Debt Consolidation Companies Comparison

Debt consolidation is one option to help manage your money troubles. Our focus in this article is on debt consolidation companies and how they work. We aim to answer your key questions about this topic. These include:

- How debt consolidation loans work.

- The real cost of a bad debt consolidation loan.

- How to choose the right consolidation company.

- The top 5 Debt Consolidation Companies and their reviews.

- How credit matters when getting a consolidation loan.

Every month, over 170,000 people use our website for advice on money matters. We understand that being in debt can feel very tough, but you’re not alone. There are many ways to cope with debt, and we’re here to guide you through them.

Let’s begin our journey to understand more about debt consolidation companies. By the end of this article, we hope you’ll feel more confident about your options and can make the best choice for your situation.

Let’s dive in.

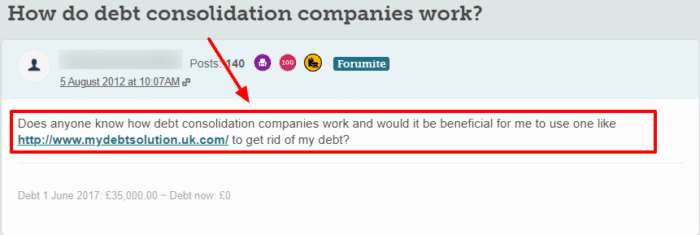

What are Consolidation Companies?

In order to consolidate your debts, you will need a large amount.

Consolidation companies play an important part in providing you with the money which shall be used in debt consolidation.

These organisations will provide you with new lending tailored specifically to your debt needs and their repayments. In this way, you can pay off your existing debts and create just one debt towards the lending institution.

They will review your application as well as:

- Your credit score

- Your payment history

- Your financial position

After the approval of your request, you shall be able to take out the credit.

It’s worth noting that debt consolidation companies do not eliminate your debts. Rather, they help you shuffle all your debt together in one place. You still have to pay off the larger debt.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

The Top 5

1. TSB

TSB offers a lucrative offer of credit amounts ranging from £1000 to £25000. The company provides you with many added benefits and solutions to consolidate your debt.

Besides, TSB has an online debt calculator which will help you to get a personalised quotation for the loan.

The maximum rate of APR is 39.9%, but the interest rate will vary according to your quotation. You can make monthly payments on the date of your choice, and you can also make overpayments in any month. The payback period has a window of 1 to 7 years.

The best part about the TSB loan is that you can avail of the skipping of payment for up to 3 months. However, this offer has some terms and conditions applied to it.

There are some eligibility requirements. For example, the borrower must be a resident of the UK over the age of 18 and registered in England.

Get a quote from TSB by clicking here.

2. Post Office Money

Post office money was the winner of the Moneyfacts award in 2018. Hailed as one of the top lending institutions in England, they allow you to take out a debt consolidation loan, amounting from £1000-£25000.

This company has a fixed APR rate of 8.9% on a debt consolidation loan of £3000-£4999. The time to pay the amount back will differ according to the loan, but they have a slab of 1 to 7 years.

Post office money provides you with an instant transfer of the credit amount. You can also manage and see your monthly payments, including your progress, by using their online tools.

They also offer you an early settlement offer, which will reduce your overall interest cost, thus saving you some money.

3. Freedom Finance

A unique selling proposition of Freedom Finance is that it gives out loans with an APR of as low as 3.4% APR.

They also promise to provide a quick service and tailor the quotation according to your demands. You can also get a decision from them within minutes.

They provide both secured loans and unsecured loans. The secured loan comes at a relatively lower interest rate. The payback period will be decided once you get a quotation from the company. To do that, you can go here.

4. Monevo

Monevo has been a winner of several different awards. The company has grown rapidly in recent years. They provide many types of personal loans, including debt consolidation loans and debt management guides and advice.

You can get a loan amount of up to £ 50,000 with a payback period of more than 5 years. Monevo provides excellent customer care service, and they also have decent online debt management tools.

Aspire Money

Aspire Money will answer all your questions regarding the consolidation of loans and provide you with the best possible package for your needs.

The company is a credit brokerage and not a direct lender, but they will help you find the best loans at the lowest possible APR rates.

This brokerage firm also takes relatively small commission fees and other miscellaneous expenses. The firm will help you secure a loan quite easily with the help of their technical assistance.

All of these institutions are authorised and regulated by the Financial Conduct Authority of the UK.

I suggest you analyse the pros and cons of each company and pick out the best one for yourself.

Debt consolidations loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking for a better interest rate?

- Stuck with the confusion of multiple repayment plans?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

How to Select the Right Company?

Selecting the right company from which you are going to obtain credit can be a tricky task.

Many factors come into play when selecting a debt company.

First, list down your needs and demands that you might want to address at the time of taking out a debt consolidation loan.

Secondly, review your financial position and your historical record. If you have a bad credit score, adjust your demands accordingly. However, having a bad credit history doesn’t mean you should make an impulsive decision.

Factors to Compare When Selecting a Loan

A few major factors hold much importance when deciding where to get a loan from. However, for some people, other terms and conditions might be of importance.

It all depends on your personal circumstances and needs.

1. Interest rate

Usually, the interest rate is based on multiple factors, such as your credit score, amount of lending, and its payback period. Apart from these things, some lending businesses have a fixed slab of interest rate.

You will need to look for the one that offers the best interest rate based on your financial standing.

2. Costs and fees

There are many costs included while applying for debt consolidation loans like the upfront payments of application, deposit costs, and other sundry expenses.

If you are on a tight budget, look for a company that offers lower costs than its competitors.

3. Payback period

Different institutions will cater for you according to their terms and policies. The payment period for the same amount of loan may differ between several organisations too.

Revise your financial planning and conclusively decide which company is best per your payment period plan.

4. Services Offered

You might want to get a good look at the company’s services.

Some only provide you with a loan to consolidate your debt, but others might propose a full debt management plan with varying costs according to the service opted, of course. Make sure you select the right service for yourself.

How Does Credit Matter?

Credit rating is very important to get any loan or, more specifically, a consolidation loan. The company that will loan you the money needs to ensure you can repay it.

Your credit history and score are your impressions towards any lending institution. While granting you the loan, the company will put a great emphasis on your credit score.

Final Thoughts

Managing debt consolidation loans requires some understanding, and for selecting the right company, You need to have a good understanding of the market.

If you need help deciding if debt consolidation would work for your financial situation, contact an independent debt charity like National Debtline or MoneyHelper.

Does using the companies work?

Of course! According to surveys, the figure shows that around 68% of people who consolidated their debts using a consolidation company were able to improve their credit score.

How much debt can I consolidate?

You can consolidate your major and small debts, but I suggest you consolidate only the high-interest debts, such as credit cards. It also depends on the company and how much they are willing to loan.

How long does it take to get approved?

The normal approval period is 30 to 90 days. If your loan hasn’t been approved within 90 days, you should contact the lending institution.

What is better: consolidating or personal loan?

It depends on your preferences and demands. Personal loans are usually taken out for personal needs, and on the other hand, debt consolidation loans are to manage your debts by refinancing them.

Can I get a personal loan with a credit score of 550?

The starting rate for personal loans is 585, so it might be difficult. You might get a secured loan if you provide collateral or security for it.

What other options do I have?

Direct lending or a personal loan is another option that you can use for debt consolidation.

How long will it stay on my credit report?

Debt consolidation will stay on your report for up to 10 years.