How Do I Know if My Debt Is Statute Barred? Quick Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Is your debt statute barred? This question might be on your mind if you have an old debt.

You’ve come to the right place for answers. Over 170,000 people visit our website each month looking for guidance on debt matters.

This guide will help you:

- Understand what a statute barred debt is.

- Learn how to tell if your debt is statute barred.

- Find out what to do if you’re unsure about the limitation period.

- Discover the impact of a statute barred debt on your credit score.

- And learn how to deal with unaffordable debt.

A study by Citizens Advice found evidence of poor practices by debt collectors in the UK, including the collection of very old debt.1 So, it’s understandable to be concerned about your debt.

Don’t worry; we’re here to give you clear, helpful advice.

Understanding the Status

If you had a debt to which you haven’t made any payments in a while and your creditor hasn’t contacted you about it, there’s a chance it could have become statute-barred.

The type of debts that could become statute-barred include overdrafts, credit cards, catalogue debts and most unsecured loans.

With the conditions of the statute of limitation on debts in the UK being so challenging to track, it can be difficult to determine statute barred status of a debt.

Today, I’ll be discussing how you can identify whether a debt of yours has become unenforceable, the steps that you can take and how to complain should your creditors or a debt collection agency harass you for a debt that is statute-barred.

How can I Tell?

If you stop paying for most types of debts, your creditor has to act against you within a specific time limit.

Typically, this action sends you a default notice asking you to make your payments and then pursuing court action against you if you don’t make payments after the default notice.

For most types of debts, the time limit on legal action for debts is six years.

Your debt has become statute-barred if your creditor does not act against you for six years after the default notice or from when you last made a payment or acknowledged the debt.

According to the Limitation Act 1980, your limitation period can restart if you make a payment towards your debt or if you admit in writing or any other method that you owe them the debt.

This would mean another six years until the debt becomes statute-barred. If you are in Scotland, the time limit is five years.

It is extremely important that you do not, in any way acknowledge the debt, so you need to be very careful with what you say or write because any acknowledgement no matter how small can restart the limitation period.

As you can probably imagine, it can be challenging to identify when a limitation period has started and whether it has been reset over six years.

You must also remember that if your creditor has taken out a County Court Judgment (CCJ) against you, your debt cannot become statute-barred, i.e., there is no time limit.

You must check the last date you made a payment and the date you were sent a default notice.

If it has been six years since you were sent a default notice and you have not made any further payments after the default notice, your debt is statute-barred.

Remember that according to the Limitation Act 1980, six years is the limitation period for most types of debts but not all of them.

Mortgage shortfalls have a limitation period of twelve years for the capital and six years for the interest. HMRC debts, including capital gains tax, VAT and income tax, student loans and child support arrears, cannot become statute-barred.

Any debts to which a CCJ is attached also cannot become statute-barred.

The Limitation Period isn’t Complete

If you know your debt is still within the time limit of its being enforceable, then you have two options:

- You can choose to ignore it and hope that it eventually becomes statute-barred.

- You can contact your creditor and start making arrangements to pay it back.

While the first option may seem tempting, it’s not something I would recommend. While it’s true that there’s a chance you may get away with it, it’s doubtful.

It’s rare for a creditor not to take action to get back their debts from you. If you ignore your debt, your creditor will likely take out a County Court Judgment (CCJ) against you.

This will be a much worse position for you since bailiffs could now be sent to your home if you miss any payments. Not to mention that a CCJ has a highly negative impact on your credit score and will make it very hard for you to secure any credit in the future.

Many creditors also wait for the limitation period to end before pursuing court action against you.

This is why I always recommend people to go for the second option. If you’re sure the limitation period has not been reached, I suggest contacting your creditor and explaining your plan to them.

It’s important to be communicative with your creditors and to assure them that you’re doing all you can to make payments towards your debt.

If you feel you’re unable to afford to pay back your debts, you can tell this to your creditors. If you have a copy of your expenditures and income, you can send it to them.

They may sit down with you and attempt to formulate a payment plan which would be affordable to you. In some cases, depending on the type of debt, they may even decide to reduce the amount you owe.

I’m Unsure if It’s Complete or Not

If you’re unsure if the limitation period is complete, you have the same two options: to ignore it or to find out whether it has been completed.

You can contact your creditor to ask them about the details of your debt, being very careful that you do not acknowledge it.

It’s essential that you don’t contact your creditor in the form of writing if you’re unsure if the debt is statute-barred or not.

This means you should not send them an email, a letter, a text or a message in any online chat. If you write to them, they may use this as proof to reset your limitation period.

The best way to inquire about this is through a phone call.

Ask them about the debt and whether it has become a statute-barred debt. It is important that you do not acknowledge the debt as this will restart the process.

You can ask them for proof if they say it is still enforceable. This can be a payment receipt dated within the last six years or a written acknowledgement from you dated within the previous six years.

» TAKE ACTION NOW: Fill out the short debt form

Remember that you don’t have to prove whether a debt is statute-barred. Your creditor has to confirm that it isn’t statute-barred.

If your creditor cannot prove your debt is still enforceable, it is statute-barred.

However, if they send you proof that the debt is still enforceable, you’ll have to start arranging to pay it back.

I’m Sure, but My Creditor is Still Contacting Me

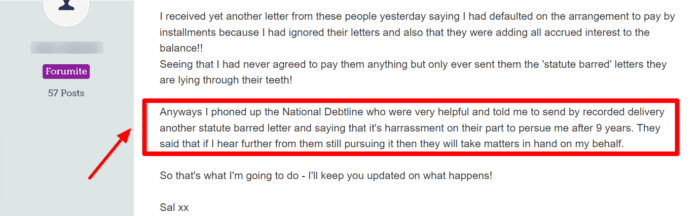

Harassment from creditors for statute-barred debts is pretty common.

If the debt is unenforceable, write to your creditor and ask them to stop contacting you.

Explicitly state in your letter that you don’t admit any liability for the creditor’s claim. Don’t say that you’re not entirely sure what you owe or if you think that the amount they’ve stated is wrong.

If your creditor continues to argue that it isn’t a statute-barred debt, they will have to take you to court and present evidence to prove it.

If your creditor tries to pursue court action against you for a statute-barred debt, I highly suggest you contact one of the debt management services in the UK for help.

Source Money Saving Expert

Remember that if a creditor cannot prove that the debt isn’t statute-barred, they shouldn’t contact you regarding that debt. If a creditor continues to contact you, you can report them to the Financial Conduct Authority.

The Financial Conduct Authority (FCA) Guidelines have strict rules about what debt collection agencies can and can’t do, such as harassment, coercion or intimidation.

Before making a complaint, make sure that you have gathered evidence of the harassment as well as proof that the debt is statute-barred.

Your complaint should first be made to the creditor or debt collection agency.

Write to them by email or post, and ask them to cease contacting you about a statute-barred debt to which you do not acknowledge.

Include evidence of harassment, such as call logs showing repeated call attempts and any calls made during unsociable hours, letters and emails.

Should the harassment continue, you can take your complaint to the financial conduct authority, again giving them all the evidence so that they can look into the matter for you and make a decision based on the evidence that you have given them.

You must note that creditors the FCA does not regulate can still contact you regarding your debt even if it has become unenforceable. This means these creditors can’t pursue you in court if the debt has become unenforceable, but they can still contact you.

Another thing to remember is that some creditors can take action against you for the debts you owe without needing to go to court.

An example of this could be income tax or council tax.

HM Revenue and Customs, for example, can take money directly from your wages or benefits as payment for your debts.

Most of the information provided in this post applies to unsecured credit debts such as credit cards, personal loans, payday loans, catalogues, etc.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

The Impact On Credit Score

It is important to be aware that even if the debt becomes statute barred, it will remain an unpaid debt, and remain on your credit file for six years, just as any other debt, statute-barred or not, affecting your credit rating and ability to obtain credit in the future such as obtaining a mortgage, getting a loan or applying for a credit card.

Before deciding what action to take, seeking professional help for statute-barred debts from organisations such as Step Change, Citizens Advice Bureau, and the National Debt Helpline is essential.

Quick Recap

With so many conditions and regulations, it can be confusing to determine whether or not a debt has become statute-barred.

In this case, the best thing you can do is to know your rights and all the conditions required for a limitation period to be valid.

The critical thing to remember is that the proof of burden is not on you but on your creditors.

They’re the ones who have to prove that a debt isn’t statute-barred if they’re going to attempt to recover any money from you.