Why Is My Clearpay Account Frozen?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you found that your Clearpay account is suddenly frozen, and you’re unsure why? You’ve landed in the right place for answers. Each month, over 170,000 people visit our website seeking advice on debt solutions.

In this easy-to-understand guide, we will explain:

- Why Clearpay might freeze your account

- What to do if your Clearpay order is being declined

- How to get in touch with Clearpay

- How you can unfreeze your Clearpay account

- Clearpay’s late fee rules

Navigating financial difficulties can be challenging, and it’s common to feel unsure about seeking help. In fact, Citizens Advice revealed that 60% of adults facing financial difficulties hesitate to seek assistance.1

If that’s your case, don’t worry! We know that it can be quite scary to find out that your account is frozen, and we’re here to help you.

Let’s get started!

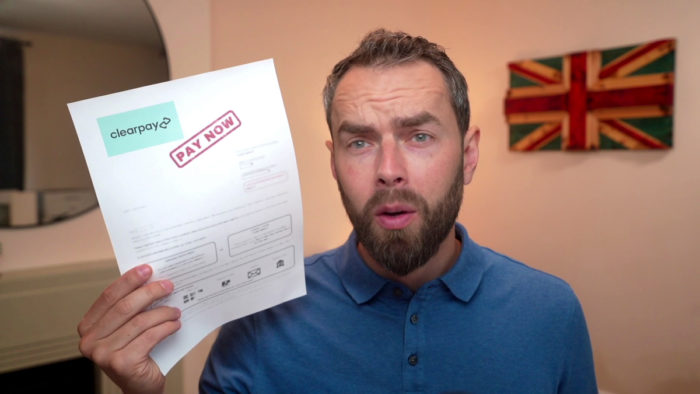

Clearpay Account Frozen Due to a Missed Payment?

When you miss a scheduled instalment, Clearpay freezes your account straight away.

They will contact you the next day and try to sort things out. You could incur late fees if you fail to respond and Clearpay can’t get in touch.

Late fees soon mount up and could make the debt harder to settle. On top of the outstanding owed, you’ll have to deal with several late fee charges.

Also, the block remains in place until you pay the outstanding amount. It means you won’t be able to buy anything using the Clearpay buy now pay later option.

As mentioned above, Clearpay may report you to a credit reference agency.

This will harm your credit history and damage your ability to borrow. You could find it hard or impossible to get credit, or take out a loan or mortgage.

» TAKE ACTION NOW: Fill out the short debt form

Clearpay Buy Now Pay Later Terms of Use

Clearpay provides shoppers with the chance to buy goods and services without paying upfront.

Their BNPL scheme lets you pay an initial instalment when you buy something. You pay the balance in three further instalments scheduled every two weeks.

When there’s a problem, Clearpay prevents you from using their buy now pay later service.

They block your account until the problem is sorted out as part of their Clearpay debt management scheme. When this happens to you, contact their support team and don’t ignore any messages you’re sent.

Communication is the best option to prevent things from going any further.

When you get in touch, Clearpay should answer, ‘Why is my Clearpay account frozen?’. Only then can you resolve the problem.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can I Ask Them to Freeze My Account?

Clearpay will ‘freeze’ your account when you ask them to.

They will place a ‘temporary’ freeze on the account, which stays until you ask for Clearpay to lift it.

If your finances worry you, it’s a good option. It’s a great way of controlling your spending when things are tight.

That being said, it can be hard to do with temptation knocking on your door.

Can I Unfreeze My Account?

You must pay any outstanding balances and late fees to unfreeze an account.

You’ll get a message from Clearpay the day after you missed a payment. They give you till 11 pm the following day to pay the amount owed.

They’ll charge you £6 late fees when you don’t pay.

You then have seven days to settle the outstanding; if you don’t, Clearpay charges another £6 in late fees. You must pay late fees immediately under your agreement with Clearpay.

Remember, every plan you open is a short-term loan agreement you must respect. Avoiding late fees with Clearpay is not something you can do unless you pay on time every time.

If you pay off any owed money and communicate clearly with Clearpay, including sending the required documents and information, they will unfreeze your account sooner and reduce the chance of Clearpay and credit score impact.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

My Clearpay Order Is Being Declined?

Clearpay may block an account and decline an order for several reasons. There may not be enough money in the account linked to your Clearpay account.

You could have met your Clearpay account limits, not stuck to your Clearpay repayment schedule, have too many plans open, or not be managing Clearpay payments very well.

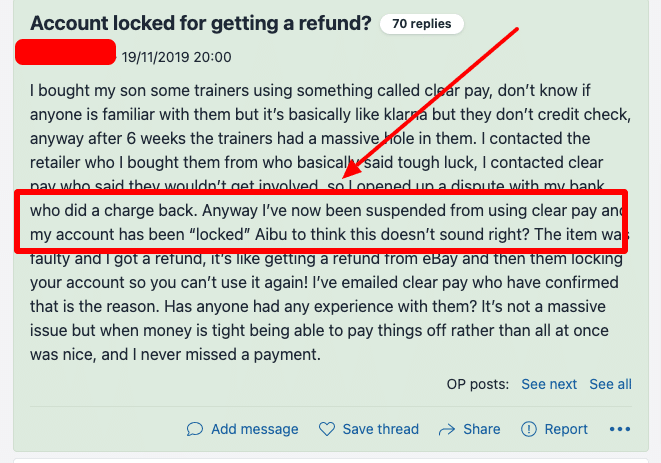

It could be for other reasons, as the forum user on Mumsnet discusses below:

Clearpay sends you a message before they take payment from you.

Ensure there’s enough money in an account to meet the scheduled payment. Check how many orders are open and whether you’ve met your spending limit.

Outstanding payments could affect whether you can make any more purchases. It could prevent a credit limit increase even if you do pay.

These reasons could be why Clearpay prevents you from using their buy now later services.

If you are unsure, contact Clearpay support and ask for their advice.

Clearpay Contact Details

| Website: | https://www.clearpay.co.uk/en-GB |

| Email: | [email protected] |

| Help Center: | Get in touch |

| Mail: | Clearpay Customer Service, Clearpay Finance Limited, Jactin House, 24 Hood Street, Ancoats, Manchester, M4 6WX |

A Final Word

According to a Which report, debt collection agencies chase one in ten buy now pay later shoppers. Debt collectors contacted 12% of shoppers between 18 and 34.

The debt problems that buy now-pay later schemes create are taking a toll on people’s finances.

So much so that the government is now seeking to regulate this type of credit agreement. In short, the Financial Conduct Authority is set to regulate BNPL schemes.

Don’t ignore any messages you’re sent. It’s better to stay in touch with Clearpay to avoid them passing your details to a debt collection agency.

The longer you take to pay off what’s owed, the more late fees you’ll pay. Clearpay could report you to a credit reference agency!

You should sort a Clearpay frozen account out as soon as possible to avoid further problems. I advise contacting their support and asking what’s gone wrong.

If you’ve got too many plans open, pay off a few, but if you have missed a payment, pay what’s owed as soon as possible.