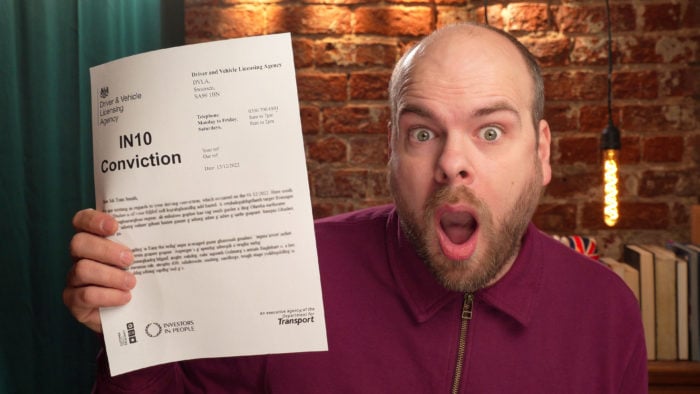

Affordable Car Insurance with IN10 Conviction for you

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

Are you searching for affordable car insurance after an IN10 conviction? You’re not alone! Every month, more than 9,300 people visit our website for guidance on this exact issue.

In this handy guide, we’ll cover:

- The meaning of an IN10 conviction.

- How an IN10 conviction can affect your car insurance.

- Affordable ways to get car insurance with an IN10 conviction for you.

- The importance of telling your insurance firm about your conviction.

Did you know that according to Unlock, insurers can legally adjust prices based on perceived risk, potentially making insurance seem unattainable with a conviction? 1

We know this can be worrying, but we believe in giving clear and useful advice to support you during this challenging time. Together, we can find a solution that works for you.

What is an IN10 Conviction?

If you are found driving or leaving your vehicle parked on the road without insurance, you will receive a notice called an IN10 conviction.

An IN10 conviction does not qualify as a recordable offence. Thus, it won’t appear on your criminal history.

Despite this, it carries severe penalties and may raise the cost of your car insurance since you must disclose any convictions to your insurer before purchasing a policy.

Also, you may have difficulty finding a cover if you’re under 25 and have an IN10 conviction.

It is common for IN10 drivers to drive “unintentionally” without valid insurance.

In fact, due to miscommunication with their insurance provider, many of those found guilty were unaware they were uninsured.

For instance, they might have skipped a payment resulting in the cancellation of their policy, or they might have provided incorrect information on their insurance policy.

If you have been driving while carrying the wrong type of insurance, you may receive an IN10 conviction.

For example, if you’re driving for work purposes on a social/domestic policy. This is why, when getting car insurance, you should always ensure you have the right level of coverage.

Reasons for Getting One

Not all drivers with an IN10 conviction do it on purpose. Several circumstances that might lead to you committing an IN10 offence include:

- Choosing the wrong type of policy

- withholding critical information about yourself or your vehicle from the insurance company

- forgetting to update a policy on time

- Undisclosed car modifications: You might not be aware that you must inform an insurance company of certain changes. Also, you must be mindful of alterations made by the previous owner.

- Erroneously assuming that driving other’s cars is covered by your insurance.

Penalties for driving without insurance

| Conviction code | IN10 |

| Motoring Offence | Using a vehicle without insurance against third-party risks |

| Penalty points | 6-8 points |

| Duration conviction stays on Licence | 4 years from the date of offence |

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

Insurance for Convicted Drivers

With an IN10 conviction, you can still get car insurance, but it might time to get a good offer.

Five years of expensive insurance rates are a severe consequence of driving without insurance.

Most insurance companies will raise your rate if they give you a quote since they see you as a high-risk insurance policy.

It is important to note that you must disclose any convictions you have when applying for car insurance; otherwise, you will be breaking the law and may be subject to higher fines.

Additionally, it would void your insurance. If the police pull you over, you will be issued a driving ban, making it difficult for you to get insurance companies willing to insure you in the future.

» TAKE ACTION NOW: Find the best insurance for drivers with points

Insurance Reduction

I understand how frustrating it can be to face high insurance costs due to a mistake. Luckily, there are different things you can try to reduce insurance rates.

| How to Reduce Insurance Rates | Keep in Mind… |

|---|---|

| Choose Your Car Wisely | Consider age, engine, insurance group & price. The lower the group, the lower the premium. A high-powered & fast car, or cheap car with less value come with a higher risk, which means a higher premium. |

| Ensure Car Safety & Security | Park in a driveway or locked garage. Use safety technology. |

| Add a Named Driver | Adding an experienced driver with a good claims history, such as a parent, can lower your insurance premium by reducing the perceived risk. |

| Drive Fewer Miles | Reduced mileage = Reduced risk. |

| Complete a Rehabilitation Course |

Third-Party Only – the bare minimum; as required by law Comprehensive – provides full coverage and may include personal accident and medical expenses coverage Third Party, Fire & Theft – TPO cover and also insures against damage to other vehicles and injuries to others in accidents where you’re at fault, accidental fires or arson, stolen vehicles |

| Determine the Cover Level You Need |

Third-Party Only – the bare minimum; as required by law. Comprehensive – provides full coverage and may include personal accident and medical expenses coverage. Third Party, Fire & Theft – TPO cover and also insures against damage to other vehicles and injuries to others in accidents where you’re at fault, accidental fires or arson, stolen vehicles. |

| Compare Policies and Opt Out of Extras | Get quotes tailored to your specific convictions and needs. Optional extras like excess protection, legal cover, breakdown, windscreen, and gadget cover are nice to have but come with added costs. |

| Increase Your Excess | Raising the amount of excess (upfront payment for any claim; the rest to be paid by the insurer) on your policy can lower your insurance premium. |

Where to Get Affordable Insurance

Getting car insurance after an IN10 conviction is not easy; you might have to pay huge insurance premiums.

Here are a few UK insurance companies that offer reduced premiums to drivers with an IN10 conviction:

Admiral is one of the top insurance companies in the UK because of its wide range of insurance services.

For IN10 convicted drivers seeking telematics coverage or a comprehensive policy, Admiral offers premium insurance at exceptionally affordable prices. They charge around £1712.48 per annum.

Diamond offers the option of a named or low-risk driver, making it a good choice for IN10 convicted drivers looking for affordable premium rates. Diamond offers premium insurance services at £1794.44 to convicted drivers.

Tesco offers fully comprehensive car policies and black box insurance, making it another option for an IN10 convicted driver. It also provides a cover for legal processes.

Tesco offers premium insurance services at £1209.05 every year.

These are just a few insurance companies that provide affordable premiums to IN10 convicted drivers. It is in your best interest to look at other options and make the best decision.

Find better convicted driver insurance deals for you

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

How do I get the Most Affordable Insurance?

Any conviction may impact how much your car insurance will cost.

So, you need to look around for the lowest price. However, making certain adjustments may help in getting lower insurance premiums.

Here are a few ideas you might want to consider:

- If you have a conviction, enrolling in an advanced driving course may help certain insurers view you as a lower risk.

- Avoiding car modifications: If your vehicle is modified, your insurance premiums may increase.

- Limiting your annual mileage: An insurer will be more inclined to cover you if you travel fewer miles yearly because you pose less risk to them.

- Obtaining black box insurance coverage that monitors your driving can offer you lower rates if you drive safely.

- Increasing your voluntary excess is a good idea: usually, it ranges between £100-£500. The mandatory excess cannot be changed; however, you can alter the voluntary amount.

- Changing your vehicle. A vehicle with better security may cost less to insure.

How long does an IN10 conviction affect my car insurance?

If you are found guilty of driving without insurance, the IN10 conviction will remain on your driving record for four years; nevertheless, you must tell your insurance company about the conviction.

Is N10 a Criminal Offence?

You won’t go to jail for IN10 because it isn’t a crime. Driving without insurance is still a serious traffic offence, increasing your risk to insurers. As a result, whenever you request an insurance quote, you should always be honest about any convictions.

What is the maximum fine for driving without insurance?

A police officer can apprehend you and issue you a maximum of £300 fine or take your car. You might be subject to high fines or be disqualified if your case goes to court.