How Do I Qualify for a Debt Consolidation Loan

The path to managing your debts can seem long and winding. But, a debt consolidation loan might be the tool you need to bring all your debts together, making it simpler to tackle your money worries. Qualifying for one, however, requires understanding certain factors. This guide aims to illuminate these for you.

In this article, we’ll explore:

- The definition of a debt consolidation loan.

- The process to see if you’re eligible for one.

- The potential cost of a poor debt consolidation loan.

- How to obtain a debt consolidation loan even with bad credit.

- Commonly asked questions about debt consolidation loans.

With more than 170,000 people turning to our website every month for advice on debt solutions, we’re well-versed in the worries unpaid debts can cause. We’re here to provide you with the knowledge and guidance you need to navigate this process.

Let’s dive in.

Debt consolidation qualifications

To qualify for debt consolidation, you will need to be approved for a new loan and a loan amount that enables you to pay back at least two existing debts.

This means making a new credit application and being accepted based on your individual circumstances and your credit score.

But it’s not just about being able to access credit. You should assess your situation to ensure consolidation is the most appropriate method to improve your debt situation.

There may be an alternative that can save you more money or even write off some of your debt.

To find out if you qualify from this perspective, you can ask for guidance from a free debt advice charity. They could help you out of debt in the best way for you!

You should also know there are other ways to consolidate debt besides personal loans.

- If you are only wanting to consolidate credit cards, you can complete a balance transfer using a balance transfer credit card.

- You can also consolidate through debt solutions, such as a Debt Management Plan (DMP) or Debt Arrangement Scheme (for Scottish residents).

- Another option is remortgaging to release home equity and using that money to pay off your debts

Remortgaging your home as a way to consolidate debt is by far the most risky. You should only consider this after speaking with a professional mortgage advisor and a debt advice charity.

Where can I get a loan?

Debt consolidation loans are available with banks and building societies offering credit products and services.

Getting a decision on your application is usually quick, especially if you already have a bank account with the lender. These types of personal loans are also available from online loan providers.

You should diligently search the market for the provider with the best APR representative interest rate. But always remember the interest rate you’re offered will depend on the loan amount and individual circumstances.

One useful tool that most loan providers will offer is a loan calculator. The loan calculator allows you to determine the cost of your debt consolidation loan.

Simply enter the amount of money you would like to borrow to consolidate your existing loans and cards – and how long you need to repay.

A loan calculator should only be used as an estimation of the fixed monthly payments you’ll be asked to pay, and the interest rate you’ll be subject to.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

How hard is it to get one?

The difficulty of accessing a debt consolidation loan is comparable to trying to get any other type of unsecured personal loan.

Some experts suggest getting a debt consolidation loan is a little more difficult. However, there is not a big difference, if any difference at all.

The lender will evaluate how likely you will be able to keep up with monthly payments based on the loan amount and interest rate available to you.

Much of this will depend on your income and how you handled your finances in the past. This means acceptance of these loans is subject to a credit score check.

Before you apply for a loan of this kind, you might want to try and improve your score first (more on this below!).

What credit score do you need to consolidate debt?

“One of the biggest credit reference agencies, Experian, states that the very best consolidation loans with the lowest fixed interest rate are only available to people with a “good” or “excellent” credit score.

Experian also says that “Good credit” equates to a FICO score of 670 or above. You could use a free subscription to access your file and see how your score fairs against this benchmark.

Remember to cancel your free trial, or you will be billed each month.

You may be wondering how someone with lots of arrears would have a credit score this high. The reality is they probably don’t.

Keep in mind that these loans are also used by people who are not in arrears. They’re taken out by those who want a new personal loan to consolidate other credit and make repaying their current loans and credit cards cheaper – even if they’re not struggling to repay them in the first place.

It’s not just people with financial difficulty who use debt consolidation loans!

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.84% |

£218.47 |

£26,216.67 |

| Selina | 6.34% |

£219.34 |

£26,320.83 |

| Equifinance | 6.59% |

£219.77 |

£26,372.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 7.4% |

£221.18 |

£26,541.67 |

| Norton | 9.05% |

£224.05 |

£26,885.42 |

| Masthaven | 9.65% |

£225.09 |

£27,010.42 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

How do I get it with bad credit?

The above does not mean you will be automatically rejected for a debt consolidation personal loan if you don’t have a “good” or “excellent” rating.

There could still be plenty of lenders willing to accept you for a loan with a poor credit rating.

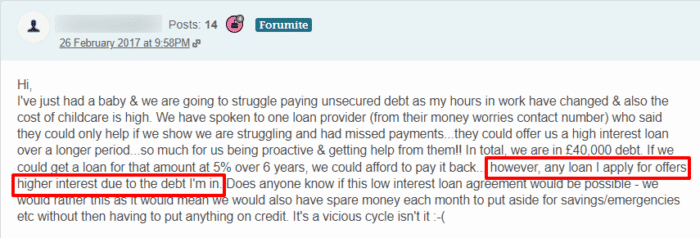

However, because you are seen as a greater risk for defaulting on payments or not repaying the fixed monthly payment in full, the interest you pay is likely to be higher.

Remember that the representative APR example is based on at least 51% of successful applicants only.

If your score is worse than the average population, then the interest rates offered to you won’t likely be as good as the representative example.

If you want to find creditors that lend to people without a perfect credit score, you can search your options online.

Or you can check out this guide, which discusses some of the debt consolidation loan options for people with a poor credit history.

On the other hand, you could try to improve your credit file over many months before using the debt consolidation strategy. Taking your time to improve your file and then applying for a loan could be more beneficial in the long term.

The loan amount you need by that time may also be smaller if you’ve continued repaying, making it even more likely to get accepted for the loan.

Will I qualify?

Your debt consolidation loan application will be assessed by the lender you apply to based on individual circumstances, your credit score, the loan rates and amount – and possibly other factors.

Because so many things need to be considered, it’s not possible to say if you will or will not qualify for the debt consolidation loan you apply for.

Some lenders may be able to give you a good indication of how likely you are to be accepted and what interest rate you’ll be offered without marking your credit file. This is called pre-qualification.

If your debt consolidation loan application is rejected, try not to worry. There are alternative options and strategies you could use that will also help you get back on track.

We’ve discussed them in further detail below…

How to get approved

There is no sure-fire way of getting approval for a debt consolidation loan. But there are things you can do to improve your chances.

Most of them revolve around improving your credit score so creditors believe you are not a risk.

So, how could you improve your credit score?

We’ve already explained the importance of looking for credit file errors and having them put right. But here are some additional hints and tips that may improve your score in the short term:

1. Get on the electoral register

If you didn’t know already, simply adding your name to the electoral register is a quick way to improve your score.

It’s not going to make a huge difference, but this small task might be the difference between getting a personal loan accepted or rejected.

Adding your name to the electoral register in your area will slightly improve your credit score because it helps with the identification process. It’s as simple as that!

2. Reduce your credit utilisation

Your credit utilisation is the amount of credit you have been approved for against the amount of credit you have used.

For example, if you have been approved for three cards of £500 each and you have spent £750 across those three cards, you have a credit utilisation of 50%.

Reducing your credit utilisation is another term for reducing your debt, which will improve your score.

However, it can be better to keep credit accounts open even if the balance is zero. Closing the account will make your credit utilisation increase significantly.

3. Keep up with bills

It’s tempting to think your ongoing bills don’t matter when you have more serious debts. But you should be putting the same efforts into preventing those bills from becoming debts that you put into clearing your debt.

Any missed payment will harm your credit file.

Debt consolidations loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking for a better interest rate?

- Stuck with the confusion of multiple repayment plans?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

Alternative Debt Solutions

If you do not get approval for a debt consolidation loan, there are other debt management strategies and debt solutions available.

Some of the most popular are:

1. Debt Management Plans

A Debt Management Plan (DMP) is an informal agreement with your lenders to pay off your debt in one monthly payment.

The new payment will take into account your financial difficulty and may not include a lower interest rate.

2. Debt Relief Order

Another debt solution option is a Debt Relief Order (DRO). This is a formal solution that stops creditors from contacting you or asking for payments for a full year.

It is only available if you have less than £75 disposable income each month and own no assets worth more than £2,000.

If the year ends and your financial situation hasn’t improved, you can write off all of your debt.

3. The Snowball Method

The Snowball Method is used when someone has multiple debts. The debtor prioritises minimum monthly payments on each debt, and then any extra disposable income is used completely to pay the smallest debt. Thus, it focuses on reducing the number of debts first.

A word on balance transfer cards

If you would like to borrow to consolidate credit cards only, then another alternative is to use a balance transfer credit card instead of a consolidation loan.

This is a special type of credit card that allows you to transfer the balance of your existing debts (credit cards only!) to the new card.

If the new card has a lower fixed interest rate than your other cards, then you could save on your payments. Many of these cards include a 0% fixed rate for so many months to help reduce payments.

This could be a more appropriate and lucrative option than applying for loans.

More information

We’ve covered many questions from debtors about how to qualify for debt consolidation loans. If you didn’t find what you were looking for, we’ve probably covered it in one of our other consolidation debt guides.

And remember there are many excellent UK debt charities waiting to help you. They offer free private debt advice to help guide you through the process. They will assess your situation and recommend the most suitable debt solution based on your personal situation.

Some of the most popular charities include StepChange, MoneyHelper and National Debtline.

If you’ve just started thinking about debt consolidation, pick up the phone and have a chat with a trained advisor!