How Does a Revoked Licence Affect Insurance?

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

Are you wondering how a revoked licence might change your car insurance costs in the UK? You’ve come to the right place for answers. Every month, thousands of people seek advice on this exact issue.

We’ll help you understand:

- How losing your licence might happen.

- The difference between a driving ban and a revoked licence.

- How getting your licence back could change your car insurance.

- How to find a good deal on insurance even after a licence issue.

- The importance of telling your insurer about your licence history.

Did you know that according to Unlock, insurers can legally adjust prices based on perceived risk, potentially making insurance seem unattainable with a conviction? 1

I know this sounds concerning, but don’t worry. With the right tips and advice, you can still find good car insurance. We’re here to guide you through it.

Why Might Your Licence Be Revoked?

There are many reasons why the Driver Vehicle and Licensing Authority (DVLA) might revoke or suspend your licence. Below, you will find a list of the most common reasons.

- Your licence was obtained based on fraudulent information.

- You let somebody else use your licence.

- When you applied for your licence, you misrepresented your qualifications.

- A currently unspent driving conviction puts you into the automatic refusal category of driver.

- You are not a resident of the UK for work purposes.

- You breach the conditions of the licence in some way.

- You fail to undertake all training that the DVLA has instructed you to.

- Other ad-hoc reasons, that fall under the consider additional factors category.

- The DLVA simply doesn’t believe you are a suitable individual to have a licence for some reason.

Is a Revoked License the Same as a Driving Ban?

In general, no. A revoked or suspended licence isn’t the same as receiving a driving ban.

Either a ban for being convicted of a driving offence or a ban as a result of accrued penalty points.

But there could be a conviction tied to the revoked licence.

For example, if you obtained your licence using a fake identity, or even refused to give a blood sample when asked, you might be prosecuted and summarily convicted for this fraud.

Is a Revoked Licence Always the Result of a Driving Conviction?

No, it isn’t always a driving conviction associated with the reason that your license is revoked.

In general, a driving conviction would result in you being disqualified from driving. Not in your licence being revoked.

And of course, car insurance for disqualified or convicted drivers is going to be more expensive.

But as they say, the law is an ass, and the situation can be a little grey here.

It is not unknown for a driving conviction to result in your licence being revoked as well. A good example here, is if you are convicted for driving without wearing eyesight correctional aids if you need them.

The fact you have to wear glasses is recorded on your licence.

If you are caught driving without glasses or contact lenses, you may be convicted. However, if there is some question about whether your eyesight is good enough to drive even with your current correctional aids, your licence might be revoked for medical reasons.

Until such time as you can prove that your eyesight once corrected, is fine for driving.

Convicted Driver Insurance Increase

Understanding how points on your license affect insurance costs is essential, as each point can lead to increased expenses.

To see the direct impact, check out our table below.

| Points on License | Estimated Average Rate Increase |

|---|---|

| 1 – 3 Points : This range usually covers minor offenses. Insurance rates may increase but not excessively. | 5% – 20% |

| 4 – 6 Points : This range might indicate repeat offenses or a more serious violation. Insurance premiums are likely to rise more significantly. | 20% – 40% |

| 7 – 9 Points : At this level, the driver is considered high-risk. This can lead to substantial rate increases. | 40% – 60% |

| 10 – 12 Points : Accumulating this many points might lead to a driving ban. If insurance is offered, it would likely be at a very high rate. | 60% – 100%+ |

When You Get Your Licence Back, Will It Be Harder To Get Insurance?

This is an important question.

There are two possible answers here, as much depends on your own circumstances, and whether insurance firms will now see you as a high-risk driver.

- Your licence was revoked for honest reasons. For example, a current health problem means that you are unfit to drive, and your licence has been revoked until you are. In this case, depending on the health issue, insurers may see you as a slightly higher risk.

- Your licence was revoked for more nefarious reasons. For example, you obtained it by providing false information. In this case, you have shown yourself to be untrustworthy, and you would be seen as a higher risk by insurers.

» TAKE ACTION NOW: Find the best insurance for drivers with points

An important factor here is whether you had to take a retest or not before you got your licence back.

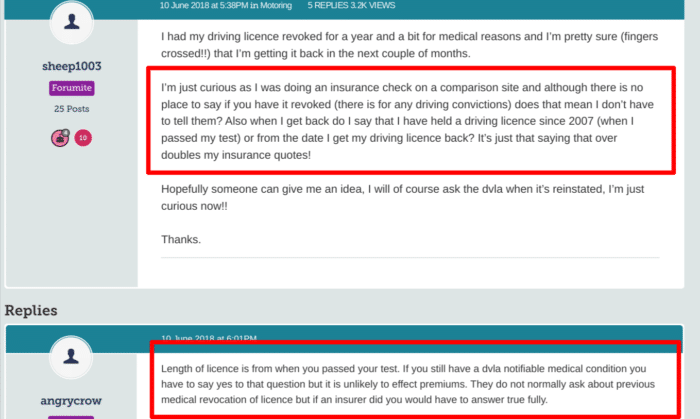

When an insurer asks you how long you have held a full licence, this runs from the date you last took a test. If you had to retest, then this is going to mean your insurance cost will be higher.

Will You Have To Pay More for Insurance After You Get Your Licence Back?

The answer to this question is tied to the ones given in the previous section. Much depends on your own circumstances.

Let’s go over a hypothetical situation here. Let’s say that you received a fixed penalty notice for speeding.

Part of the process of dealing with a fixed penalty notice, is turning your licence in for it to be updated with penalty points.

Now let’s say that whilst your licence is being updated, it is noted that there is some kind of problem with it, possibly something entirely innocent such as you now wear glasses and didn’t when you passed your test.

This could result in your licence being revoked.

In this case, you would probably need to retest with corrected eyesight before your licence is returned to you, and this would definitely impact the cost of your insurance.

So, in short, having your licence revoked shouldn’t impact the cost of your insurance very much.

Unless there are extenuating circumstances, such as having to take a retest, or you are subsequently convicted of a driving offence after your licence was revoked.

Find better convicted driver insurance deals for you

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

Shop Around

It will always pay to shop around and get affordable vehicle insurance quote.

How much you pay after a drink driving ban, for example, depends on how the insurer calculates risk, and this does differ between insurers.

Other factors like failing to supply a specimen for analysis will also affect your insurance quote.

Don’t Forget To Try Comparison Sites

Comparison sites will take your driver details, and query a whole bank of different insurers, then return the results to you in a simple-to-understand format.