lender conducts a credit check to assess John’s creditworthiness and repayment history. Loan Offer: Based on the valuation and credit check, the lender offers John a loan of £20,000 with a specific interest rate. |

| Loan Terms |

Amount: £20,000. Interest Rate: Variable or fixed, depending on the agreement, say 5%. Repayment Period: 10 years. Monthly Repayment: Depends on the interest rate and term, but let’s assume £212 per month. Total Repayable Amount: £25,440 (£20,000 principal + £5,440 interest). |

| Benefits | Lower interest rates compared to unsecured loans due to collateral. Longer repayment periods. Larger loan amounts can be borrowed. Loan used for home renovation. |

| Risks | John’s home is at risk if he fails to make repayments. Potential for negative equity if the property value decreases. Early repayment charges may apply if the loan is paid off early. |

| Outcome |

Loan Repayment: John successfully repays the loan over the 10-year period. Impact on Credit Score: Positive, as John made regular payments. Property Value: An increase in home value due to renovations and market conditions. |

Will he find out if I take out a loan?

It’s possible to take out a loan without your partner knowing. However, it’s impossible to secretly take out a secured loan against an asset you have joint ownership in.

If you want to access credit without your husband knowing, you would need to take out an unsecured loan or credit card in your name only. To prevent him from finding out about the loan, you would need to instruct the lender to take payments from a personal bank account rather than a joint bank account.

However, hiding money issues from loved ones may not be the best course of action. Hiding financial decisions can lead to broken trust, which can be challenging to rebuild. You may want to get money advice before proceeding with a “secret loan” by speaking with a UK debt charity or Citizens Advice.

There are lots of ways of dealing with money problems that you might not be aware of – in my experience, a loan isn’t always the best solution.

If you find yourself in a challenging financial situation, you could consider seeking financial counselling from UK-based charities such as StepChange or National Debtline, which offer free debt advice.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

Can one person take it out on a joint account?

It’s unlikely that you will be able to take out a loan by yourself and have monthly repayments come out of a joint bank account. It all depends on what type of payments are being processed.

Direct debit payments that automatically come out of a joint account need to be approved by all account holders. So, to do this, the other person would need to approve the direct debit instruction.

However, recurring card payments can be made on one of the personal bank cards associated with the joint account, and these only need to be approved by the individual cardholder.

In either case, the other person will be able to see the payments to the lender leave the account each month on their bank statements.

Secured loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking to fund a home improvement project?

- Dreaming of finally taking the once-in-a-lifetime trip?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

What happens when you apply?

When you apply for a secured loan, you must fill in all your personal details and prove a number of things, including:

- Prove your identity

- Prove your income

- Prove your address

- Prove ownership of the asset, which is usually your property

- Prove the amount of equity you have in the property

The lender can take between two and six weeks to reach a decision on your secured loan application.

The true cost of a bad secured loan

Think about this.

If you get a £30,000 secured loan at 4% on a 15 year term, it’ll cost you £221 per month to pay back. That exact same loan at 5% is about £18 per month more expensive. Not a big deal right?

Well that’s a full £2,916 more expensive over the entire term.

Fill out the short form below to access the best secured loan rates available from the UK’s leading lenders.