The information in this article is for editorial purposes only and not intended as financial advice.

Are you trying to find car insurance after a driving ban? You’re not alone – every month, our website is visited by over 9,300 people looking for guidance on this very subject. It can be tough to find affordable car insurance after a ban, but it is far from impossible.

In this handy guide, we’ll provide clear information and helpful advice on:

- Understanding what a driving ban means.

- The impact of a driving ban on your car insurance.

- The difference between a driving ban and having your licence taken away.

- Ways to find affordable car insurance even after a ban.

- The importance of telling your insurance company about your ban.

We know it can be worrying to think about not being able to afford car insurance or worse, not being able to get it at all. But fear not; we’re here to help you through this tricky time. Whether it’s understanding how a ban affects insurance or if someone else can drive your car while you’re banned, we’ve got you covered.

Let’s dive in.

What is a driving ban?

A UK driving ban is given to motorists who accumulate 12 or more penalty points on their driving licence within any three-year period.

This can be through multiple driving offences or convictions, such as speeding or dangerous driving. These bans are known as a totting up driving ban.

Courts also have the power to impose driving bans at their discretion as part of individual offences or criminal convictions. The judge will decide how long your driving ban lasts.

A driving ban is formally called a driving disqualification in the UK.

Driving Offence Codes

Endorsement codes, also called driving offence codes or driving conviction codes, are attributed to different types of UK driving offences. Every endorsement has a specific code and is given penalty points ranging from 1 to 11, with driving under the influence and causing death due to careless driving costing 11 points. These codes can remain on a driving license for 4 to 11 years.

Is a revoked licence a disqualification?

A driving ban or disqualification isn’t the same as revoking your licence.

Driving bans are imposed on people found guilty of driving offences, whereas a licence revocation can occur for other reasons, such as a medical condition.

Difference between driving ban and licence revocation

The other main difference is that a driving ban stops you from driving for a fixed period, and then you must reapply for your licence. But a revocation prevents you from moving until you get a new legal licence. Either way, a driving ban and a revocation can have negative implications – especially if you have a job requiring frequent travel or a clean driving record.

What happens when the DVLA revokes your licence?

When the DVLA revokes your licence, you can appeal the decision or apply for a new provisional licence and retake your test. You can do this immediately if desired.

A driving licence revocation invalidates your insurance because you need a legal licence to hold vehicle insurance.

How do I get my licence back after revoking UK?

If your licence has been revoked or you have been disqualified from driving, you must apply for a new one.

New drivers and provisional licence holders must retake both parts of their driving test if their license was revoked after passing their test. In addition, new drivers need to apply for a new provisional licence.

How do I get my licence back after drink or drug driving?

Individuals disqualified for drink or drug driving can reapply for their provisional or full driving licence immediately. However, they cannot drive until their disqualification period is over. To get your licence back, you must fill in a D27 renewal form and send it to DVLA along with the licence fee. You should receive a form in the post from DVLA. You can pick one up from the Post Office if you don’t.

Does a driving ban affect insurance?

Yes, receiving a driving ban will affect your insurance immediately and in the future. This applies to all reasons for a driving ban, from dangerous driving to drink driving and more.

Read on for more information about the impact of a driving ban on insurance premiums and DUI and car insurance rates.

What happens to my insurance if I get banned?

If you get disqualified from driving, your current insurance policy will most likely become invalid for all named drivers.

Does being disqualified from driving invalidate insurance?

Yes, getting banned from driving will invalidate your insurance. Vehicle insurance companies usually include a clause stating that the insurance is null and void when you’re disqualified from driving.

However, this means the policy will no longer stand, and you won’t be required to make any more payments to the insurer, but always check the terms of your agreement first. You will still need insurance on the vehicle if it is being kept on a public road.

Can someone else drive my car if I am banned?

Other licensed and insured drivers can still use your car while you’re banned.

But be aware that getting banned usually invalidates the insurance policy for yourself and any other named drivers on the policy.

In my experience, the prospective driver must take out a new insurance policy to drive the car legally.

Can you insure a car if you are banned from driving?

Yes, you can insure a vehicle when you’re banned from driving, but this is only available to insure the vehicle if it’s parked on a public road.

You’re still legally required to insure the vehicle if it isn’t being kept on private land during your driving ban. You might need to search for specialist car insurance by looking for convicted driver car insurance companies.

Will my insurance go up after a driving ban?

Yes, a driving ban and increased insurance rates go hand in hand. You will almost certainly have to pay more for insurance after a driving ban because:

- You’ll have fewer options

- Insurers will consider you a more significant risk and want to mitigate the risk by charging more for the insurance

However, there are ways to find cheaper insurance for banned drivers, which we will discuss below.

Cheapest car insurance for banned drivers

Finding cheap car insurance post-ban can be difficult. The most affordable insurance for convicted drivers is typically offered by insurance providers that advertise policies for previously banned people. It’s frequently called convicted driver insurance but can be marketed by other names.

Using convicted car insurance companies will also save you from making standard applications and getting rejected, therefore saving you time.

Is convicted driver insurance easy to find?

You can make finding convicted driver insurance easier with these three tips:

- Search specifically for convicted driver insurance or banned driver insurance instead of searching mainstream policies.

- Combine these searches with comparison websites instead of searching independently online. It doesn’t mean you have to opt for insurance through the comparison website; you can always go directly to the insurer’s website after.

- Use a vehicle insurance broker specialising in helping people get insured after a conviction or driving ban. They might know of companies you won’t find online, and they might be able to unlock exclusive deals.

More tips and information on searching these policies can be found via our convicted driver insurance info hub.

What convictions will affect my insurance?

All driving convictions, whether you get banned from driving or not as part of the punishment, will affect your insurance options and cost.

According to Admiral, even getting just three penalty points on your licence can increase future car insurance premiums by an average of 42%.

Of course, the more serious your conviction, the greater chance of a driving ban, and the more expense will be added to your insurance.

Do you have to declare a driving ban on insurance?

You must declare a driving ban when applying for insurance unless the conviction has become “spent”.

You can learn more about specific driving convictions below and their consequences. We have guides covering individual motoring convictions with in-depth info.

How long after a driving ban must you declare it to your insurance?

When applying for insurance, you typically have to declare any conviction that occurred within the previous five years. The timescale may differ in some situations, such as when the conviction occurred before you turned 18.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

What happens if you don’t declare driving convictions?

If you don’t declare driving convictions upon renewal or application, your insurance can be considered null and void, meaning you’ll drive without insurance. If you have claimed the insurance since, the company could even ask for its money back, putting you in debt.

Not telling an insurer about a driving ban or conviction is serious!

What happens if you have spent convictions?

In most instances, you don’t have to declare any spent driving convictions when you renew or apply for vehicle insurance. You don’t have to disclose this information when the conviction is spent, even if the insurer asks you.

How can I get cheaper insurance after a drunk driving ban?

You can get cheaper insurance after a driving ban for drunk driving by using a convicted driver insurance broker or by taking the time to search the market for the best options.

You might be able to reduce your insurance premiums by choosing to drive a vehicle that is usually less costly to insure.

How rehabilitation courses affect insurance rates

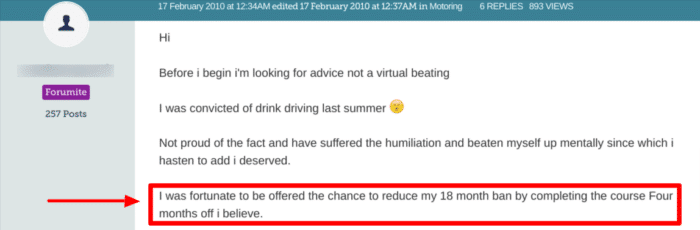

Drink Drive Rehabilitation courses, such as the Drink Drive Rehabilitation Scheme (DDRS), are offered to people who have been convicted of drink-driving or have been given a ban that lasts one year or more. Participating in these courses might help you get your licence back quicker and save you money on motor insurance.

As you can see, this MoneySavingExpert forum user was offered the chance to participate in a course. If they decide to participate, they will get their licence back four months quicker than initially planned.

What’s the cheapest car to insure after drunk driving?

Several vehicles can be cheaper to insure after a drunk driving ban and any other driving conviction.

Some of the common examples, in no particular order, are:

- Ford Fiesta

- Renault Clio

- Citroen C1

- Kia Rio

- Mazda CX-5

Find better convicted driver insurance deals for you

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

Can I get insurance after drug driving?

Getting insurance after a conviction for drug driving is more challenging, but it’s certainly not impossible. However, a drug-driving conviction and car insurance usually equal higher rates.

How much does insurance go up after a drug driving ban?

A drug-driving ban will last for at least one year. Your insurance will increase significantly during the ban, so it may be best to take and declare the vehicle off the road during this time.

Drug driving bans will significantly increase insurance premiums once you can drive again with a new licence. Sources suggest the increase could be between 85% and 100%+.

You can learn more about these situations in our car insurance after drug driving article.

How long does drug driving affect insurance?

Drug driving convictions will affect the cost of your insurance for five years from the date of the driving conviction. The declaration period for drug driving is five years. After five years, the conviction won’t need to be declared to insurance providers and, therefore, cannot affect your premiums.

Can I get insurance if I was previously banned for careless driving?

You can also get insurance if you were banned for CD convictions, otherwise known as careless driving. There are many CD convictions ranging in seriousness.

The lesser motoring offences only result in three points on your licence and no ban, but if someone dies as part of the incident, you should expect a ban, possible prison sentence and costly insurance in the future.

What if I’m refused cover?

It can be frustrating to go through an application and then get rejected for cover. If this happens to you, try not to panic and consider alternative insurers. If you didn’t previously use an insurance broker, you might want to consider using one this time.

Can I get temporary car insurance for convicted drivers?

Yes, temporary car insurance for convicted drivers is possible. It’s even possible for previously banned drivers to get insurance temporarily.

Do I need to declare criminal convictions?

Yes, the vehicle insurance company might ask you about criminal convictions unrelated to motoring offences. You must declare these as well if they’re unspent.

How does a criminal record affect car insurance?

Non-motor-related criminal convictions can also increase your insurance because these incidents tell the insurer about your personality and behaviour, which could be transferable while using a vehicle.