Best Cheap Residential Park Home Finance Companies in the UK

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

If you’re thinking about buying a park home but aren’t sure how to pay for it, you’re in the right place. Every month, over 6,900 people visit our website seeking advice on loans, which is not surprising, as in the UK, early repayment fees for secured loans have more than doubled since the start of the decade, peaking in 2018.1

We know that finding the right finance for a park home can be a bit tricky. There are rules about selling park homes that are different from other houses. And you might be worried about the real cost of a bad loan. But don’t worry, we’re here to help.

In this easy guide, we’re going to tell you about:

- What a park home is.

- Why park homes cost less than other homes.

- How you can find the right park home for you.

- The different ways you can pay for a park home.

- How to find the best and cheapest park home finance.

Remember, you’re not alone – lots of people need advice on buying a park home. We’re here to give you clear and simple tips.

So, let’s learn about park home finance together.

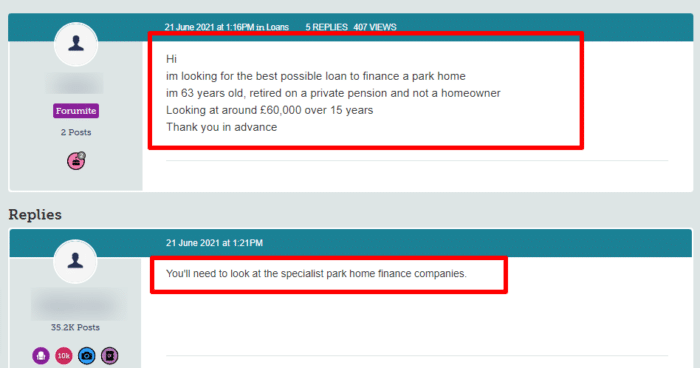

Is It Possible To Get Finance for a Park Home?

It is possible to get financing for a park home. Many lenders offer park home loans, secured loans, or mortgages designed explicitly for park homes. However, the ideal option depends on your financial circumstances and whether you own a home.

What Options Are There Available To Finance the Purchase of a Park Home?

If you are looking at park home finance, and trying to find the cheapest, best option, you need to know what kinds of finance might be available. I have listed some of the most common options below.

- The purchase of a park home can be financed with a personal loan from a bank, building society, or other lender. A personal loan is typically an unsecured loan that can be used for various purposes. Depending on the lender and your circumstances, your interest rate and repayment terms may vary.

-

Some lenders offer specialist mortgages for park homes. The loan is similar to a traditional mortgage but is geared toward park homes rather than brick-and-mortar properties. The eligibility criteria, interest rates, and repayment terms may differ from those of traditional mortgages.

- You may be able to release equity from an existing property to finance the purchase of a park home. With equity release, you can access some of the value of your property without selling it. The equity release market includes a range of products, including lifetime mortgages and home reversions.

- Bridging loans are short-term loans that bridge a financial gap until a longer-term financing solution can be arranged. They can help finance a park home if you need to act quickly while you sell another property, but they are generally more expensive than other financing options.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.84% |

£218.47 |

£26,216.67 |

| Selina | 6.34% |

£219.34 |

£26,320.83 |

| Equifinance | 6.59% |

£219.77 |

£26,372.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 7.4% |

£221.18 |

£26,541.67 |

| Norton | 9.05% |

£224.05 |

£26,885.42 |

| Masthaven | 9.65% |

£225.09 |

£27,010.42 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

How To Find the Cheapest and Best Park Home Finance?

Choosing the best lender for your park home financing needs requires researching and comparing different lenders and products. Below are some factors to consider before settling on a specific lender.

- Park home finance products have varying interest rates based on the lender and product type. Ensure your chosen product’s interest rate is competitive and you can afford to pay it back.

- Consider the repayment terms offered by different lenders, such as the length of the loan and the type of payments.

- Know what fees and charges are associated with the finance product, including arrangement fees, early repayment fees, and exit fees.

- Ensure you meet the lender’s requirements by checking the eligibility criteria for each product. Factors such as your age, income, credit history, and the age of the park home may play a role in this.

Which Type of Finance Is Right for You?

Your income, credit history, and the amount needed to borrow will determine the type of financing you choose to purchase a park home. If you’re deciding which type of finance is right for you, consider these factors below.

- Would you qualify for an unsecured loan?

- Is a secured loan an option? Do you have collateral to put up?

- Do you own another property, and can you remortgage it to get finance?

- Do you have very high limits on one or more credit cards? You might be able to use them to purchase a park home.

Check the following secured loan case study to understand the situation better.

| Category | Details |

|---|---|

| Background |

Borrower: John, a homeowner in the UK. Financial Situation: Stable income, owns a home, needs additional funds for home renovation. Loan Requirement: £20,000. |

| Loan Process |

Application: John applies for a secured loan from a bank or a financial institution. Property Valuation: The lender assesses the value of John’s home to determine how much they can lend. Credit Check: The lender conducts a credit check to assess John’s creditworthiness and repayment history. Loan Offer: Based on the valuation and credit check, the lender offers John a loan of £20,000 with a specific interest rate. |

| Loan Terms |

Amount: £20,000. Interest Rate: Variable or fixed, depending on the agreement, say 5%. Repayment Period: 10 years. Monthly Repayment: Depends on the interest rate and term, but let’s assume £212 per month. Total Repayable Amount: £25,440 (£20,000 principal + £5,440 interest). |

| Benefits | Lower interest rates compared to unsecured loans due to collateral. Longer repayment periods. Larger loan amounts can be borrowed. Loan used for home renovation. |

| Risks | John’s home is at risk if he fails to make repayments. Potential for negative equity if the property value decreases. Early repayment charges may apply if the loan is paid off early. |

| Outcome |

Loan Repayment: John successfully repays the loan over the 10-year period. Impact on Credit Score: Positive, as John made regular payments. Property Value: An increase in home value due to renovations and market conditions. |

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

Park Home Insurance

As with traditional property, a park home can be a substantial investment, so many people would be inclined to protect their homes by insuring their property and the contents within. It is a good idea to compare quotes to receive the best deal possible on your insurance.

Park home insurance can vary significantly depending on a number of factors. This can include the value of a park home, how old it is, the location, the insurance provider, and how much coverage you need.

Are Park Home Sales Regulated?

In the UK, park home sales are regulated. Park homes are regulated by the Mobile Homes Act 2013, establishing a framework for selling and managing them. A park home owner and site owner have rights and responsibilities under the Act, including rules for selling park homes and resolving disputes.

To occupy a pitch, park homeowners must sign a written agreement with the site owner. Specific statutory requirements must be met, including rules regarding pitch fees, security of tenure, and dispute resolution.

The sale of park homes is subject to other regulations besides the Mobile Homes Act. Park home sales, for example, are subject to the same consumer protection laws as other types of property sales, such as Consumer Protection from Unfair Trading Regulations 2008 and Consumer Contracts (Information, Cancellation and Additional Charges) Regulations 2013.

Additionally, voluntary codes of practice promote good practices in the park home industry. A Code of Practice for the sale of new and used park homes is set forth by the National Caravan Council (NCC). A solicitor or other professional can assist you with any questions or concerns about purchasing a park home.

Secured loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking to fund a home improvement project?

- Dreaming of finally taking the once-in-a-lifetime trip?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

Why Are Park Homes Cheaper Than Traditional Bricks and Mortar Housing?

There are many good reasons why buying and maintaining a park home could be a much cheaper option than owning a traditional brick-and-mortar home. I have listed some of these below.

- Prefabricated parts and materials are used to construct park homes in factories. In other words, construction is more streamlined and efficient than traditional housing construction, which involves many tradespeople and materials. Consequently, park homes are generally cheaper to build than conventional homes.

- Park homes are usually located on plots within a residential park, which the park operator manages. A park home usually includes the cost of the land rather than having to purchase it separately, like traditional housing. Park homes can be an affordable option in desirable locations with high land prices.

- Homeowners can reduce their ongoing maintenance costs by choosing park homes because they are low-maintenance and energy-efficient. Many park homes feature durable, low-maintenance materials such as UPVC cladding, double-glazed windows and central heating.

- A park home typically has a lower council tax rate than a traditional home. This is because park homes are classified as movable property, not fixed property, so they are taxed at a lower rate than fixed properties.

Park homes may be cheaper than traditional housing. Still, they also come with some drawbacks, such as the fact that they are subject to specific regulations and legal requirements and are more difficult to sell than traditional housing. If you’re considering a park home, you should research and weigh all the factors before deciding.