Arrangement to Pay on Credit File – Why and How to Remove?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

An arrangement to pay on your credit file represents a negotiated repayment agreement with a creditor and, unfortunately, cannot be directly removed. However, you do have some options.

We know having an ‘arrangement to pay’ on your credit file can be worrying, but you’re not alone. Every month, over 170,000 people seek our advice on debt solutions.

In this friendly guide, we’ll explain:

- The meaning of an ‘arrangement to pay’ on your credit file.

- How it appears and affects your credit score.

- The length of its stay on your credit file.

- Its impact on getting a mortgage.

- Ways to remove an ‘arrangement to pay’ from your credit file.

Navigating financial difficulties can be challenging, and it’s common to feel unsure about seeking help. In fact, Citizens Advice revealed that 60% of adults facing financial difficulties hesitate to seek assistance.1

If that’s your case, don’t worry — you’re not alone. We’ll guide you through your choices and help you find a solution that suits your situation.

What is an arrangement to pay?

An arrangement to pay is a debt management solution agreed upon with a creditor when you cannot afford to pay back credit as per the original terms and conditions.

It allows you to pay less back than you expected, possibly with interest frozen.

For example, you might be temporarily off work and cannot afford your monthly loan repayments. So you call your loan provider and spend some time negotiating lower repayments for a fixed period to help you over a difficult period.

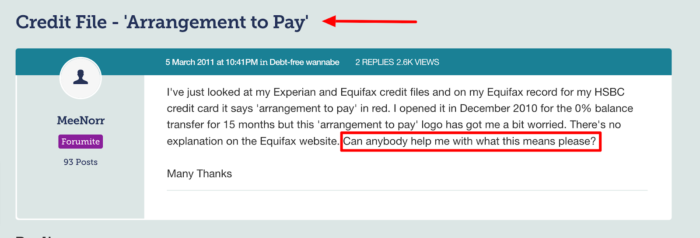

Source: https://forums.moneysavingexpert.com/discussion/3093888/credit-file-arrangement-to-pay

This stops you from missing payments altogether and could stop you from being hit with missed payment fees. But the loan provider will extend the repayment period, so it still gets back what is owed.

Why does a negotiation to repay agreement appear on your credit file?

The arrangement to pay is added to your credit file by the lender with which you’ve agreed.

This shows any other party that you are repaying a debt in a way that wasn’t originally agreed.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What does that mean on your credit report?

An arrangement to pay on a credit report means you can pay a debt with a creditor in a way other than originally agreed.

It is indicated with an “AR” marker on your credit report.

Will it affect your credit score?

An arrangement to pay will likely decrease your credit score.

This is because you’ve been unable to honour debt repayments as initially agreed, which may indicate that you haven’t managed your money as well as you should have.

Of course, this might not be the case. You could be a victim of unfortunate circumstances preventing you from repaying as originally agreed, such as being off work sick or unexpectedly losing your job.

And let’s not forget simply missing payments is much worse for your credit score, so an arrangement to pay can be a wise decision.

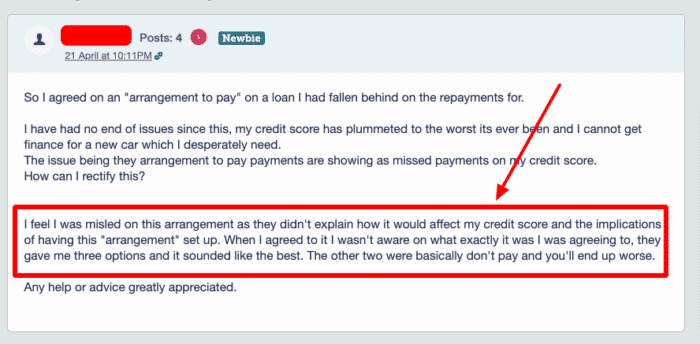

It is important to remember it stays on your credit file – it can come as a nasty shock to many people, as the below forum user found out!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How long does an arrangement to pay stay on your credit file?

An arrangement to pay will remain on your credit report for six years.

After six years, the arrangement to pay will be automatically removed along with your payment history. You won’t need to do anything.

Will a renegotiated payment agreement stop you from getting a mortgage?

An arrangement to pay can make it slightly more difficult to get a mortgage.

An ongoing arrangement to pay will reduce your borrowing power (compared to if you have already repaid your debt).

» TAKE ACTION NOW: Fill out the short debt form

Some creditors view an arrangement to pay as positive action you took to avoid a bigger debt problem and be responsible for financial management. Thus, these arrangements can be seen positively, even if they’re not ideal.

However, many people manage to get mortgage approval with an arrangement to pay on their report, especially if the arrangement to pay occurred many years ago and/or the debt has now been repaid.

How to remove the record on your credit file

You cannot remove an arrangement to pay from your credit file, but your credit report will show that you have managed to repay the debt because the arrangement will have stopped without any default recorded.

By repaying the debt, your credit report will look better and should affect you less.