For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about a debt and wondering if it’s too old to pay? You’re in the right place. We understand how stressful it can be to deal with debts, and we’re here to help.

Each month, over 170,000 people turn to us for advice on their debts. This article will guide you on:

- Understanding what a statute-barred debt is and how it works.

- Knowing how long creditors can chase you for money.

- Learning what to do if your debt is past its time limit.

- Finding out if your debt can be written off.

- Knowing how a statute-barred debt can affect your credit file.

Our team has a lot of experience with debt issues, so we know how you’re feeling. We’ve used that knowledge to create this guide to help you understand your rights and options when it comes to old debts.

Let’s walk through this together and find out more about statute-barred debts.

How long can my creditors chase me?

Creditors can only chase you for a debt for so long before they’re not allowed to anymore.

The length of time creditors can chase you or take legal action depends on your location and the type of debt. In most cases, a creditor can only chase a debt for six years in England or Wales and five years in Scotland.

There’s much more to the rules you need to know, which you can uncover throughout this guide.

What is the statute of limitations?

A statute of limitations is a law stating the maximum amount of time that can pass after an event before legal action cannot take place.

It can also be known as the prescription period.

What is statute-barred debt?

Statute-barred debts are debts that haven’t been recovered within the limitation period. They are known as prescribed debts in Scotland, but the two terms are sometimes used interchangeably.

The limitation period differs depending on the type of debt and your location, which will be discussed further in the section below. But note the limitation period can be reset if certain events take place.

If you:

- Make a debt repayment, or

- Acknowledge the debt is yours in writing,

The limitations period starts from the beginning. If you have a joint debt, the limitation period resets for both people if a payment is made towards the debt. But the limitation period only resets for one of the debtors if they acknowledge the debt in writing.

Some other things to remember about legal rights concerning statute-barred debt:

- Mortgage shortfalls have a longer limitation period of twelve years for the money you borrowed (the ‘capital’), while the interest charged on this has a limitation period of six years.

- Personal injury claims have a shorter limitation period of three years.

- The rules are different regarding HM Revenue & Customs and statute-barred debts. Income tax, VAT and capital gains tax debts to HM Revenue & Customs don’t have a limitation period. This means HMRC can take you to court for these debts even if they date back many years.

It is also important to know the rules around County Court Judgement (CCJ) and statute-barred debts. A debt can never become statute-barred if court action has already been taken within the limitation period. The creditor has unlimited time to enforce a court order asking you to pay.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Does disputing a debt restart the statute of limitations?

Disputing a debt doesn’t restart the limitation period, but you need to be extra careful about anything you put in writing to a creditor.

You might state something that is perceived as acknowledging you owe the debt, such as disputing the amount instead of completely disputing the debt. Always check a disputed debt and statute-barred status.

When does the time limit begin?

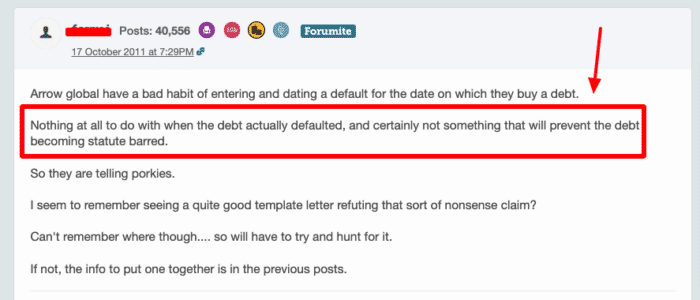

The main confusion regarding the limitation period occurs because many people are unaware of when it starts – debt agencies included, as shown in the forum entry below.

The UK Statute of Limitations Act 1980 states that the limitation period starts from the ‘cause of action’. It’s important to research the cause of action since it’s not the same for all types of debt.

For simple unsecured debts covered by the Consumer Credit Act, such as credit cards or personal loans, the cause of action is typically when your credit agreement states that the creditor has the right to pursue court action against you.

For other credit agreements, this may be after you have received a default notice and that default notice has expired.

» TAKE ACTION NOW: Fill out the short debt form

How long does it take for a debt to be statute barred?

Most debts become statute-barred after a six-year limitation period or a five-year prescription period in Scotland from the cause of action.

This includes:

- Unsecured debts such as payday loans, credit cards and store cards

- Energy arrears

- Overdrafts

But some debts have different limitation periods, and some never become statute-barred.

For example, council tax arrears in Scotland have a 20-year limitation period. Personal injury claims have a three-year period. And mortgage arrears after foreclosure is six years for the interest and 12 years for the capital.

Debt is no longer on my credit record – is it statute-barred?

Not necessarily. Records on your credit file are automatically deleted after six years. But this doesn’t mean the debt will always be statute barred. The debt might not become too old to be enforced within six years or have a longer limitation period.

Additionally, the limitation period might have been reset during the time it was recorded on your credit file.

Does statute barred mean my debt is written off?

A statute-barred debt in England, Wales or Northern Ireland isn’t written off. The debt still exists. On the other hand, a prescribed debt in Scotland no longer exists, comparable to having the debt written off.

Outside of Scotland, you might want to ask for a statute-barred debt to be written off by writing to your creditor.

Make sure the debt is statute-barred before doing this. If it’s not quite a statute barred yet, you could reset the limitation period and become liable to pay again. You can sit tight and do nothing right now to avoid this risk.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can a statute-barred debt be enforced?

No, a statute-barred debt cannot be enforced. This means the creditor can no longer take legal action against you to try and recover the debt.

Do I have to pay a statute-barred debt?

You can never be made to pay a statute-barred debt because the creditor cannot take legal action and get a court order for you to pay.

Without a court order, the creditor cannot try to enforce debt collection, usually done with bailiffs, an Attachment of Earnings or a Charging Order.

However, you can still volunteer to pay off the debt unless you’re in Scotland because the debt won’t exist anymore.

How does it affect my credit file?

One thing you may be concerned about is the effects of statute-barred debt on your credit score. Statute-barred or prescribed debt won’t be reported to credit reference agencies and won’t feature on your credit report.

But any missed payments, late payments and defaults that occurred before the debt became too old to be enforced can be recorded on your credit history – and will lower your credit score.

What can a creditor do after the limitation period has passed?

The creditor should stop contacting you and asking for payment once the limitation period has passed and the debt becomes statute barred.

However, many creditors will still try to recover the debt by asking for payment. The creditor itself might not realise that the debt is statute-barred and continue with debt enforcement after the limitation period.

Can I ignore a letter about a statute-barred debt?

Rather than ignore a letter from a creditor after the debt becomes statute barred, you can reply to tell them that you “don’t admit liability for the claim”.

Don’t say that you don’t agree with the amount or anything similar. Doing so could be perceived as accepting that the debt is yours, and if the limitations period hasn’t passed, you could mistakenly reset the time limit for the debt to be collected. It could be worth talking to someone from a debt services charity, such as Stepchange or National Debtline, for advice.

We have made writing this letter easier and quicker with our free-to-download statute-barred template letter.

It’s best to keep a copy of this letter and proof of posting. If the creditor continues to ask for payment, you should make a direct complaint. If it continues further, escalate your complaint to the Financial Ombudsman.

Can a creditor start court action after the limitation period has passed?

A statute-barred debt cannot be enforced with court action. But that doesn’t mean they won’t try.

They might send you a Letter Before Action, informing you that you must pay or expect to face legal action which

Can I ignore a Letter Before Action about a statute-barred debt?

No, you shouldn’t ignore a Letter Before Action from a creditor trying to take you to court for a statute-barred debt. Reply by telling them you don’t take liability for the debt, using the template we have provided for free here.

If the creditor ignores your letter, they might start court action. You must reply to any court papers by the deadline to state (and prove!) the debt is statute-barred, so the matter cannot be decided on in court.

You can get help to deal with statute-barred debt if you find yourself in a situation from Citizens Advice and many debt charities.

When does a CCJ become statute-barred?

A County Court Judgment (CCJ) doesn’t become statute-barred. If you don’t pay a court order, the creditor can get permission to use debt enforcement action, such as bailiffs. If six years pass and the court order hasn’t been enforced, the creditor may need permission to enforce the debt.

Further information on CCJs and how to deal with enforcement action can be found on dedicated guides via our debt info hub.

How do I check if a debt is statute-barred?

To check if your debt is statute-barred, you first need to work out when your type of debt becomes statute barred. Remember that the rules can differ in Scotland.

You’ll then need to ensure your debt qualifies to be statute-barred or prescribed, which will involve looking at past bank statements and carefully considering all communications you’ve had with the creditor.

It’s best to get support with this task. You can get help by contacting debt charities or Citizens Advice.

Can a statute-barred debt become “unbarred”?

Statute-barred debts can never become legally enforceable again. It’s impossible for a statute-barred debt to become “unbarred” in the future.

Can repayment be accepted from a debtor once a debt is statute-barred?

Creditors can still accept payments from a debtor in England, Wales or Northern Ireland for a statute-barred debt. This is because the debt still exists.

This might occur if the debtor wishes to pay off the debt despite the debt being legally unenforceable. Making a payment doesn’t stop the debt from being statute barred. So the debtor could change their mind and decide not to make any more payments.

Do tax debts and benefit overpayments become statute-barred?

Yes, benefit overpayments, such as a tax credit overpayment, can become statute-barred in England, Wales and Northern Ireland. The limitation period for these debts is six years.

Tax debts owed to HMRC never become statute-barred or prescribed in the UK.

Can a debt become statute-barred while in jail?

Going to jail won’t stop your debts from becoming statute barred in normal circumstances.

Learn more about debts when you’re sent to prison in our special debts in prison article.

Can debt ever truly be written off?

Yes, a debt can be completely and truly written off.

Statute barred debts in Scotland no longer exist so they can be considered written off. And you can ask for a debt to be written off after it becomes statute barred in the rest of the UK.

There are even debt solutions that can write off some or all of your debt, such as a Debt Relief Order or bankruptcy.

Does a debt die with you?

When you die, your debts might be paid off from your estate. If you cannot repay the debts from your estate, they won’t have to be paid by friends or family. In that sense, debts can die with you.