Bank Accounts that Accept IVA Customers

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you trying to manage your money during or after an Individual Voluntary Arrangement (IVA)? If your answer is yes, this guide is for you.

We’re going to talk about bank accounts that welcome IVA customers. It’s a topic many people want to know more about. In fact, over 170,000 people visit our website each month for help with debt solutions.

In this guide, we’ll cover:

- Choosing a new bank account before starting an IVA

- What happens if your bank freezes or closes your account

- How to write off some debt

- The things you need to know before opening a new account

Navigating financial difficulties can be challenging, and it’s common to feel unsure about seeking help. In fact, Citizens Advice revealed that 60% of adults facing financial difficulties hesitate to seek assistance.1

If that’s your case, don’t worry — you’re not alone. We’re here to support you every step of the way.

Why Should I Get a New Bank Account Before Entering an Individual Voluntary Arrangement?

There are mainly two reasons why getting a new basic account set up before entering an IVA is a very good idea. Let’s take a look at some of the IVA and banking implications.

Your Bank May Freeze or Close Your Account

If you owe any kind of debt to your bank, such as an overdraft, credit card or loan, and you enter into an IVA, there’s a chance they may freeze your account.

Remember that when you enter an IVA, your name enters the Individual Insolvency Register. Banks closely monitor this; if your name shows up, they’ll know you’ve entered an IVA.

If your bank account gets frozen, you won’t be able to access your cash. This would be extremely troublesome as you may need it for essential expenses and bills.

If you have a credit balance in your bank account, it could also be frozen.

The bank will protect this cash if they need to hand it over to your Insolvency Practitioner. An Insolvency Practitioner (IP) plays a crucial role in an IVA. They will work with you to create a proposal to your creditors, administer the IVA and ensure payments are distributed among your creditors.

Your IP can also provide advice on managing your finances during an IVA, addressing important questions such as what happens to your IVA if you lose your job.

You can talk to your IP and ask them to persuade the bank to unfreeze your account. While this is possible, it’s not always immediate, and you could be inconvenienced for many days or weeks.

Your bank could also opt to close down your current account entirely.

This could happen if you owe them money. You’ll be heavily inconvenienced if they close your account. A new one would take a lot of time to get set up, and your IVA would also make it difficult to set one up.

While sorting out your debts, you don’t want to worry about your IVA and bank account closure. Hence, I suggest you open a new basic account with a bank you don’t owe any money. Even if you don’t have any credit agreements, I suggest you set up a new basic account.

» TAKE ACTION NOW: Fill out the short debt form

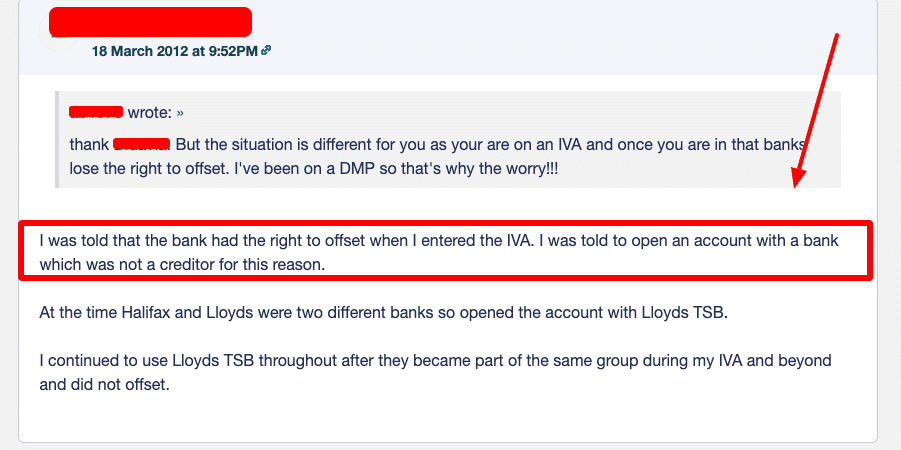

Your Bank can “Set-Off” Your Money

“Setting-off” of money refers to a bank transferring money from one account to repay another.

For example, suppose you have a current account with a certain bank and a loan with them. Suppose you’ve just decided to enter an IVA, and while setting up this IVA, you cease making payments towards your bank loan.

In this case, your bank may transfer money from your current account into your loan account to pay off your loan.

As you can probably imagine, this can be extremely inconvenient and troublesome. You may need that cash for important bills and expenses.

This practice may seem unfair, but it’s legal under guidelines authorised and regulated by the Financial Conduct Authority.

The best way to avoid “set-off” is to set up a basic account in a different bank to which you don’t owe any money. Be sure to do this before you enter into your IVA.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Is There Anything I Should Know Before Opening a New Basic Account for My IVA?

There’s not much you need to know, as setting up a bank account has been made very simple and convenient in recent years. Most banks give you the option of completely setting up your account online.

All you have to do is pass an electronic ID check, and you can set it up for most banks.

If you opt for an account with a bank that requires you to visit one of their branches, be cautious of staff trying to sell you upgraded accounts. Not only do these accounts usually have a monthly fee, but they may also get frozen or closed once you enter into an IVA.

Once your account is open, transfer all your money from your old account into this one. This will ensure you don’t lose anything if your old account gets frozen or closed.

Here are some tips for managing your bank account while you’re in an IVA:

- Keep track of your income and expenses. This will help you stick to your budget.

- Make sure all your income is going into your new basic account.

- Regularly check your account to spot any mistakes or irregularities.

» TAKE ACTION NOW: Fill out the short debt form

IVA Breakdown

Understanding the basics of an Individual Voluntary Arrangement (IVA) is essential for anyone navigating financial decisions.

To provide clarity on this important solution, I’ve put together a table outlining key IVA elements.

If you want to learn more about IVA and its benefits, be sure to read our specialized guide.

How Do I Choose My New Bank?

You can easily choose a new bank account by identifying which bank you don’t owe any money to and where you have no open credit facilities.

Then, you can go to their website and look for details regarding their basic bank accounts.

A basic account may seem unattractive, but it will give you everything you need to navigate an Individual Voluntary Arrangement.

Basic bank accounts usually come with a debit card and online and mobile banking access.

You can arrange standing orders and direct debits to pay utility and household bills, which is important for managing finances during an IVA.

Always check the fine print to get information regarding your eligibility. Some banks don’t allow people with IVAs to have bank accounts.

Ensure this isn’t the case so yours doesn’t get frozen or closed when you enter an IVA.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Which Bank Should I Go for?

Although basic bank accounts may lack some of the benefits of regular accounts, they offer a range of features that will help you manage your money during your IVA.

They allow you to receive money (like wages or benefits), pay bills and expenses, and provide online or telephone banking access. These accounts generally do not have an overdraft facility, which can be beneficial in helping to manage spending.

Here are some great options that you can consider for opening basic bank accounts:

- The FlexBasic account of the Nationwide Building Society.

- The Basic Current Account of Barclays Bank.

- The Cashminder account of the Co-operative Bank.

- The Cash account of Metro Bank.

These options include a debit card to withdraw cash and accept Automated Credit Transfer (ACT) payments.

They also don’t have fees for failed payments, and all of them let you set up direct debits and standing orders.

Most can be set up online except for the Co-operative and Metro Bank.

The Co-operative Bank offers the option of setting it up via post or visiting a branch. Metro Bank only lets you set up an account by visiting a branch.

As with anything, I recommend you research the best banks for IVA customers before committing to anything.