Can I Get a Second Mortgage? Here Are The Rules

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

If you’ve been thinking about getting a second mortgage but are unsure of the rules, this article is for you.

Every month, over 6,900 people visit our website to understand secured loans better, so you’re not alone. We’re here to help.

In this article, we’ll talk about:

- What a second charge mortgage is and how it works.

- The things you need to know about a bad second charge mortgage.

- The good and bad points of a second charge mortgage.

- How you can apply for a second charge mortgage.

- Ways to make your credit score better.

We know that getting a second mortgage can be confusing and a bit scary. You might be worried about how a second charge mortgage works, especially if your credit isn’t very good.

Don’t worry! We’re here to help you understand it all, and show you that even with bad credit, getting a second charge mortgage can be possible.

Can you get a second mortgage if you already have a mortgage?

If you already have a mortgage, it is possible to get a second mortgage. You could get a second charge mortgage, which is a second mortgage on a property that already has a first charge mortgage, i.e. a mortgage you used to buy the property. Or you might be able to get a second mortgage to buy another property (either a residential or buy-to-let mortgage).

A second charge mortgage is a second mortgage on one property that allows you to borrow against home equity. For example, if you have £100,000 home equity, you could take out a second charge mortgage for £50,000 to receive a lump sum payment and use it as you wish. You’ll now have to pay your first and second mortgages to own your home outright, which will be paid through separate monthly payments.

Your home is used as collateral.

Second charge mortgages are usually shortened to just second mortgages, which creates confusion because people also use “second mortgage” to refer to buying another property with a second first charge mortgage.

To add to the confusion, some people use the money borrowed against home equity in a second charge mortgage to help buy another property, such as a holiday home.

To summarise, you could:

- Get a second mortgage to buy another home, which is a second first charge mortgage

- Get a second charge mortgage as a way to borrow against home equity and use the money as you wish

- You might choose to use the second charge mortgage loan amount to help fund another home purchase

Getting a second mortgage in any situation is a big deal and should only be done after serious consideration. If you want to borrow with a second mortgage, only use a lender authorised and regulated by the Financial Conduct Authority (FCA). If the FCA does not regulate them, they are operating illegally and could be a scam.

Can I get a second mortgage?

To get a second charge mortgage, you must be eligible to apply. The first thing you must have is enough home equity, as this is what your second mortgage will be borrowed against.

Home equity is the value of your home without any attached debt. You can work it out by subtracting your first charge mortgage balance away from the current value of your home. For example, £220,000 (property value) minus £100,000 (remaining mortgage) gives you £120,000 home equity. If you have any other debts attached to your property, you’ll also need to subtract these amounts from your home’s value to work out the equity in your property.

Taking out a second mortgage requires the lender to calculate your property’s equity amount accurately. You may need to pay a fee for them to complete an appraisal. You should not assume that the property is worth the same amount you paid, even if you only bought it in the last year or two.

Many lenders require you to take out a minimum amount when getting a second mortgage. As you cannot borrow against 100% of your home equity to prevent the risk of getting into negative equity (owing more on your first and second charge than what the property is worth because it decreased in value), you will need to have more equity in your home than the minimum amount you can borrow.

Even if you have the required home equity to get the loan amount you need, this doesn’t mean you will automatically be approved for credit secured against your home equity. You’ll be subject to affordability checks, meaning your income will be assessed against all existing debts. This includes personal loans and credit cards as well as your first mortgage. Your credit score will be checked to see how you have repaid lenders in the past.

If you start looking for second charge mortgages, make sure you also search for home equity loans and home equity lines of credit, better known as HELOCs. These products are types of second charge mortgages.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 6.34% |

£219.34 |

£26,320.83 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 7.99% |

£222.20 |

£26,664.58 |

| Selina | 8.45% |

£223.00 |

£26,760.42 |

| Equifinance | 9.95% |

£225.61 |

£27,072.92 |

| Evolution | 10.2% |

£226.04 |

£27,125.00 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

Getting a second mortgage in the UK

Second charge mortgages and home equity loans are widely available through UK banks and building societies. Some online banks and lenders may also offer these methods of credit. However, unlike other loans, these are not as widely advertised, and you may need to search for HELOCs instead, which appear to be used more often on web pages. Just be aware that a HELOC works slightly differently because the loan is not paid out as a lump sum.

You may have to speak with your local bank branch rather than rely on their website for second charge mortgage information.

Another option is to use the services of a credit broker or mortgage consultant. They could save you time by searching the market on your behalf, but their services come with upfront costs, commissions, or both. Always check mortgage terms before signing anything.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

The benefits of a second charge mortgage

Choosing a second charge mortgage as a way to access credit can be beneficial. Because you are borrowing against home equity, you may be able to access a more significant loan amount this way than using a personal loan or credit card.

As such, these mortgages are often used to complete home improvements, such as installing a fancy new kitchen or converting a loft. Doing this can increase the value of your home and therefore increase your home equity again. From my experience, you’re not restricted to completing renovations. From buying cars and trips abroad to debt consolidation, you can use the money as you see fit.

Another potential benefit of using a second charge mortgage is that you might get a lower interest rate than other options. Secured loans generally provide lower rates because the lender feels more comfortable when an asset is listed as collateral within the credit agreement.

A nice benefit of using a second charge mortgage is that it can help you avoid an early repayment charge on the first mortgage compared to refinancing or remortgaging your first mortgage. However, other fees may be associated with a second charge loan that could wipe these savings out.

The risks of a second charge mortgage

When you get a mortgage a second time on the same home, there are multiple risks. The main one is risking your family property.

By securing further debt against your home, you are risking the property. If you don’t keep up with your agreed payments, the house may be repossessed, and the lender will sell your home. Once they sell your home, the money raised will be used to pay back the first charge mortgage lender and then the second charge lender. If anything remains, you will receive the money, but if there is a shortfall due to negative equity. You could land in serious debt, possibly requiring bankruptcy.

One way of mitigating the risk of not being able to afford your mortgages is to never overborrow against your equity or seek alternative credit methods. If you feel uncomfortable using your family home as collateral, you may want to look at other secured options or consider unsecured credit, such as a personal loan.

What is the purpose of remortgaging?

In simple terms, remortgaging is when you pay off an existing mortgage on your existing property with a new mortgage arrangement. This arrangement could be with your current lender or a new mortgage provider. People often remortgage their property if their current mortgage rate is coming to an end. However, they may also require a mortgage refinance if they’re after a better deal or if they want to borrow more money against their property.

Advantages and disadvantages of remortgaging

If your current mortgage arrangement is ending, your lender may move to a standard variable rate (SRV) which is often higher than other rates on the market. Remortgaging your property can help homeowners avoid paying higher rates. Not to mention, obtaining a further advance with an existing lender might be cheaper than getting a separate second charge mortgage.

However, if your current mortgage arrangement is on a lifetime tracker rate, you might be required to remortgage your entire mortgage, and your lender might charge a higher rate.

Both a second charge mortgage and a remortgage are excellent ways to release additional funds against a property. However, you must keep up with repayments for both options if you don’t want your property repossessed.

Second charge mortgage for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking to fund a home improvement project?

- Dreaming of finally taking the once-in-a-lifetime trip?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

Can I get a second residential mortgage?

As mentioned at the start of the guide, getting a second residential mortgage to buy another property is possible. This involves applying for a separate first charge mortgage to buy the property, not related to your existing property, and the first charge mortgage you are paying for. Many people buy a second property as a holiday home or investment. Speaking to a mortgage broker to find the best mortgage deals is a good idea.

You must have a large enough deposit to get a second mortgage to buy other property. Second mortgage lenders will not lend you all the money to buy the second property, so you must have saved enough cash for the down payment. This generally means saving at least 20% of the purchase price as lenders have an average Loan-to-Value (LTV) ratio of 80%, meaning they will lend you 80% of the asset’s worth at most.

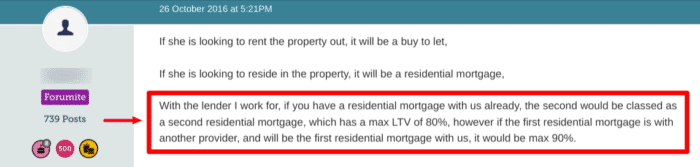

This MoneySavingExpert forum user works for a lender and is offering another user advice regarding residential mortgages. They confirm that a second residential mortgage will have a maximum LTV ratio of 80%. However, the LTV ratio would be 90% maximum if they take out a first residential mortgage with this lender.

Affordability Checks

Having enough of a deposit is not all that is required to get a mortgage for a second home. You must complete affordability checks and compare your income to all existing debts. In addition, your credit file will be checked to ensure all debts have been disclosed and to prove you have been able to keep up with other repayments.

Buy-to-Let Mortgage for Second Property

If you want to rent out the property, you will need a buy-to-let mortgage instead of a residential mortgage.

If the second property you buy will be a rental investment with a buy-to-let mortgage, you will probably need a larger deposit and as much as 40% of the purchase price. As I see it, mortgage lenders see buy-to-let properties as a greater risk. Relying on tenants to pay rent on time and contribute to your mortgage repayments is risky, so they require a bigger deposit.

Also mentioned earlier was that some homeowners borrow against their existing home with a second charge mortgage to raise money for a downpayment. From my experience, this can be advantageous when buying a second home, but it won’t always work.

This is because it creates another debt, and the mortgage lender will assess all debts against your income. They could decide you cannot afford two mortgages on one property and a further mortgage on the second home because of the additional debt.

Can I get a second mortgage with no equity?

It is impossible to get a second charge mortgage with no remaining equity in your property, but you could still borrow on a second first charge mortgage to buy a second home.

Because a second charge mortgage is secured against your home equity, with no equity, there would be no collateral available and nothing for you to borrow against. You must have sufficient equity to get a second charge mortgage. You can grow your equity by continuing to pay on your existing mortgage, providing your property does not drastically decrease in value.

You could get a second first charge mortgage with no equity in another property if you can cover the deposit required to buy the property and prove you can afford the second mortgage.

However, if you have no equity in your first home, that suggests you have additional debts already tied to this property or the property has decreased in value. If it is the former, these additional debts may make proving you can afford the second first charge mortgage more complicated. However, it is not impossible to prove you can afford it.